It seems like 2024 was filled with nonstop bad news about UX job losses and difficult job searches.

It seems like 2024 was filled with nonstop bad news about UX job losses and difficult job searches.

Layoffs in tech are nothing new. What seems to have been different in the past two years has been the volume of layoffs across so many companies and how few new jobs were posted.

Having been in the industry for 27 and 45 years respectively, we’ve experienced the ups and downs from the dotcom crash of 2001–2003 and the great recession of 2008–2009.

In our experience helping many talented UX professionals find jobs, the last two years (2023–2024) somewhat resembled the dotcom contraction. That event affected mostly tech companies, but the 2008–2009 recession devastated real estate, financial institutions, construction, and manufacturing. That said, many UX practitioners work across all industries and were not completely spared.

But we also know the availability of information via social media channels like LinkedIn can distort our perceptions and reinforce our biases.

Although we don’t know exactly how 2025 will differ from the last two years and whether the job market will be better, we can investigate how UX professionals feel about the upcoming year and compare that to some historical data. To do so, we’ll look into the results of the recent 2024 UXPA Salary survey.

Adding or Losing Staff

The first question we looked at in the survey asked all respondents whether their organization added staff, lost staff, or stayed the same. In 2024, about the same percentages reported losing staff as adding staff (35%; Table 1). By themselves, those numbers can be hard to interpret. Is that a lot?

| 2024 | 2022 | 2018 | 2016 | 2014 | 2011 | 2009 | |

|---|---|---|---|---|---|---|---|

| Added staff | 35% | 55% | 53% | 51% | 48% | 53% | 26% |

| Stayed the same | 24% | 19% | 23% | 25% | 23% | 43% | 56% |

| Lost staff | 35% | 17% | 18% | 18% | 14% | 4% | 18% |

| I don't know | 7% | 8% | 5% | 6% | 15% | N/A | N/A |

| Sample Size | 408 | 625 | 1351 | 1357 | 1669 | 89 | 117 |

Table 1: Percent of respondents’ answers to “Did the user experience/user-centered design/usability group in your company or organization add or lose staff in the past 12 months?”

Fortunately, we’ve been helping collect and analyze the same UXPA survey data for over a decade, so we dug into the archives to find some historical data. The same item was asked in the UXPA salary survey going back to 2009. The period covers both a long expansion in tech (2010 to 2022) as well as covering the time immediately after the deep global recession of 2008.

Table 1 shows that 35% of organizations losing staff is indeed high. It is roughly double what it was from 2022 all the way back to 2009. The percentage reporting their organization added staff is lower than most years but was at least a little higher than in 2009.

The main difference between 2024 and 2009 is that more organizations reported staying at about the same headcount in 2009 (56%) compared to 24%, suggesting 2024 was a more turbulent time than 2009.

