What you need to know

Southeast Asia is now the focus for Taiwanese start-ups.

By Matthew Fulco

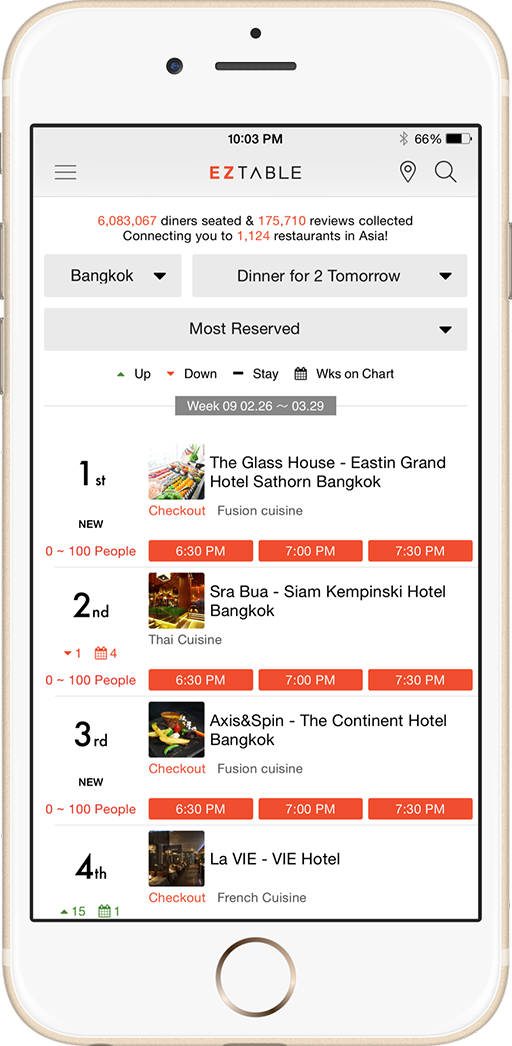

Alex Chen is ebullient about Indonesia. Southeast Asia’s largest nation is integral to the global expansion of EZTable, the online restaurant booking platform Chen established a decade ago in Taipei. It has since become the largest platform of its kind in Asia. Last year, Chen moved EZTable’s headquarters to the Indonesian capital of Jakarta as the company launched its second foray into Southeast Asia after Thailand.

“This is the best environment for startups in Southeast Asia,” he says, citing Indonesia’s strong economy – it grew by more than 5 percent last year – and population of 260 million. The greater Jakarta area alone has 30 million people.

In total, Southeast Asian startups received US$7.86 billion from investors in 2017, up more than 300 percent year-on-year, according to data compiled by tech news site Tech In Asia. Indonesia accounted for more than 22 percent of that investment, second only to Singapore.

In terms of opportunity, “if you think about what China was like 15 years ago, that’s similar to where Indonesia is now,” Chen says. “It’s getting a lot of attention from foreign investors. Everyone wants a piece of the growing pie.”

Photo Credit: EZTable

EZTable is one of dozens of Taiwanese tech startups expanding globally after achieving success at home. Southeast Asia is their top destination, but some are expanding to Japan, Korea, and Hong Kong as well. They’re a new breed of Taiwanese tech firm: software-driven, youthful, and multilingual. Instead of making components for smartphones, they’re building the apps on those handsets. With low capital equipment expenditures, these startups are highly mobile. They can work anywhere with an internet connection.

What a difference three years can make. When Taiwan Business TOPICS reported three years ago on the nascent startup scene here, Taiwanese startup owners talked about going global, but most were heavily focused on their home market.

Now their horizons are broader. “Taiwan can serve as a good test bed for startups, but it’s too small for most companies to achieve scalable growth,” says Jamie Lin, founding partner of the Taipei-based AppWorks accelerator. “To get bigger, you need to expand to other markets.”

As an accelerator, AppWorks focuses on helping early-stage startups grow by offering them financing, mentorship, and education. It currently has 323 startups in its ecosystem (including EZTable), which have raised a total of US$432 million. Together, the startups earn annual revenues of US$1.3 billion and have a valuation of US$1.6 billion.

Startups enter accelerators for a fixed three- or six-month period as part of a cohort of companies, and the time spent in an accelerator often shapes startups’ future development. “The accelerator experience packs a huge amount of hands-on learning into just a few months,” says Holly Harrington, general manager of the state-backed Taiwan Startup Stadium (TSS), a program that helps prepare startups for international expansion. The best accelerators help teach startups how to run a successful business and grow it sustainably, she explains.

Other entities besides accelerators provide crucial support to startups. Incubators provide management training and office space. Angel investors provide the funding that helps early-stage companies to get up and running, and in exchange they receive equity ownership interest or convertible debt. Venture capitalists also invest in startups. But only accelerators are mentorship-driven, fixed-term, cohort-based, and conclude with a demo day when startups pitch their products to a live audience, noted the Harvard Business Review in a March 2016 report.

