What Can a Good Chargeback Analyst Do for Your Business?

In a perfect world, consumers and merchants could exist in a retail space without the threat of fraud or fees. Goods and services would be fulfilled and delivered on time, every time. Purchases could go smoothly from start to finish.

Unfortunately, reality is far from the ideal.

Merchants always have to look for new, more innovative ways to meet consumer demand. At the same time, they have to protect their businesses from chargebacks, which present a growing threat to the online marketplace. This challenge calls for specialized knowledge, and that’s where a chargeback analyst comes in.

Recommended reading

- Prevent Double Refund Chargebacks & Unnecessary Losses

- 10 Common Misconceptions about Chargeback Win Rates

- What’s an “Acceptable” Chargeback Rate? Why Does it Matter?

- Looking for a Chargeback Solution? 10 Questions to Ask First

- How to Find the Right Chargeback Management System

- Do Chargeback Bans Actually Help Stop Disputes?

What is a Chargeback Analyst?

- Chargeback Analyst

A chargeback analyst is a payments industry professional who works with banks, processors, and card networks on behalf of a merchant. Their primary job is to analyze chargeback data to help resolve customer disputes and eliminate chargeback risk factors.

[noun]/chahrj • bak • an • əl • əst/A chargeback analyst plays an important role in managing long-term chargeback risk. They review and collate information pulled from past disputes to identify patterns or trends. They can then use that insight to develop a strategy that will prevent chargebacks from happening.

Any problems that arise on a consistent basis need to be communicated to the relevant party. For example, the analyst may pinpoint vulnerabilities in your fraud management strategy and provide a game plan for how to fix the problem. They may also make recommendations for changes to policies and procedures, helping to prevent recurring errors or missteps.

The Role of a Chargeback Analyst

A chargeback analyst is responsible for all the in-depth data and communication aspects of chargeback processing.

Your analyst is a logical “buffer” for your business. They exist to help prevent disputes when possible and fight back against any that occur due to chargeback abuse. Their day-to-day operations include:

Qualifications to Become a Chargeback Analyst

A skilled chargeback analyst should possess a solid foundation in finance and effective communication. They also need specific professional experience and knowledge of managing payments.

The qualifications for this position typically involve a mix of educational background, technical skills, industry knowledge, and personal attributes. These include:

Educational Background

- A bachelor’s degree in finance, accounting, business administration, or a related field is often preferred.

- Some companies may consider applicants with an associate degree and/or equivalent experience in a related field.

- Certifications related to fraud management, financial analysis, or cybersecurity can be advantageous.

Experience

- Previous experience in chargeback management, fraud analysis, payment processing, or a related field is highly desirable.

- Familiarity with the financial services industry, specifically in areas related to credit card processing, banking, or eCommerce.

Technical Skills & Knowledge

- Proficiency in data analysis tools and software (Excel, SQL, etc.) to analyze transaction patterns and identify fraudulent activities.

- Knowledge of payment processing systems, chargeback processes, and industry regulations (like PCI-DSS requirements).

- Familiarity with chargeback management software, and the tools used for dispute resolution and fraud prevention.

- Understanding of the legal and regulatory framework surrounding chargebacks and dispute resolution

- Knowledge of Visa, Mastercard, and other payment network rules and regulations.

- Awareness of current trends in fraud, cybersecurity threats, and countermeasures.

Soft Skills

- Strong analytical and problem-solving skills to effectively assess chargeback claims and dispute cases.

- Excellent communication and negotiation skills to deal with customers, banks, and payment processors.

- Attention to detail and the ability to work under pressure, manage tight deadlines, and handle multiple cases simultaneously.

- Integrity and a strong ethical stance, given the sensitive nature of the work involving financial transactions and personal data.

- Proactive attitude; willing to research and work towards identifying and addressing potential fraud risks.

- Ability to work independently, as well as part of a team.

In addition to these qualifications, a chargeback analyst should be committed to continuous learning. Your analyst should have a desire to stay up-to-date with changes in payment technologies, fraud detection techniques, and industry best practices.

What Value Does a Chargeback Analyst Offer?

