Why fears of a banking crisis were overblown — bad regulation is the real problem

Is there really some banking crisis?

In March, I told you Silicon Valley and Signature Bank were isolated episodes—not systemic threats.

First Republic’s subsequent demise and plunging regional bank stocks furthered fears of an imploding domino effect.

Yet these episodes and emerging data reinforce my point.

Contagion isn’t the risk now, potential bad regulation is. Hear me out.

Hoopla aside, since SVB’s failure, the S&P 500 is up 6.5%.

Yes, regional bank stocks are down. But larger S&P 500 Financials are off just -1.6% since SVB’s collapse.

Overall bank deposits are down -2.5% — smaller banks’ -4.6%. Not great but not catastrophic, either. And lending hasn’t imploded.

The Fed’s Q1 Senior Loan Officer Opinion Survey showed slightly tighter lending standards and lower demand — neither new nor severe.

I had argued SVB and Signature chiefly failed from hyper-concentrated deposit bases — the former in Venture Capital, the latter in cryptocurrency.

Few banks are so concentrated with such mutually communicative depositors.

Tightly knit depositor communities make bank runs easier.

FRC was somewhat similar, courting wealthy clients that were geographically and culturally overlapped with SVB’s — pushing specialized products with uncommonly high uninsured deposits.

Depositors fearfully yanked savings, the stock imploded, and fearing total failure the FDIC interceded, took control and brokered a near failure, sweetheart takeover by JPMorgan on May 1.

Yet no calamity ensued.

Why? Inflation adjusted, these few banks weren’t huge.

