From the Curinos webinar, “Harnessing the 4 Most Crucial Drivers of Growth in 2025,” presented on December 3, 2024, and featuring Curinos managing directors Peter Serene, Adam Stockton and Bob Warnock and SVPs Olivia Lui and Rich Martin.

Our experts dove deep into what are likely to be the four most consequential and influential factors on banking performance in 2025: the direction of rates, changing customer behavior, personalization and accelerating AI, and regulatory changes and possible restructuring. They unpacked them in a conversational format that offered their data-driven perspectives on what to expect and how to prepare. Here are but a few of their insights:

1. YoY net income results for Q3 were positive, driven by relief in interest expense, but a lot of digging out remains.

As a result of recent rate cuts, banks and credit unions realized revenue growth for the first time in six quarters and modestly higher overall net income performance of 2.1%, while net interest margin improved to just over 4%. Curinos is expecting positive operating leverage to percolate in Q4, but deposit and loan growth thus far has remained muted, each at about 2% year-over-year in Q3. And declines in return on tangible common equity (ROTCE) persist, both year-over-year and quarter-over-quarter, which means a fair amount of optimization is thus far being left on the table.

Q3 2024 Financial Performance

Source(s): SNL, Curinos Analysis

2. Relative to the last rate cycle (July through October 2019), every line of business has managed to pass through a higher beta, except Consumer, where repricing has been offset by balance rotation.

With the exception of Consumer, beta pass-throughs have approached 50%, which means FIs have been able to realize an effective savings of up to nearly 25 bp of interest expense from the Federal Reserve’s 50 bp rate cut from August to October of this year. These lines of business have been aided by a smaller back book, and many Commercial balances are in non-interest-bearing deposits. In Consumer, however, even though headline rates have declined, portfolio rates remain stubbornly high because of the remixing of deposit balances.

Betas are higher in this rate cycle versus the last one because of 1) a higher rate ending point in this cycle, 2) a sharper institutional eye on costs, and 3) a less acute need for deposit growth at most institutions. But betas on the downside of the cycle are much less what they were on the upside, so expectations going forward need to be tempered – interest-expense savings are not likely to be as great or as quick as the expense going up. In managing deposit costs, FIs will need to know to which customers rate will matter, or not, and acting on that information surgically. As an example, mass promotions for new money shouldn’t disturb current balances that would otherwise stay put.

Overall Beta by Line of Business | Current vs. Last Cycle

Source(s): Curinos Deposit Analyzer

Note(s): 1) Current cycle defined as Aug – Oct ’24 (50-bp cut); Last cycle defined as Jul – Oct ’19 (50-bp cut)