Think of a chargeback analyst as being more than just a role to be filled. Think of it as a strategic investment that safeguards your revenue, enhances your customer relationships, and bolsters your fraud defense mechanisms. Your analyst can help with:

Chargeback analysts are skilled in dissecting and responding to disputed transactions. Their expertise not only helps in contesting unwarranted chargebacks, but also in recovering revenue that might otherwise be lost. This proactive defense and strategic recovery effort directly contribute to your bottom line. Thus, your analyst helps ensure that legitimate sales translate into retained earnings.

By helping manage chargeback disputes, analysts prevent long, drawn-out processes that can frustrate customers. Their ability to quickly resolve disputes often results in higher customer satisfaction. Furthermore, analysts help streamline the purchasing process by identifying and addressing the root causes of chargebacks. This can enhance the overall shopping experience and foster customer loyalty.

Chargeback analysts possess a keen eye for patterns that signify fraud. Their preventive measures go a long way in safeguarding your business against fraudulent activities. Implementing robust fraud detection and prevention strategies helps minimize exposure to fraud, thereby protecting your revenue and maintaining your business’s reputation.

Chargeback analysts bring a level of specialization that allows for the efficient handling of disputes and chargebacks. Their expertise ensures that your business complies with the complex web of regulations governing transactions and disputes. This efficiency not only saves time but also reduces the operational burden on your team, allowing them to focus on core business activities.

Analysts provide valuable insights into trends and patterns in chargeback and fraud activities. This information is crucial for strategic decision-making, helping you to refine your product offerings, customer service approaches, and fraud prevention measures. Over time, these insights contribute to a cycle of continuous improvement, enhancing your business’s resilience and competitive edge.

Chargeback analysts ensure that your business stays ahead of regulatory changes and complies with industry standards, thus minimizing legal and financial risks. Their expertise in navigating the regulatory landscape helps avoid potential penalties and maintain a positive standing with card networks and financial institutions.

A chargeback analyst can help defend your business from revenue loss, disputes, and fraud. They help improve your business’s operational efficiency, customer satisfaction, and overall financial health. Investing in a chargeback analyst means investing in the sustained growth and security of your business.

Is an In-House Chargeback Analyst the Right Solution?

You need someone to manage chargebacks. But, should you opt for an in-house chargeback analyst? Or, is it better to outsource all operations?

Savings, security, personalized knowledge — those all seem like compelling arguments in favor of in-house chargeback analysis. Remember, however, that this person will need support. In-house analysts may ultimately cost more than hiring a third-party expert.

To get the full picture, let’s have a look at the common assumptions about in-house chargeback management and let you decide for yourself which option is right for you.

Need

Is this something that really requires a full-time position to handle?

The Assumption:

Chargebacks are only a part-time concern. An in-house analyst can handle chargebacks when necessary, then split their time performing other tasks.

The Truth:

Between monitoring for fraud, changing industry regulations, and disputes data, managing chargebacks will be a full-time job. One chargeback analyst, let alone a part-time analyst, is probably not suited to the task.

Familiarity

Isn’t it better for someone with first-hand experience with the company and its culture to handle disputes?

The Assumption:

Our people know the company and the product. They can represent us better than a third-party provider who doesn’t know how we operate.

The Truth:

Knowing your company is important, but it’s ultimately a minor part of the equation. It’s more important to have the expertise and experience to know the chargeback system inside and out, be able to individualize disputes and have strong existing relationships with banks.

Education

Shouldn’t it be easy to get an in-house chargeback analyst up to speed?

The Assumption:

There will be a learning curve. However, once we understand the basics, we’ll be able to manage our own chargebacks with no problem.

The Truth:

The rules and regulations enforced by the card networks are constantly changing. The evolution of technology means new threats will continue to emerge. Without constant monitoring, your business could take a serious hit before you’re even aware of the risk.

Oversight

Isn’t it better to have direct oversight over chargebacks?

The Assumption:

With in-house chargeback management, we’ll be able to oversee every step of the process, which will be impossible with outsourcing.

The Truth:

In-house prevention efforts aren’t objective. It’s prohibitively difficult for merchants to analyze their own policies to determine chargeback triggers or effective representment. An outsourced analyst can give you easy-to-interpret information with relevant KPIs.

Security

Isn’t it always safer to handle data in-house?

The Assumption:

Keeping outsiders away from sensitive company information will always be more secure than transmitting it to a third party.

The Truth:

With a reputable PCI-compliant mitigation firm, employees will have limited access that does not disclose valuable data. Administration staff will be bonded under a liability policy, and security protocols are likely to be tighter than the ones you have in place now.

