When one of China’s once-popular electric vehicle startups went bust, car owners encountered an unexpected problem: Their vehicles went “offline.”

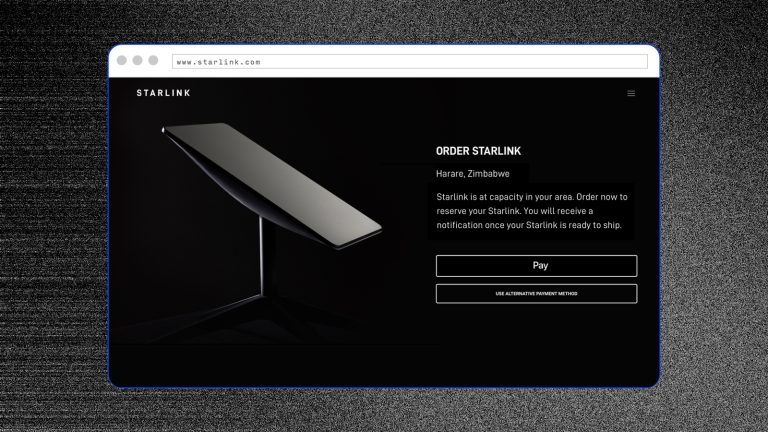

Richard Qian didn’t know what to expect when he heard that WM Motor, a Shanghai-based EV maker popular for its low prices, filed for bankruptcy in October 2023. He tried to drive his compact EX5 SUV as he normally would, but discovered that he could no longer log into WM Motor’s smartphone app, which remotely controlled the car lock and air conditioner. He also couldn’t see his car’s mileage and charging status on the dashboard.

Qian was not alone. Other WM Motor owners reported that the smartphone app was unusable, and the built-in car stereo, which required an internet connection, had stopped working. Multiple WM Motor owners filed complaints on 12365auto, a Chinese automobile review site. “The car system is paralyzed and I can’t log in. The entire entertainment system is unusable, and the vehicle status cannot be checked,” one owner wrote. “The car has become a huge safety hazard!”

WM Motor later apologized for the server downtime and temporarily resolved the issues. But some owners still have difficulties accessing basic features, such as in-car entertainment, according to Chinese media reports. The company has not updated its firmware since the bankruptcy filing, and the WM Motor app is currently not available on Chinese app stores.

“Luckily I had the app previously installed on my phone,” Qian told Rest of World, but he doesn’t know how much longer he will have a functioning vehicle.

As Chinese car owners brace for further consolidation of the country’s hypercompetitive EV market, the fact that many electric cars rely on cloud services — from smartphone controls to software updates — has raised concerns about the long-term serviceability of the vehicles.

Intense price wars and the phasing out of government subsidies have left a number of the nation’s EV manufacturers — estimated at more than 100 — struggling for survival. Since 2020, more than 20 EV makers in China, including Singulato and Aiways, have left the market. Most recently, the high-end carmaker HiPhi, which only sold 4,520 vehicles in 2022, halted production in February as it wrestled with financial woes. WM Motor was the largest Chinese electric carmaker to date to become insolvent, having sold approximately 100,000 vehicles between 2019 and 2022.

Between EV companies that have filed for bankruptcy and those that have halted operations, an estimated 160,000 Chinese car owners are left in the lurch, according to the China Automobile Dealers Association.

Owners are worried about their access to factory parts in future repairs. Wang, a driver who bought a HiPhi X because the design stood out from the “seriously homogenous” EVs on Chinese roads, told Rest of World he is prepared to scour for spare parts from used markets in the future if his 570,000-yuan ($97,174) car needs repairs and the company is no longer around to provide digital or mechanical services.

China’s automobile regulations say car manufacturers must ensure the supply of hardware parts and after-sales service for at least 10 years following a model’s discontinuation. EVs, however, are far more dependent on advanced software, which is not explicitly covered by China’s after-sales support requirement. Proprietary software is often used for features like charging, remote access, door keys, and even in-car entertainment. They’re also often connected to internet-based services that are reliant on the carmaker’s cloud servers.

“The biggest concern [for EV owners] is battery degradation, and secondly the operability and stability of the software,” Lei Xing, EV analyst and co-host of the China EVs & More podcast, told Rest of World.

The frustrations of Chinese EV owners come amid a wider shift in the industry. EVs have been dubbed “smartphones on wheels,” because there is now a heavy emphasis on software — rather than hardware — to provide new features. Both Xpeng and Nio advertise custom software updates delivered automatically over the air, voice controls, and scheduled workflows. Xing said he doesn’t think the market can go back to the time when cars could run without internet. “It’s just the way that the industry is developing and where it is headed,” he said.

A reliance on cloud services means that cars can have issues even when there’s no fault with the vehicle itself. In 2021, Tesla owners around the world who didn’t carry their physical keys were locked out of their cars when the company’s smartphone app had an outage. In June, after U.S. carmaker Fisker went bankrupt, drivers found themselves unable to lock their EVs or turn on air conditioning, making the cars unbearable to drive in the summer.

The Chinese government is trying to boost the EV sector. It introduced new consumer incentives in July — a subsidy of 20,000 yuan ($2,800) for car owners hoping to replace their gas cars with EVs — in a clear attempt to keep struggling automakers afloat.

Xing is not expecting sudden brand collapses in the next year. “Many will be under pressure for sure, but we’re unlikely to see announcements of ‘We’re done,’” he said. “It’s a slow-death process.”

One investor familiar with WM Motor told Rest of World that being an independent startup made the company’s plight more difficult.

“WM Motor is a special case because it built its own operations from zero, with its own factories and R&D,” said Ren, requesting to be identified only by his last name because bankruptcy proceedings are underway. “Many other EV startups are either subsidiaries of, or in partnership with, established carmakers or tech companies, who are able to take over the after-sales liabilities if the EV startups fail.”

The best outcome for WM Motor, said Ren, is to sell off its after-sales liabilities — including the digital services, which can still be profitable for the new buyer. WM Motor did not respond to a request for comment.

The result is that Chinese consumers seem to be moving away from young EV startups. According to the latest EV sales figures, Chinese consumers are sticking to more established brands such as BYDBYDBYD Auto is a Chinese carmaker that became the world’s leading EV manufacturer in 2023, competing with Tesla for market share and global attention.READ MORE, Tesla, and GAC Motor. Only one of the 20 bestselling EV models in China in the first half of 2024 was made by an EV startup — the Li L6 by Li Auto — and eight of them were from BYD.

“Consumers are now factoring in the risk of manufacturers going bankrupt,” Ren said.