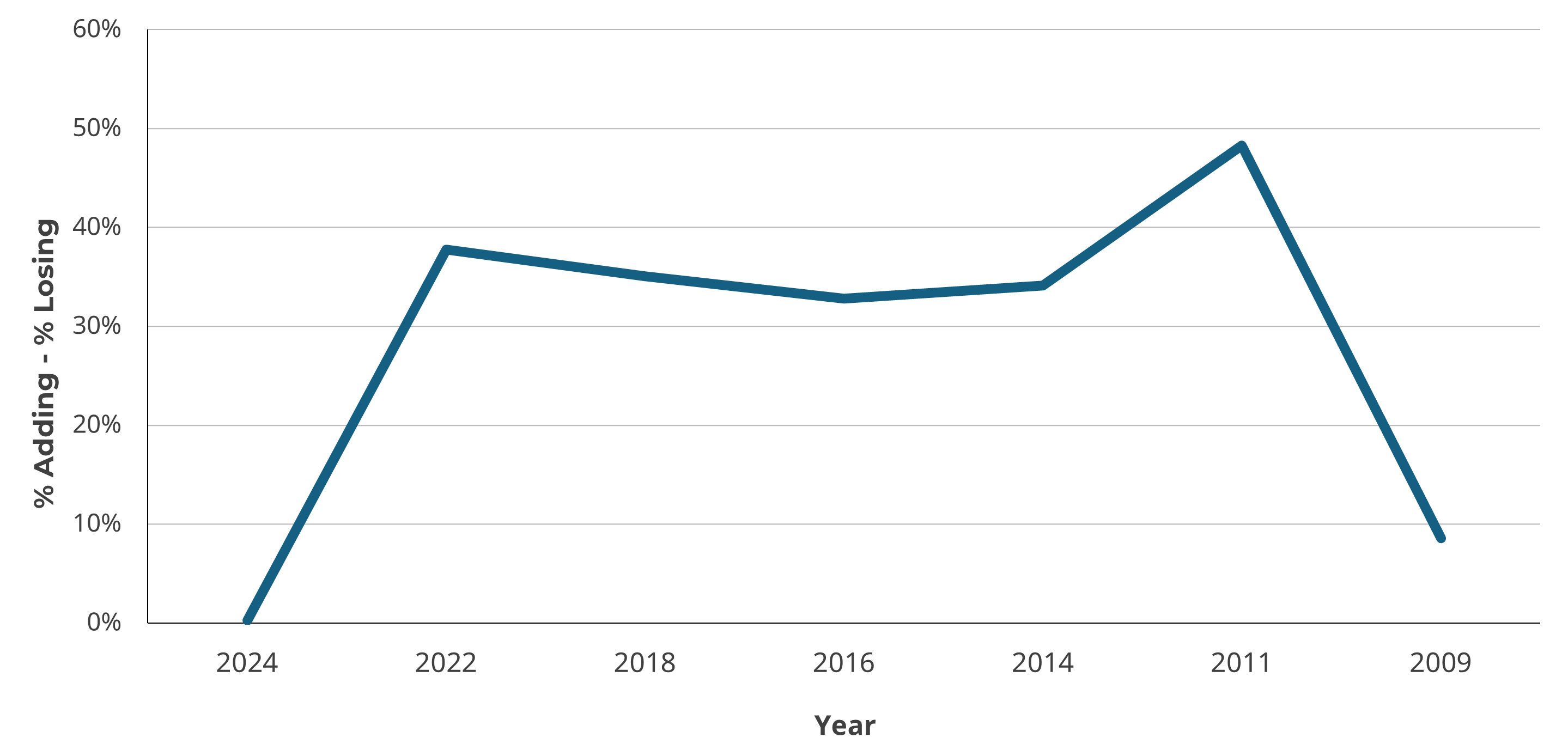

We created a net new job metric by subtracting lost staff from added staff (shown in Figure 1) to display the trend. The contraction in 2024 can be seen as nominally worse than 2009.

Figure 1: Net jobs added (% added minus % lost) by year.

In 2024, a new item was added to the UXPA survey that asked respondents whether their organization had layoffs. This item corroborates the reduced staffing item, as 37% reported that their company had layoffs (about the same as the percentage reporting reduced staff). Nine percent reported they were laid off themselves.

A note on the historical data: In earlier versions of the survey (2009 and 2011), only business owners and directors were asked the staffing question. In 2014, the question was shown to all respondents, and an “I don’t know” response option was added. Consequently, the sample sizes are much smaller in the earlier surveys.

Tech Contraction

Job losses in UX don’t happen in isolation. While UX professionals aren’t software developers, developer job figures are likely a good proxy to understand what’s happening in the broader tech industry, as UX designers and researchers often work with software developers.

While there isn’t a long history of tracking layoffs, evidence is strong that the broader tech industry has had a substantial number of layoffs. There are also far fewer new job postings for software developers on the large job website Indeed.

ADP, the payroll company that often provides payroll data to gauge unemployment, started tracking employment data specifically for software engineers in 2018. For tracking purposes, they set their initial 2018 benchmark to 100.

Figure 2 shows that the employment index for software engineers peaked around 2020 and has fallen well below 2018 levels.

Figure 2: Employment index for software engineer job titles from 2018 to 2024 (data derived from ADP as reported in the WSJ <behind paywall>).

The low-interest rate environment (often called ZIRP for Zero Interest Rate Policy) between 2020–2022 fueled startup growth and hiring in tech. With the rapid rise in interest rates to combat inflation, venture funding dried up as capital became more expensive, leading to a significant reduction in startup hiring (which often includes a lot of tech talent).