Outsourcing your chargeback analysis could yield greater long-term savings, but you will still need someone to liaise with that person in-house.

Ultimately, we’re not saying you shouldn’t hire in-house chargeback analysts. What we are saying, however, is that sometimes outside help is the more effective solution.

The fewer chargebacks you have each month, and the more disputes you win, the greater your ROI. Generally speaking, an outsourced solution provider is going to be able to accomplish both of those things more effectively.

Will a Chargeback Analyst Be Enough?

Chargeback analysts typically work in tandem with another expert: a chargeback manager.

This is an important distinction to make. These roles appear very similar, but they should be two separate positions. Each specializes in a different facet of chargeback management.

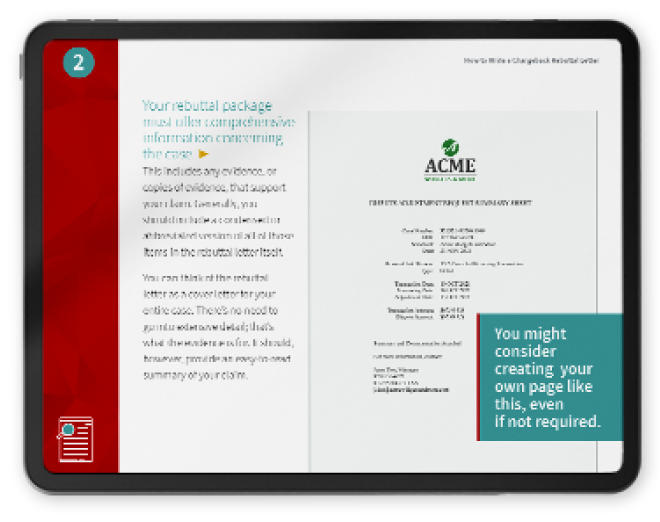

Processes like representment are difficult and time-consuming. They require a ton of research, meticulous record-keeping, and the ability to make decisions on the fly. A chargeback manager needs to understand the data collection and implementation stage and also be able to communicate that information to all relevant parties in a timely and effective manner.

In contrast, your chargeback analyst is focused on the finer details of parsing that data. They’re doing deeper analysis that can help the chargeback manager develop a long-term strategy.

Can Your Internal Team Get the Job Done?

You can manage chargebacks in-house. However, it's a difficult task, and there's a limited prospect of success. Before you decide, consider these questions:

- Are there any guarantees?

- Do you need on-demand assistance or long-term chargeback reduction?

- Are there client testimonials available to validate candidates’ claims?

- Does either method support future technology and fraud trends?

- Do the up-front costs exceed transaction volume?

- Can this method analyze growth potential and budget accordingly?

- Is either solution adaptive to your business’ culture and goals?

Outsourcing some or all chargeback management responsibility doesn’t mean giving up control, nor does it mean that prior work will go to waste. On the contrary, your previously acquired data can make products and services more efficient. Remember: you want a service provider that works with your internal risk management efforts, not in spite of them.

Our team works alongside your internal risk remediation team to deliver maximum revenue retention, leading to more efficient staff allocation. Our efforts are backed by the industry’s only performance-based ROI guarantee: if you don’t save, you don’t pay.

Click below to see how much revenue you could recover by adding the Chargebacks911® suite of tools and strategies to your operations.

FAQs

What does a chargeback analyst do?

A chargeback analyst investigates and resolves disputed transactions to prevent revenue loss and mitigate fraud for a business. They also develop strategies to reduce future chargebacks and ensure compliance with payment processing standards.

How much does a chargeback analyst make in the US?

Exact figures can be difficult to pin down due to regional and industry differences. But, based on the same specification for similar roles, a chargeback analyst in the United States may earn an annual salary ranging from approximately $40,000 to $70,000.

What is a chargeback specialist job description?

A chargeback specialist is responsible for investigating and resolving credit card disputes, working to recover funds for chargebacks, and implementing measures to prevent future disputes and fraud. This safeguards the company's revenue and maintains compliance with payment industry standards.

How do I become a chargeback analyst?

To become a chargeback analyst, one typically needs a degree in finance, business, or a related field. However, it is more important to have relevant experience in payment processing, fraud detection, or financial services, along with strong analytical and problem-solving skills. Additional training or certifications in fraud prevention and chargeback management can enhance employability and expertise in the field.