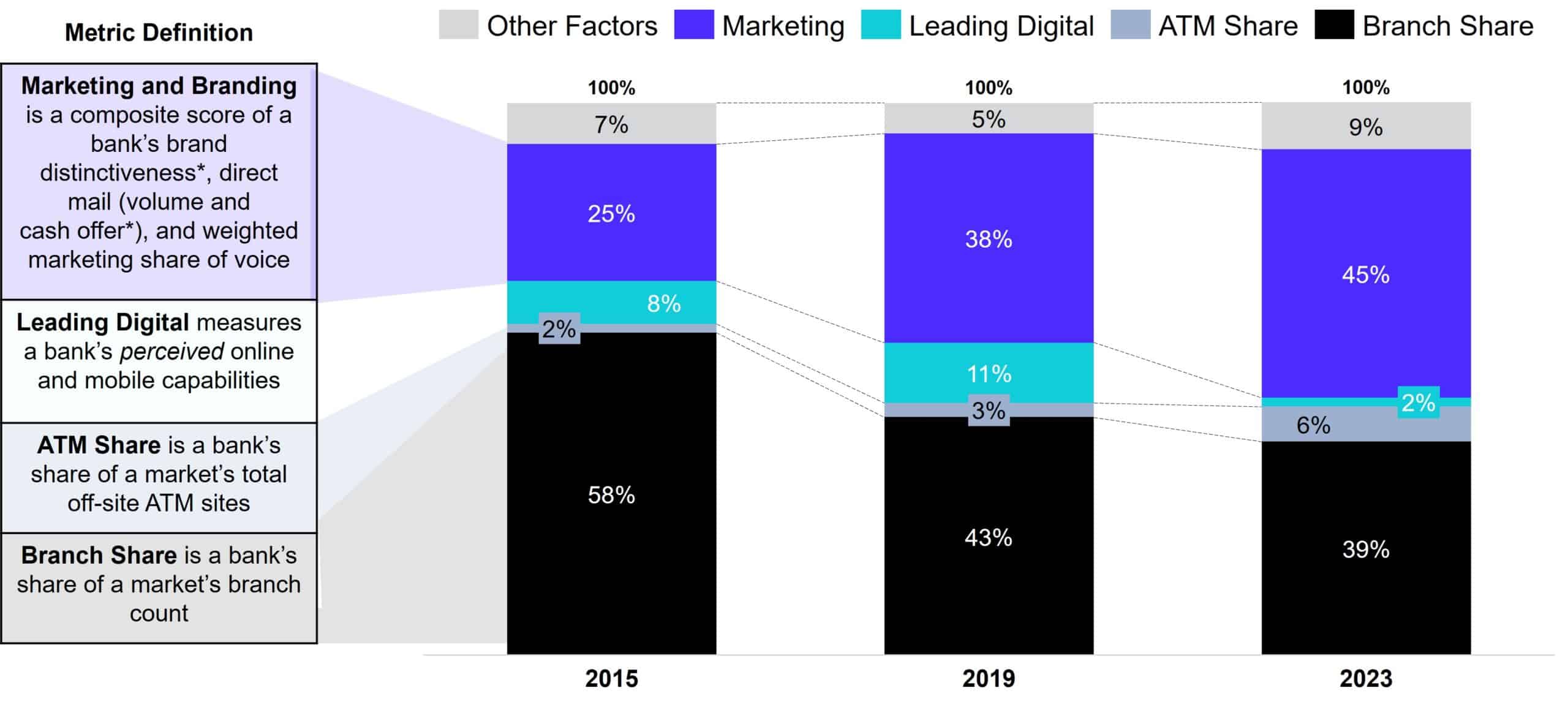

3. Traditional banks are increasingly leaning on marketing and differentiation to drive acquisition.

For acquiring new checking customers, branches are giving way to marketing and branding, which now accounts for 45% of new relationships. But even though the direct role of branches has been diminished in acquisition, they continue to serve the important purpose of brand recognition, serving as de facto billboards in key locations that can reinforce an institution’s presence. In addition, relationships initiated at the branch continue to display significantly higher lifetime value than those initiated outside of the branch.

In addition, digital (perceived online and mobile capabilities) as an acquisition driver appears to be on the wane, but this is only because a satisfying digital experience has become table stakes in any acquisition effort. This means that a good experience can’t necessarily help gain new relationships directly, but a bad one can certainly hurt – in lost opportunity and attrition.

Primary Checking Acquisition Drivers - Changes Over Time

Source(s): Curinos Analysis of Primary Checking Purchasers | Curinos 2019, 2022, and 2023 U.S. Shopper Surveys | Curinos BranchScape | MasterCard ATM Data | Kantar Media | Comperemedia

Note(s): *Brand – composed of various attributes (e.g., “friendly and helpful”, “helps you plan”) from the Curinos Shopper Survey | *Cash Offer – whether the respondents received cash offer when they opened their primary checking account | only includes banks with a branch presence | 2020 and 2021 excluded due to COVID-19 spikes

4. Effective personalization fueled by AI is becoming critical in accelerating ROI with the current book of customers or members.

Effective personalization is the ability to reach the right customer or member with the right offer or message at the right time. Often through conventional marketing stacks that are not AI-empowered, this can be achieved only through the efforts of many dozens of dedicated individuals at an untenable cost. In the recent case study shown here, automated personalization that continually optimizes learning at the account level was shown to significantly improve results across all important dimensions. Customers who received optimized marketing accounted for fewer than half of customers but more than two-thirds of new–account revenue. Compared to control groups, they were 1.5x more likely to open a new product and 2x more likely to engage with bill pay or e-statements. And accounts opened by customers receiving optimized marketing were also more likely to still be open after three months and after six months.

Case Study

Source: Curinos Amplero Personalization Outcomes

5. With policy changes potentially on the horizon, FIs need to be nimble enough to scale while maintaining their focus on primary customers and members.

The uptick in M&A activity of the past several weeks is likely to continue. FIs that are potential targets are well advised to polish up their deposit books because these are the crown jewels sought by acquirers. For potential acquirers, the right management of deposit books can also be a powerful lever in increasing equity value, the coin of the realm in any transaction. At the same time, institutions need to prepare for the many customers and inhouse associates who are likely to become much more restive in such an environment.

Relaxed regulation can also trigger intensified competition, so FIs need to focus intently on optimizing their product suite and how to acquire customers effectively through marketing and sales at the lowest possible cost. Finally, a more favorable business climate could also spur economic growth and the potential for sustained inflation and elevated rates. Institutions will need to stay flexible in their what-if planning. This could include rate strategies across funding pools rather than siloed and a continued emphasis on low-cost or no-cost checking.