Southbound reprise

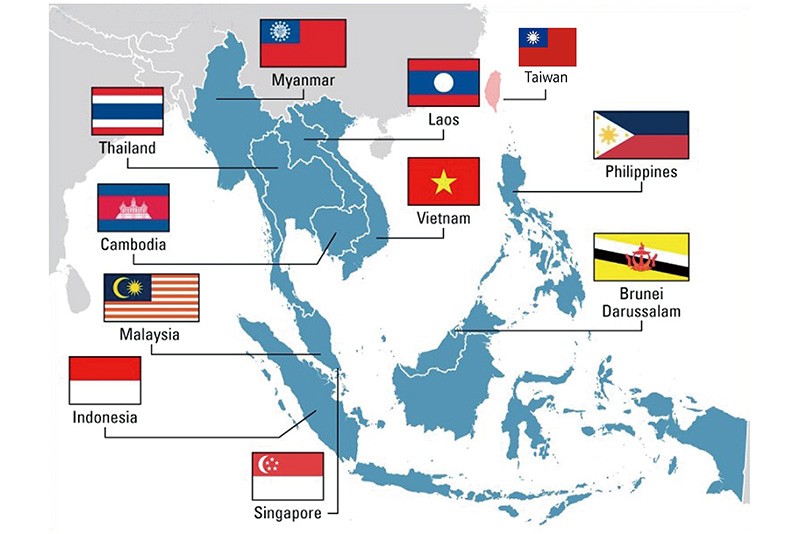

AppWorks’ Lin is a tireless advocate of expansion to Southeast Asia, which he believes offers the best long-term business prospects for Taiwanese startups. There’s even a large map of “Greater Southeast Asia” – which includes Taiwan, Hong Kong, and Macau – on the wall in the AppWorks office. The map features a brief description of each market, highlighting the most relevant indicators for startups – not just GDP and GDP per capita, but also internet, mobile internet, and online-ad market penetration.

Photo Credit: Taiwan Business TOPICS

“Southeast Asia checks all the boxes for Taiwanese startups,” Lin says. “It’s a fast-growing region home to the world’s third-largest number of internet users, many of whom are just now coming to terms with increasing affluence, consumer sophistication, and digital transformation.” Southeast Asia’s digital economy will be worth US$200 billion by 2025, according to research by Google and Temasek, Singapore’s sovereign wealth fund.

The Taiwanese government is equally excited about Southeast Asia. Soon after President Tsai Ing-wen (蔡英文) took office in May 2016, the government unveiled the New Southbound Policy, which is designed to strengthen ties between Taiwan and its neighbors to the southwest.

The World Bank forecasts that annual GDP growth in Indonesia, Vietnam, the Philippines, Myanmar, Cambodia, and Laos will expand by more than 5 percent this year.

With all this exuberance about ASEAN, it feels like 1993 all over again. That’s when former President Lee Teng-hui (李登輝) launched the original Southbound Policy in a bid to direct Taiwanese investment to ASEAN countries instead of China. Lee foresaw the trouble that China-centric expansion would bring: over-reliance on a single market, forced technology transfers, and regulatory imbroglios, to name a few.

Lee might have succeeded if not for the Asian financial crisis of 1997-98. Risk-averse Taiwanese firms rushed to the relative safe haven of China, where capital- and foreign-exchange controls insulated its financial system from the worst of the crisis, as investors turned bearish on Southeast Asia. In 1998, all of ASEAN’s key economies except for Vietnam contracted: the Philippines (-0.6 percent), Singapore (-2.2 percent), Malaysia (-7.4 percent), Thailand (-7.6 percent), and Indonesia (-13.1 percent).

Twenty years later, ASEAN is the world’s fastest-growing region. The World Bank forecasts that annual GDP growth in Indonesia, Vietnam, the Philippines, Myanmar, Cambodia, and Laos will expand by more than 5 percent this year.

One prominent Taiwanese startup in Southeast Asia is the artificial intelligence firm Appier, which has offices in Singapore, Jakarta, Kuala Lumpur, Manila, Bangkok, and Ho Chi Minh City. Appier is backed by heavyweight tech investors such as Japan’s SoftBank and Line, as well as South Korea-based Naver. Appier’s AI solutions analyze the behavior of Asian consumers across different connected devices, providing insights marketers can use to craft targeted advertising campaigns.

A case study on Appier’s website notes that the company has helped Indonesian online marketplace Tokopedia to significantly boost sales. Working with Appier, Tokopedia increased monthly transactions by over 200 percent and monthly revenue by 179 percent.

Tokopedia vice president Melissa Siska Juminto says in the case study that Appier’s use of dynamic retargeting – an advertising strategy that creates personalized ads based on a user’s past behavior – proved highly effective. She lauds the company’s “great performance and sales at scale,” supported by detailed analytics on user behavior across different connected devices.

Meanwhile, EZTable has yet to replicate its past success in Indonesia, but company founder Chen remains sanguine. Indonesia is a growing market, so restaurants are willing to pay for CRM [customer-relationship management] services if they help bring in more business, he explains. Those services involve analysis of customer data and advising restaurants on how to acquire new customers. In Indonesia, “restaurant owners feel like something better is waiting for them just around the bend, so they’re willing to invest.”