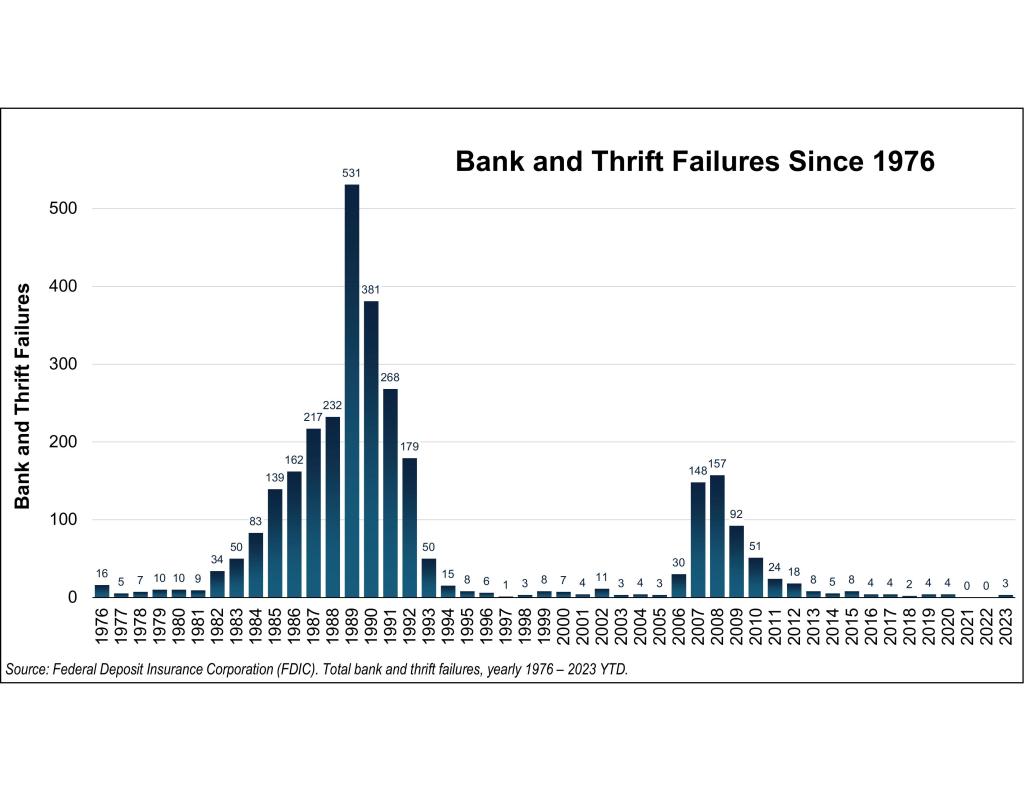

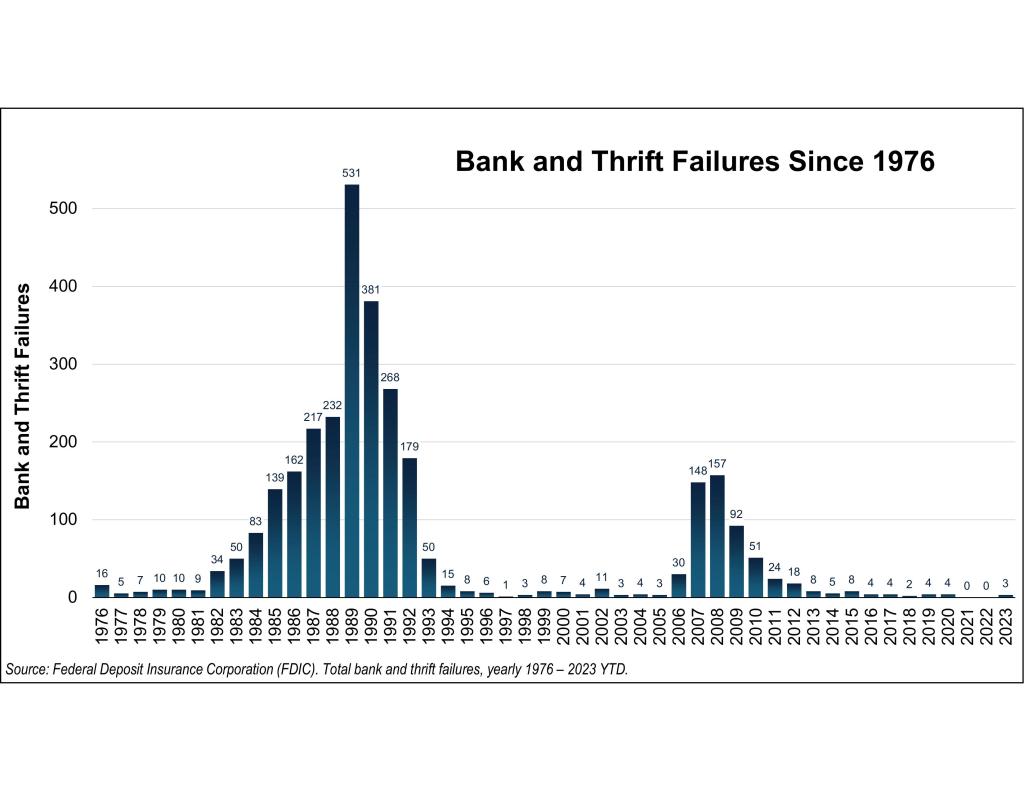

Just the clucking was. Second tier and smaller banks fail regularly — averaging 63 per year since 1975.

They often collapse in clumps, like 1989 — 1990’s 912 or 2007 — 2008’s 305. The only years with none? 2021 and 2022!

But now we notice. Hyping these few confuses exceptions with the norm.

The overall system is near its healthiest in 10, 30 or 50 years based on loan-to-deposit ratios and cash relative to total assets.

There are 4,200-plus US banks. We want a vibrant, dynamic capitalist economy — including innovative banks.

With that comes some failing, always. We should want that. Regulators try to ring-fence risk. They can’t fully. And shouldn’t.

When banks need emergency liquidity, they first borrow from their regional Federal Reserve District.

There are 12 nationally. Those regional loans are reported weekly.

Only the New York District (Signature’s home) and the San Francisco District (SVB and FRC) saw upticks.

The other 10? Nada! In any systemic crisis, that borrowing would be widespread, everywhere.

You say regulators should have “done something” before all this? Really? Be careful what you wish for.

Throughout government there is almost no actual inside-banking, real world, work experience.

Treasury Secretary Yellen was just a pinhead academic economist who, ironically, ran the now-maligned San Francisco Fed District where all these SVB/FRC issues spawned — before becoming Fed Chair.

Incompetence promoted! Current Fed Chair Jerome Powell is a born-and-bred DC lawyer, politico, swamp critter with zero real banking experience. Pretty much all are.

Never Miss a Story

Sign up to get the best stories straight to your inbox.

Thanks for signing up!

Congress? Worse! A lot of smart lawyers on relevant committees. I know and like lots of them but can count on one finger anyone senior in actually running any bank ever — Rep. French Hill (R-Ark.).

But they itch to “do something.”

Anything they do is likely worse than nothing — because they know nothing. Altered banking rules routinely backfire.

Calls for smarty-pants “fixes” to this non-crisis are why the SLOOS survey shows many banks now tightening credit — citing, “concerns about … future legislative changes.”

Congressional banking inaction beats reaction.

Less is more. Doing nothing is best. Republicans should get that cold but, seemingly, don’t.

So far, most regulation talk is abstract politicking.

If that holds, bank fears will fade faster than this column’s ending.