Fed hikes key interest rate 0.75 points for second time as inflation surges

The Federal Reserve approved another steep hike in its benchmark interest rate on Wednesday, pushing forward with a plan to tackle decades-high inflation despite fears the moves could trigger a recession.

The rate-making Federal Open Market Committee announced the hike of 0.75%, or 75 basis points, after a two-day meeting.

Fed Chair Jerome Powell acknowledged the Fed’s actions were likely to have a dampening effort on growth and cause “softening” in the labor market — but rejected the notion that the US was already in a recession.

“I do not think the US is currently in a recession and the reason is, there’s just too many areas of the economy that are performing too well,” Powell said at a press conference.

The Fed has now hiked rates by three-quarters of a percentage point for the second straight month — with the previous 0.75% increase marking the first of its kind since 1994.

“Recent indicators of spending and production have softened,” the FOMC said in a statement. “Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.”

The Fed’s latest rate hike came two weeks after dismal June inflation data revealed prices surged 9.1% in June — the highest since November 1981.

The fresh high for inflation renewed pressure on Powell and top policymakers to bring down prices that are slamming household budgets.

Powell said the Fed felt the 0.75% hike was the “right magnitude in light of the data” – and suggested the central bank could slow the pace of its planned increases moving forward.

“We anticipate that ongoing increases in the target range for the federal fund rates will be appropriate,” Powell said. “The pace of those increases will continue to depend on the incoming data and evolving outlook for the economy.”

“While another unusually large increase could be appropriate at our next meeting, that is a decision that will depend on the data that we get between now and then,” he added.

The June inflation reading initially led investors to bet that the Fed would implement a full percentage-point interest rate hike for the first time in its modern era. But the markets backed off that projection after Federal Reserve Governor Christopher Waller and others downplayed its likelihood.

A day after the June Consumer Price Index was released, Waller said he would “fully support” a three-quarter-point hike due to the elevated inflation reading — which he described as a “major league disappointment.”

US stocks soared as Powell spoke. The Dow Jones Industrial Average closed up nearly 436 points, or 1.4%, while the Nasdaq jumped 469 points and the S&P 500 was up about 100 points.

“The rate increases are having their intended effect. We are just not sure what the price is going to be,” said Jamie Cox, managing partner at Harris Financial Group. “The main effect is that markets are confident that the Fed won’t allow inflation to become anchored among consumers and businesses, and that’s maybe the first time this year that this has happened.”

By hiking interest rates, the Fed is aiming to cool demand within the economy and thereby lower prices for consumers. Higher interest rates make it more expensive to borrow money.

“With inflation running north of 9%, we’re not at the finish line and there will be more interest rate increases to come in the months ahead,” Bankrate chief financial analyst Greg McBride said.

The Fed’s benchmark rate impacts credit card interest rates, savings accounts, auto loans and other forms of borrowing that impact consumer finance. Rate hikes also have an indirect effect on mortgage rates, which have surged since January and resulted in a cooling effect on the once-booming housing market.

The Fed’s commitment to fighting inflation has led many banks and economists to warn of a rising probability of a US recession later this year or next year.

The White House released a blog post arguing a slowdown was “unlikely” even if US GDP declines for two straight quarters — the metric widely seen as a sign of a recession. Critics, including “Big Short” investor Michael Burry, accused the Biden administration of spinning the situation.

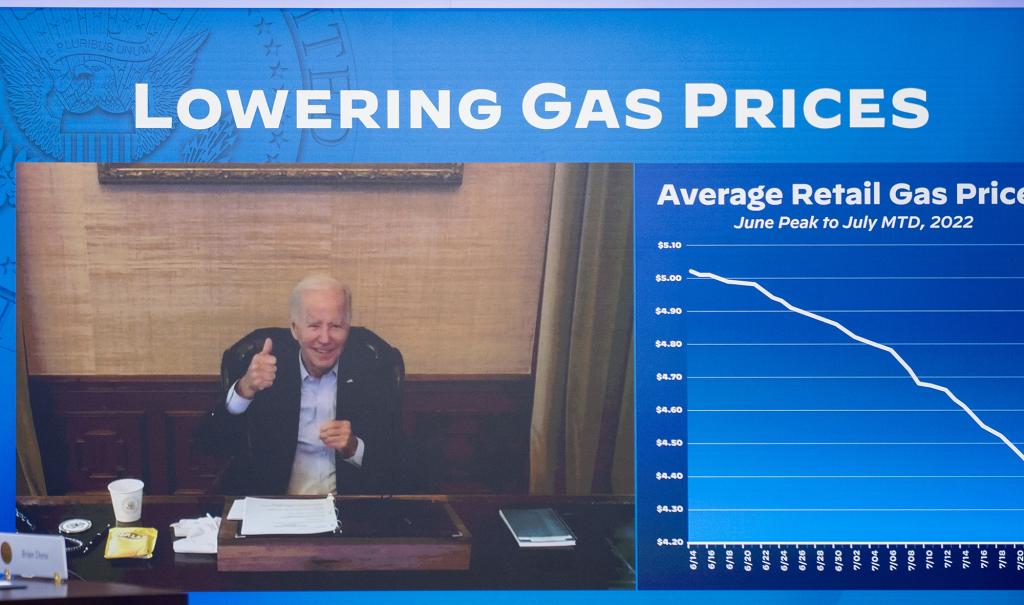

Inflation has shown some signs of moderation, with gas prices falling more than 70 cents from an all-time high of $5.016 per gallon on June 14.

The White House also drew scrutiny for bragging about the downtick in prices, with some questioning whether the victory lap was premature just as peak summer driving season gets underway.

Earlier this week, Treasury Secretary Janet Yellen pointed to ongoing strength in the US labor market as a sign that the US economy was not in a recession.

“This is not an economy that’s in recession, but we’re in a period of transition in which growth is slowing. That’s necessary and appropriate and we need to be growing at a steady and sustainable pace,” Yellen told NBC’s “Meet The Press.”

Meanwhile, ex-Treasury Secretary Larry Summers, a frequent critic of the Fed’s response to the inflation crisis, warned of a “very high likelihood of recession.”

“When we’ve been in this kind of situation before, recession has essentially always followed — when inflation has been high and unemployment has been low,” Summers said on CNN. “‘Soft landings’ represent a kind of triumph of hope over experience. I think we’re very unlikely to see one.”