Larry Summers joins outcry over Fitch downgrade: ‘Bizarre and inept’

Former Treasury Secretary Larry Summers blasted Fitch’s decision to downgrade the nation’s sovereign top-tier credit rating as “bizarre and inept.”

“The United States faces serious long-run fiscal challenges. But the decision of a credit rating agency today, as the economy looks stronger than expected, to downgrade the United States is bizarre and inept,” Summers tweeted following Fitch’s stunning move after the markets closed Tuesday.

The ratings agency cited the nation’s ballooning debt load and political dysfunction in Washington for cutting the government’s rating a notch from AAA to AA+.

However, the former treasury secretary told Bloomberg in a telephone interview that “the idea that this is creating the risk of a default on US Treasury securities is absurd, and I don’t think that Fitch has any new and useful insights into the situation.”

Summers also took issue with Fitch’s outlook that it expects the US economy to slip into a mild recession from the fourth quarter of this year into the first quarter of 2024.

“If anything, the data in the last couple of months has been that the economy is stronger than what people thought, which is good for the creditworthiness of US debt,” Summers said.

Federal Reserve Chair Jerome Powell has also said the US economy is showing resiliency and that his staff is no longer projecting a recession.

At the central bank’s July meeting — when a quarter-point hike raised the benchmark federal funds rate to between 5.5% and 5.75%, a 22-year high — Powell noted that the Consumer Price Index for June came in better than expected.

The United States faces serious long-run fiscal challenges. But the decision of a credit rating agency today, as the economy looks stronger than expected, to downgrade the United States is bizarre and inept.

— Lawrence H. Summers (@LHSummers) August 1, 2023

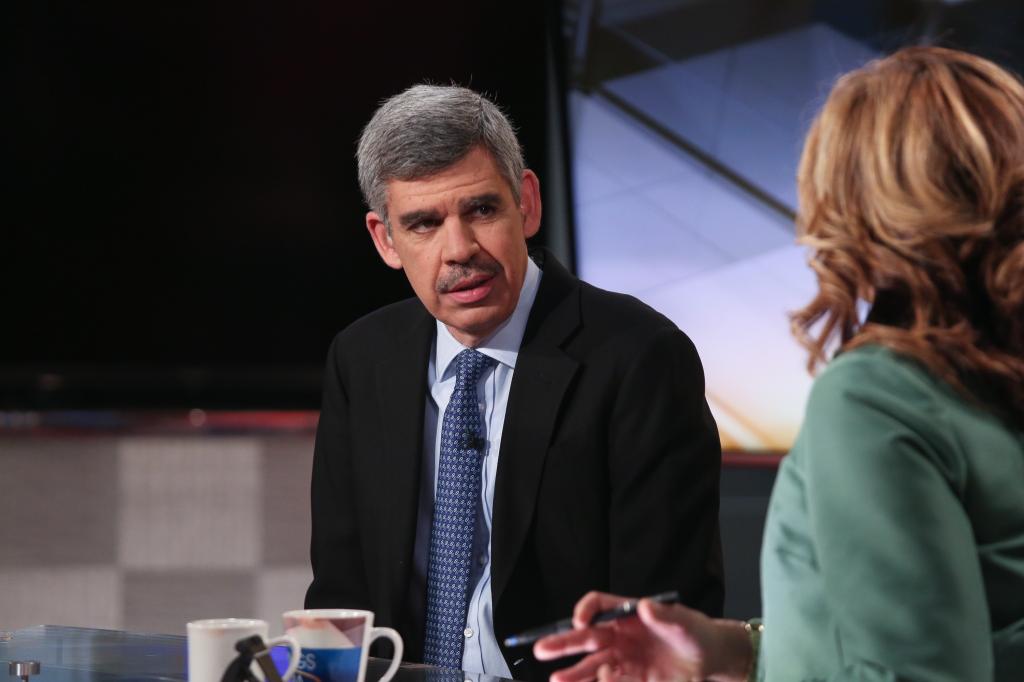

Mohamed El-Erian, chief economic adviser to financial services company Allianz SE, called the downgrade “a strange move.”

“I am very puzzled by many aspects of this announcement, as well as by the timing,” El-Erian tweeted. “Overall, this announcement is much more likely to be dismissed than have a lasting disruptive impact on the US economy and markets.”

He certainly is not alone in the sentiment. Fellow economist Paul Krugman called Fitch’s downgrade “bizarre” and a “strange decision.”

“The biggest economic news over the past year has been America’s remarkable success at getting inflation down without a recession,” Krugman penned in a post on the platform previously known as Twitter.

“Maybe the important thing to realize is that when it comes to sovereign debt, rating agencies have no inside information (and a lousy track record). Remember when S&P downgraded America in 2011? Neither do I,” he added.

Standard & Poor’s had downgraded the US credit rating amid a debt-limit standoff, marking the first time the US was not considered a risk-free borrower. It remains at AA+.

Following Fitch’s decision, Moody’s Investor Services is the only major credit ratings agency to keep the US credit at the top-notch AAA rating.

Fitch’s decision was “completely absurd,” added Jason Furman, a professor of economist practice at Harvard University and formerly President Barack Obama’s top economic adviser.

“The United States is so well within the AAA zone that small changes one way or the other in any of these shouldn’t matter,” Furman also tweeted, referring to improvements in Fitch’s own key criteria for downgrading the credit rating, such as “macroeconomic policy [and] performance.”

Fitch justified its move by arguing that America’s finances will likely deteriorate over the next three years, and the country could dip into a “mild recession” by as early as the fourth quarter, which starts on Oct. 1.

It cited US lawmakers’ recent battle over the nation’s rising debt limit, which ended in President Biden lifting the government’s $31.4 trillion debt ceiling.

“Fitch’s decision does not change what Americans, investors and people all around the world already know: that Treasury securities remain the world’s preeminent safe and liquid asset, and that the American economy is fundamentally strong,” Treasury Secretary Janet Yellen said Tuesday.