Asset Reconstruction Companies (ARCs) operate as specialized entities tasked with the challenging yet crucial role of managing and resolving distressed assets. These companies play a pivotal role in the broader framework of mitigating non-performing assets (NPAs) and revitalizing the financial health of the banking sector.

At its core, the primary function of ARCs in India is the acquisition of distressed assets from banks and other lending institutions. These assets often manifest as NPAs – loans or advances—where the borrower has defaulted on repayment for 90 days. ARCs step in to purchase these stressed assets, usually at a discounted value, thus providing relief to the selling financial institutions by helping them re-organize their balance sheets.

Once ARCs acquire these distressed assets, they begin the multi-faceted journey of recovery. This involves deploying various strategies to recover and maximize the return from these assets. Debt restructuring and enforcement via SARFAESI, debt settlements, arbitration, and strategic sales are common tools in the ARC’s arsenal. The objective is to recover the investment to the highest level and contribute to the revival of the distressed business or sector associated with these assets.

The need for digitization for Asset Reconstruction Companies (ARCs)

The digitization of debt resolution is imperative for Asset Reconstruction Companies (ARCs) engaged in retail debt to enhance the efficiency and effectiveness of the resolution process. Digitization allows ARCs to harness advanced technologies such as artificial intelligence, machine learning, and data analytics that are capable of generating actionable insights from data. These tools empower ARCs to conduct comprehensive analyses, automate processes, and employ predictive modeling, thereby enhancing the speed and accuracy of decision-making in debt resolution.

The digitization of retail debt resolution addresses the need for transparency and collaboration in the financial ecosystem. Digital platforms facilitate secure communication channels, real-time updates, and transparent reporting, creating an environment where stakeholders, including banks, creditors, and investors, can engage more effectively. ARCs purchase bulk NPA portfolios. Maintaining an action sequence on these bad loans on spreadsheets and elementary tools is nearly impossible.

The accessibility of information through digital means not only expedites the resolution process but also builds trust among stakeholders, contributing to a more accountable and resilient debt resolution framework for ARCs.

In light of the intricate processes for the resolution of retail loans, ARCs are expected to shift their focus towards recovering retail loans. Rishabh Goel, Co-founder and CEO, Credgenics, said that ARCs are acknowledging the untapped potential in small-ticket loans belonging to categories such as educational, personal, and MSMEs.

This digital environment fosters collaboration, allowing stakeholders to engage seamlessly, share necessary documents securely, and make informed decisions. In addition to speeding up the resolution process, digitization’s transparency fosters stakeholder confidence, which enhances the overall effectiveness of the ARC’s debt resolution programs.

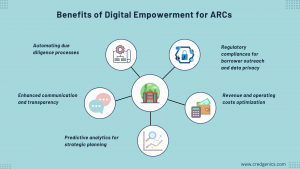

Benefits of Digital Empowerment for ARCs

Automating due diligence processes:

Digital capabilities streamline and automate the due diligence processes crucial to the debt resolution journey. ARCs can leverage automated systems to assess the viability of distressed assets, evaluate legal documentation, and conduct comprehensive financial analyses. This not only expedites decision-making but also minimizes the risk of oversight, enhancing the overall effectiveness of debt resolution efforts.

Enhanced communication and transparency:

Digital platforms facilitate enhanced communication and transparency in the debt resolution process. ARCs can leverage secure and collaborative digital environments to engage with stakeholders, including banks, creditors, and legal entities. Real-time updates, secure document sharing, and transparent communication channels contribute to a more efficient and accountable resolution process.

Predictive analytics for strategic planning:

By embracing predictive analytics, ARCs can anticipate potential challenges and market trends, enabling proactive and strategic planning. Predictive models can forecast the likelihood of successful resolution for specific assets, allowing ARCs to allocate resources strategically and prioritize high-impact opportunities. This foresight enhances decision-making and contributes to more favorable outcomes in debt resolution.

Regulatory compliances for borrower outreach and data privacy:

Given the sensitive nature of financial data involved in debt resolution, ARCs must prioritize robust cybersecurity measures. Digital capabilities empower ARCs to implement daytime and frequency controls and safeguard critical borrower information from potential threats. This not only protects the integrity of the resolution process but also builds trust among stakeholders.

Revenue and operating cost optimization:

ARCs equipped with digital capabilities can adjust debt resolution strategies by identifying barriers in repayments, identifying the most suitable mode of collections like physical or digital, and deploying these, expediting approvals for settlements and legal formalities, resulting in better revenue realizations. Automation of tasks such as borrower communication, payment processing, and legal proceedings enhances operational efficiency and reduces the need for extensive manpower, leading to cost savings for ARCs.

The integration of digital capabilities into the operations of Asset Reconstruction Companies marks a significant leap toward a more efficient, transparent, and proactive debt resolution landscape. By leveraging AI, automation, and data analytics, ARCs can navigate the complexities of distressed assets with greater precision and agility.

Credgenics, a leader in debt recovery technology, provides a technology platform for catering to the needs of Asset Reconstruction Companies (ARCs). The platform aims to equip ARCs with digital capabilities and insights-driven tools for more efficient debt resolution in retail and SME segments. ARCs face rising costs, inter-creditor conflicts, and data discrepancies during debt recovery. Credgenics’ SaaS-based platform offers tailored solutions, including complete visibility into delinquent cases, AI/ML models for communication effectiveness, policy monitoring for regulatory compliance, and automated trust settlement capabilities. The integrated mobile app digitizes field recoveries with features like automatic case allocations, geo-tracking, and digital payments. The platform also offers capabilities for automating the management of legal notices, digital debt settlement approval on mobile and litigation management systems to gain complete transparency into the NPA legal recovery status.Credgenics, with a focus on innovation, has become a key player in enhancing debt resolution capabilities for ARCs, contributing to the nation’s economic growth.

If you are looking to transform your debt collections strategy with the power of digital and data-powered insights, reach out to us to request an exploratory session at sales@credgenics.com or visit us at www.credgenics.com.

FAQs:

Q1: How do digital capabilities enhance the efficiency of debt resolution for Asset Reconstruction Companies (ARCs) in India?

Digital capabilities significantly boost the efficiency of debt resolution for ARCs in India. Technologies like artificial intelligence and machine learning enable advanced data analysis, allowing ARCs to swiftly assess risk, automate due diligence processes, and predict outcomes. This not only expedites decision-making but also enhances the accuracy of strategies employed, contributing to a more effective and timely resolution of distressed assets.

Q2: What role does cybersecurity play in the adoption of digital capabilities by ARCs in India?

Cybersecurity is paramount in the digital transformation of ARCs in India. As ARCs handle sensitive financial data during debt resolution, robust cybersecurity measures safeguard against potential threats. Secure data storage, encrypted communication channels, and proactive risk management are essential components. Ensuring the integrity and confidentiality of data builds trust among stakeholders and establishes a secure foundation for leveraging digital tools in the resolution process.

Q3: How can digital platforms facilitate better collaboration among stakeholders involved in retail debt resolution for ARCs in India?

Digital platforms play a pivotal role in fostering collaboration among stakeholders in debt resolution for ARCs in India. Online portals and secure communication channels provide real-time updates, transparent reporting, and document-sharing capabilities. This enables effective engagement between ARCs, banks, creditors, and investors, fostering a collaborative environment. The accessibility of information through digital platforms not only expedites the resolution process but also strengthens trust and accountability among stakeholders.