But that’s data about the past. What will happen in 2025?

Future Business Climate

To gauge how UX professionals feel about the future, we looked at an item that has been presented in most UXPA surveys going back to 2009.

Respondents were asked to describe the business climate for the next 12 months. Table 2 shows that about a third (35%) thought it was improving or strongly improving compared to 19%, who thought it was declining or strongly declining.

It’s hard to interpret in isolation. Is the pattern in 2024 good or bad?

| 2024 | 2022 | 2018 | 2014 | 2011 | 2009 | |

|---|---|---|---|---|---|---|

| Strongly Improving | 4% | 16% | 15% | 16% | 20% | 5% |

| Improving | 31% | 53% | 47% | 51% | 50% | 25% |

| Same level | 37% | 21% | 26% | 23% | 27% | 43% |

| Not sure | 9% | 5% | 5% | 4% | N/A | N/A |

| Declining | 17% | 4% | 6% | 5% | 3% | 24% |

| Strongly declining | 2% | 1% | 1% | 0% | 0% | 2% |

| Net Improving | 16% | 64% | 54% | 62% | 68% | 5% |

| Sample Size | 408 | 625 | 1351 | 1441 | 111 | 146 |

Table 2: Percent of respondents’ answers to “Please describe the business climate you foresee in the next 12 months.” (Item not included in 2016; only contractor/freelance/solo consultants saw this question in 2009 and 2011—full sample responded from 2014 on with the option to select “Not sure.”)

Looking at the prior years, we see those declining numbers in 2024 are, unfortunately, very high. They are about four times what they have been for the last decade, with only 2009 having nominally worse numbers. (UXPA did not conduct a salary survey during the COVID pandemic in 2020.)

We created a “Net Improving” metric, which takes the percent improving or strongly improving and subtracts the declining/strongly declining, graphed in Figure 3. With this metric, negative values are possible (more declining than improving) but fortunately, things are still slightly positive despite all the bad news.

Figure 3: Future business climate net improvement (Improving/Strongly Improving minus Declining/Strongly Declining) by year (2016 data not available).

Figure 3 clearly shows that 2024 was a bad year, but it was about the same as 2009. Have we reached the bottom? It’s hard to know for sure, especially with the potentially unknown effects of AI on jobs and lingering inflation. If the past is any indication, recovery could happen within two years as the low 2009 outlook numbers had more than recovered in 2011.

Plans to Hire

In 2024, a new item was added to the UXPA survey asking respondents whether they had the authority to hire, and if so, how many hires they expect to make in 2025. Of the 99 respondents with hiring authority, 70% reported planning to hire at least one person, and 20% reported plans to hire three or more positions.

Across those 99 who plan to hire, the total adds up to 189 new positions planned for 2025. Whether that’s enough to offset additional losses is yet to be known. Ideally, with the softening interest rate environment due to a reduction in inflation since 2021, investment in startups may begin again, which would likely improve UX job prospects.

Summary and Discussion

Our analysis of the UX job market using historical data from the UXPA salary survey revealed:

Significant UX job contraction: Roughly a third of respondents reported their organization lost staff (35%), most likely the result of layoffs (37% of organizations). The net staff reduction is the worst on the UXPA record, nominally worse than the 2009 data that happened immediately after the global financial crisis of 2008–2009.

Tech jobs down: The drop in jobs isn’t exclusive to the UX profession but is likely a function of a contracted technology sector. Software engineer new jobs and the number currently employed are at levels below 2018 (when records started).

Future business climate not rosy: Unfortunately, the sentiment of the future business climate is not positive either, with the lowest positive feelings about the future since 2009. Keep in mind these projections into the future may just be a reflection of the present.

Plans to hire in 2025: Of those in a position to hire, most (70%) reported planning to hire at least one UX position in 2025 with 20% planning three or more.

May be at the bottom (hopefully): While the net jobs added and net business outcome metrics are at the lowest point since 2009, the data suggests the worst might be over. It’s hard to know what exactly will happen in tech, but if history is a guide, the subsequent two-year period after the nadir of 2009 had net jobs and business prospects at their highest. Here’s hoping for a good New Year!