That’s not the case in Taiwan though, where EZTable can generate revenue only by taking a commission from the total restaurant bill. “Restaurants will pay you to outsource booking for them (which saves them time), but they won’t pay for information that could help them grow the business,” Chen says. Because the Taiwan market is mature, “they aren’t confident the business can grow.”

Looking east instead of west

China is growing just as fast as Southeast Asian markets but isn’t attracting nearly as many Taiwanese startups. “It’s hard to see where Taiwanese startups have an edge in China. China has many of its own strong tech companies which can better navigate their home market,” says EZTable’s Chen.

Chen Ming-ming, founder of the online travel-activity booking platform KKday, sees opportunity in China, but isn’t focusing his company’s global expansion there. In addition to its Shanghai office, KKday has operations in Japan, South Korea, Singapore, Malaysia, Thailand, Vietnam, the Philippines, Indonesia, and Hong Kong.

“You have to be extremely careful in China,” where hyper competition and protectionism are prevalent, he says. “If your company isn’t from China or working with a reliable local partner, you are likely at a disadvantage.”

With that in mind, KKday offers its travel activities to Chinese consumers through an official store on Taobao, China’s largest online marketplace. Taobao has a large base of connected young consumers – the type of people who would be interested in tailored travel activities in Taiwan.

AppWorks’ Lin sees limited potential for Taiwanese startups in China. “The big guys will eat you up,” he says, referring to the tendency of China’s internet giants to acquire the country’s most promising startups.

More ominously, companies that fall afoul of China’s ruling Communist Party can end up in hot water. “Look what happened to Wang Jianlin,” Lin says, referring to the brash billionaire chairman of China’s Dalian Wanda Group. “He used to be China’s richest man” – before getting on the wrong side of the authorities. Wang stumbled into Beijing’s crosshairs with a series of risky, debt-laden overseas investments that the party viewed as contributing to disruptive capital outflows. To assuage the Chinese government, Wang has pledged to control corporate debt and sold off dozens of properties.

“China is entirely its own beast – it’s certainly not our focus,” says Ed Deng (鄧居義), co-founder of the diabetes-tracking startup Health2Sync (H2). H2’s software provides automated feedback to users about their blood sugar, blood pressure, and weight. User data, like food intake or medicine use, can be synced to the app via cable, Wi-Fi, or Bluetooth.

Health2Sync is set to expand into Japan after raising US$6 million in November from investors led by Japanese insurance heavyweight Sompo Holdings. Japan is the number two market in the world for diabetes spending after the United States. “The Japanese government is serious about preventing diabetes complications” and has enacted policies that allow healthcare providers to receive grants or other funding to better manage the disease, he says.

Deng says that H2 may work with Sompo and other Japanese insurance providers to create a new product that incorporates the Taiwanese startup’s software.

While Health2Sync is free of charge, users have the option to pay for a premium subscription service. In the future, Deng expects one of the company’s business models will involve working with large pharmaceutical companies. “Pharma companies will be able to provide better patient support by leveraging us,” he says, adding that Health2Sync is working with the world’s largest diabetes drug manufacturers to “deliver digitized patient support.”

Japan is also a key market for Asia Yo!, whose online platform connects professional vacation-rental providers with guests. That means no unlicensed home sharing. Founder C.K. Cheng, a former investment banker, says that Japan accounts for half of his company’s business. The company generates revenue by taking a 12-15 percent commission on each transaction.

Japan has long been Taiwan’s top outbound travel destination, but some travelers balk at its pricey hotels, especially in Tokyo. For instance, the Grand Hyatt Tokyo starts from US$450 a night. Even a local brand like the Park Hotel in Tokyo’s Minato district starts from US$225 a night for a tiny room.

Vacation rentals in Japan are 20-35 percent less expensive than an equivalent hotel room and offer a better value, Cheng says. “Many of our rentals in Japan are serviced apartments, which provide cooking facilities and more than one place to sleep,” he says. “If you have children, the extra space is great.”

In the near future, AsiaYo! will target wider regional expansion. It plans to tap Japan’s outbound tourism market in both Taiwan and South Korea. “The Korean market is very attractive,” says Cheng, noting that 5 million Japanese tourists visit South Korea every year. He says that AsiaYo! is currently assembling a Korea team at Taipei headquarters and in Seoul.

The company plans to expand to Hong Kong, Singapore, and Malaysia in the second half of the year. Nothing is yet planned for China. “The China market’s travel industry is extremely competitive and a bit saturated,” Cheng says.

EZTable’s Alex Chen, also a former investment banker, likens the China market to an overvalued stock. “Professional investors look for stock which is undervalued and they sell the stock when it’s overvalued,” he says. “China’s like a very high-priced stock. It will likely keep growing but there are a lot of risks, and it won’t keep increasing sharply in value like it did in the past.”

Read Next: OwlTing Leads Taiwan's Blockchain Awakening

The News Lens has been authorized to repost this article. The piece was first published by Taiwan Business TOPICS.

(Taiwan Business TOPICS is published monthly by the American Chamber of Commerce in Taipei.)

TNL Editor: David Green