Thousands of pensioners who purchased funeral plans are having to choose whether to sign up blind with a new provider or lose money, i can reveal.

Pride Planning is one of 20 pre-paid funeral firms that are ceasing to operate rather than continuing under the regulation of the Financial Conduct Authority, which began overseeing the market on 29 July.

Pre-pay plans allow people to cover the cost of their funeral in instalments, ensuring families are not saddled with debt when a loved one dies.

Dignity Funerals Limited, which is now authorised and regulated by the FCA, has agreed to provide Pride’s 19,000 customers with a funeral plan that matches their agreement “as closely as possible and at no additional cost to the price”.

It has also stepped in to offer funeral plans to around 74,000 customers of several other firms which are ceasing to operate.

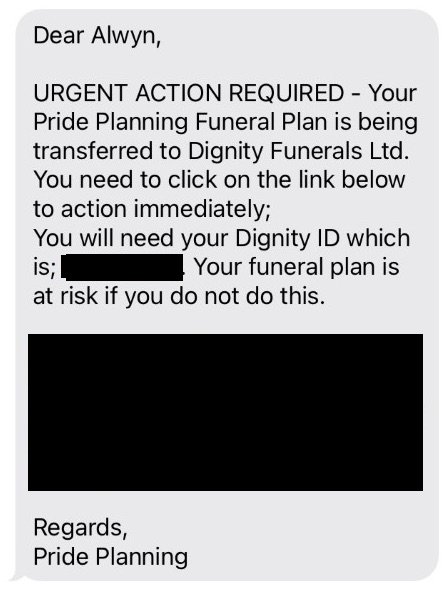

But Dignity Funerals Limited is asking customers to sign up blind, warning them that their funeral plan is at risk if they do not do. It promises that it will try to match a customer’s original funeral plan as closely as possible but that it cannot reveal the full details of any new plan until the customer has signed up.

With the average funeral estimated to cost £4,000, the total value of Pride’s 19,000 funeral plans is approximately £76m.

Alwyn Evans, 80, a grandfather of five from Cardiff, purchased a funeral plan from Pride in 2016 for £3,895.

Mr Evans received a text on 17 October, informing him that his funeral plan was being transferred from Pride to Dignity, warning that it was “at risk” unless he followed a link “immediately”.

“My initial response was it was a scam,” Mr Evans told i. “I phoned Pride and could only get through to a pre-recorded message, which said the company was transferring its assets.

“The threat of losing part of such a crucial investment was really shocking. The whole episode was disorientating.”

After following up on the text, Mr Evans says he was told he had to “opt in” to a Dignity plan or else lose his funeral cover.

A statement on Pride’s website from the administrator, Milner Boardman, states that customers have until 13 January to transfer their plan. If they fail to do so by this date they will “no longer have funeral cover”.

It adds: “Please also note that if you do choose to ‘opt out’, any refund that you receive is likely to be less than the amount that you have paid into your Pride Plan.”

Money belonging to customers who choose not to transfer their plans to Dignity will be held in a trust. If they do not receive a full refund, they may be able to make a claim for the remaining amount as a creditor, Milner Boardman says.

Mr Evans made numerous calls to Dignity but customer service staff from a third party were unable to offer any details about the nature of the plan he was being urged to transfer to.

A spokesperson for Dignity has since said customers are only able to receive full details “once they have transferred”.

Facing the prospect of losing his funeral cover altogether, Mr Evans transferred to Dignity on 31 October. Since then, he has received a single page of information about his new package.

“I feel like my funeral has been hijacked,” Mr Evans said. “Effectively, people are having to sign up blind, without any details, to schemes they have not requested.”

The Government expanded the FCA’s regulatory powers to cover the pre-paid funeral plan sector from July onwards.

The FCA is seeking to protect elderly, often vulnerable, customers from unfair sales practices, ensuring products meet their needs and offer good value.

The new rules include a ban on cold calling, along with a ban on commission payments to intermediaries. Planners must also offer full refunds if a customer dies within two years of taking out a plan.

A total of 26 firms have been authorised to operate under the FCA, together holding approximately 1.6 million plans – 87 per cent of the market.

The 20 firms which have not been authorised are no longer able to sell or carry out funeral plans. A number of firms did not apply for authorisation, while others, like Pride, withdrew their applications. At least one firm had its application refused.

A spokesperson for the FCA told i: “While people who bought a pre-paid funeral plan with Pride Planning will have been understandably concerned, it is positive that Dignity is offering them an equivalent funeral plan at no extra cost.

“The FCA was given oversight of pre-paid funeral plans by Parliament in July this year. We have put in place new, tough standards to prevent the potential for consumer harm in this market.”

More from News

Safe Hands – another large provider – went into administration March after withdrawing its application for FCA authorisation, throwing 45,000 plans into doubt.

Customers were given until 31 October to also transfer to Dignity, or pursue a refund instead.

A report by the administrator, FRP, valued Safe Hands’ assets at between £10.6m and £16.1m, compared to claims from creditors amounting to £71.13m

Anyone applying for a refund could expect a return of between just 10p and 20p for each pound they invested, the report said.

In addition to Pride and Safe Hands, Dignity has stepped in to offer equivalent funeral plans to customers of four other firms which are ceasing to operate. These are: Capital Life (approximately 13,000 plans) Empathy (7,500 plans), Rest Assured (6,000 plans) and Silver Clouds Later Life Planning (2,500 plans).

A spokesperson for Dignity told i: “We understand that this is difficult time for those that have purchased a funeral plan from a provider that has chosen not to apply – or met the standards required – to be a business regulated by the Financial Conduct Authority.

“That’s why, as a socially responsible company, we are offering all customers of Pride Planning the option to transfer to a plan with Dignity as an alternative to waiting for an offer from the administrator.

“We will do everything we can to provide Mr Evans with an FCA-regulated plan as close to the original product he purchased at no additional cost. All customers will receive full details once they have transferred.”

Grindr must act but there are darker reasons why children are on the dating app