This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

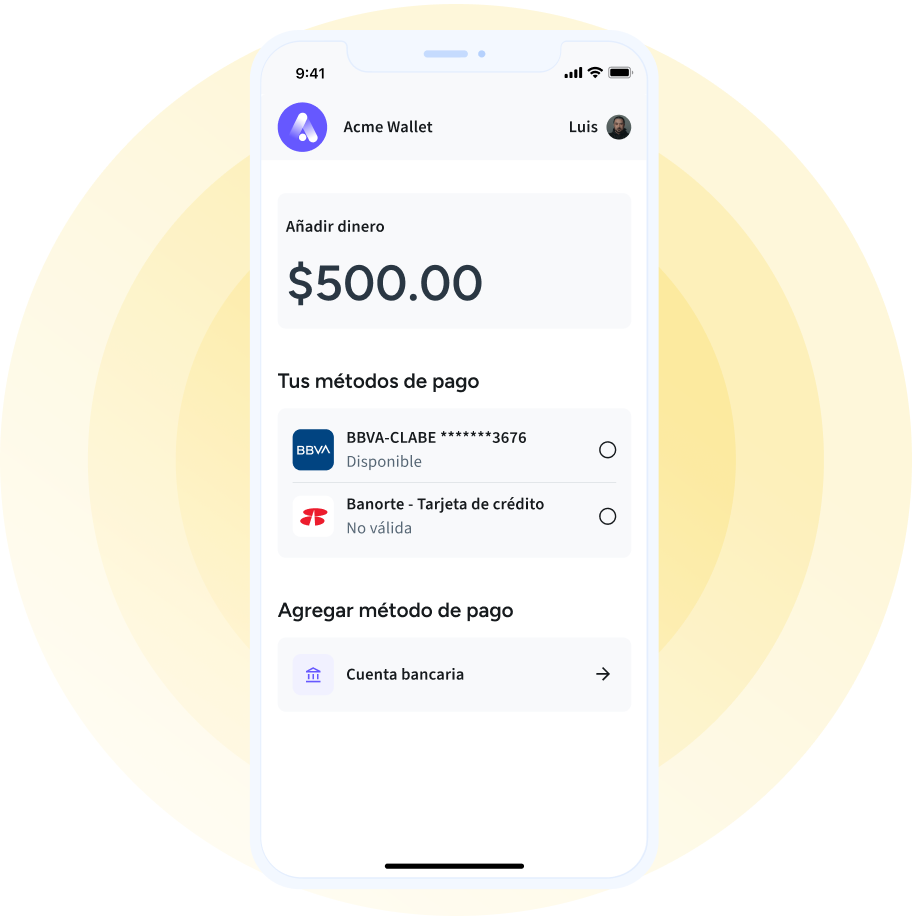

Pay-ins

Build better payment experiences with open finance

Connect to the main account-to-account payments rails across Latin America and start accepting bank payments directly inside your app or website. Provide your customers with a safe and frictionless experience to send money from their bank accounts in real time while reducing costs and fraud risk.

Trusted by the leading financial innovators

Why Belvo

Receive money in real time

The most commonly used payment methods in Latin America, like credit or debit cards, can take up to three days to be settled, while open finance account-to-account payments are 100% instant. Allow your customers to make payments in real time directly from their bank account.

Cheaper and frictionless payments

Embedding bank-to-bank payments directly into your app is faster and cheaper than traditional methods like credit cards or cash. Eliminate the need for your users to enter their credit card information and reduce the fees associated with processing credit card payments.

Grow your business with variable recurring payments

Streamline your payment processes and save time, resources and costs while you ensure your business’ scalability. Offer a convenient and user-friendly payment method and reduce customers’ churn from expired credit cards.

Optimize conversion rates

By reducing the necessary steps to complete the transaction you can substantially improve customer experience and the number of users that successfully finish the payment process. Boost your conversion rates and increase your online sales.

Connect to the main account-to-account payment rails across Latin America

Read more about payment initiation & open finance

Belvo receives a license to operate payments in Brazil

The Central Bank of Brazil has authorized Belvo to develop account-to-account payment initiation solutions in the country.

The Open Finance and payments landscape in Latin America

Brazil has been living through a payment revolution since the implementation of Pix, and there is more to come with Open Finance.

The benefits of open finance payments for ERP software

Learn how payment Initiation with Open Finance will help ERP and accounting systems to reduce operating costs and increase efficiency.

Make the most of Open Finance data through enrichment solutions

Get to know Belvo’s enrichment toolkit that makes Open Finance data even more powerful through categorization, income verification, recurring expenses, and risk insights.

We can’t wait to hear what you’re going to build

Belvo does not grant loans or ask for deposits