Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

EXCLUSIVE NEW YEAR OFFER

Unlock 6 Months of FREE Performance Management with any Superworks plan!

Optimize Workforce Management

Automate Payroll & Compliance

Enhance Employee Engagement

Don’t Let Payroll Process Hold You Back: HR Payroll Software For 2023

- web payroll

- 10 min read

- June 30, 2023

HR Payroll Software is the most important function in any business. Whether it is for small vendors or it is for big enterprises. Agree?

Who doesn’t want a salary on time?

But it becomes quite tough to calculate, process, and disburse while we are talking about the Indian payroll. Indian payroll is complex as it includes- tax filing, compliance, basic terms, etc. It actually needs a solution to streamline payroll. In that case, the HR payroll system is the most convenient solution for all the problems regarding payroll.

So, as per the complexity, we can say the process of managing employee pay and HR-related tasks can be time-consuming. Fortunately, there are numerous software solutions available that can simplify the entire payroll process and increase efficiency. In this article, we will be exploring the top 11 HR payroll software picks for 2023 that can help power up your payroll and enhance your HR operations. Whether you’re a small business or a large corporation, these software options can streamline your payroll tasks, manage employee salary information, and ensure statutory compliance with tax laws and regulations. So, if you’re looking for a payroll solution that can save your time and resources, keep reading to discover the top picks for 2023.

But, first of all, let’s understand what is payroll software and what its purpose that.

What is a Payroll Software?

Payroll software is a computer program that automates and streamlines the process of managing employee salary and benefits. It helps organizations to efficiently calculate and process employee salaries, bonuses, taxes, and deductions. The software can also generate pay slips, manage paid time off and sick leave, track attendance employee, and maintain employee records.

Additionally, the payroll system can ensure statutory compliance with tax regulations and labor laws, and reduce the risk of errors or discrepancies in employee compensation. By using HR payroll software, businesses can save more time and resources, and improve the accuracy and efficiency of their payroll operations.

What Is the Work Process Of Payroll Software?

The functioning process of payroll software involves several steps.

Firstly, the HR payroll software collects and stores employee information, including personal information, compensation details, and tax withholding preferences.

Secondly, the software calculates employee salaries, bonuses, taxes, and deductions based on the data inputted.

Thirdly, the software generates pay stubs and other necessary documents, which employees can access through an employee self-service portal.

Additionally, the software can track employee attendance portal and paid time off, and automatically adjust their compensation accordingly.

Finally, the software can help ensure compliance with tax regulations and labor laws by automatically applying the latest updates and changes to the system.

Overall, the HR and payroll software streamlines the process of managing employee compensation and benefits, saves time and resources, and reduces the risk of errors or discrepancies.

What Are The Goals Of HR Payroll Software?

The main goal of payroll solutions is to make the whole payroll management process simplified.

More than that you can consider some basic functions of the HR and payroll software in India like to do these processes with ease- computing, distributing employee paychecks, simpler taxes management, and many more.

The payroll accounting software has specific objectives to attain, one of which is to ensure that employees are paid accurately and promptly without errors or delays that could lead to financial distress or dissatisfaction. Another objective is to help businesses follow tax regulations set by the local, state, and federal governments to avoid potential financial or legal penalties.

The payroll in HR software also aims to save time and resources by automating payroll tasks, thereby decreasing the workload for HR department and accounting staff, and enabling them to concentrate on more essential duties. It also aims to enhance payroll data accuracy by reducing errors and inconsistencies in employee data such as working hours, wages, and taxes withheld.

Additionally, payroll software works with security features that protect employee data and prevent unauthorized access, reducing the risk of identity theft and data breaches. In conclusion, the main goals of HR payroll software are to simplify and optimize the payroll process, guarantee compliance with regulations, and reduce the risk of errors and security breaches.

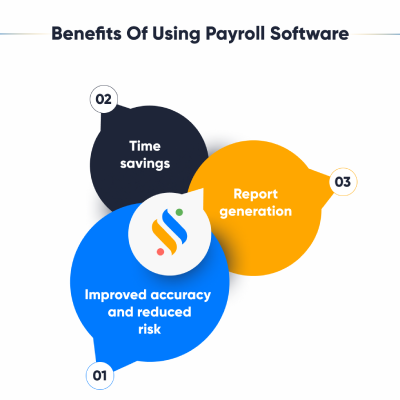

Benefits Of Using Payroll Software

If your company is currently manually tracking employee information and processing payments, implementing a HR payroll software solution can have several benefits, such as:

Improved accuracy and reduced risk

By automating payroll tasks, businesses can mitigate compliance risks and ensure that paycheck-related taxes are remitted correctly and on time, minimizing the risk of errors such as multiplication or rounding mistakes.

Time savings

One of the most significant advantages of a payroll management system is the amount of time it saves. The software is designed to be user-friendly, with a low learning curve for setting up and processing payroll. Additionally, the software tracks changes to tax codes, saving businesses the time and effort of keeping up with them manually.

Report generation

Payroll solutions allow businesses to track payroll information over time and produce reports that are useful for internal decision-making, accounting, and auditing. These reports can include summaries of quarterly costs, annual tax remittances, and historical employee benefits participation.

Overall, implementing HR payroll software can save time, improve accuracy, and facilitate compliance with tax regulations, making the payroll process simpler and more efficient for businesses.

Read more: Payroll Outsourcing Service and Payroll Software- What to Pick!

List of Top 11 HR Payroll Software To Power Up Payroll

There are numerous HR payroll software solutions available in the market, each with its own unique features and functionalities. To help you select the best payroll software for your business needs, we’ve compiled a list of the top 11 options, based on factors such as user reviews, features, pricing, and overall reputation.

Whether you’re a payroll software for small business owner or part of a large enterprise, these HR payroll software solutions can help you improve your payroll process, reduce errors, and save your time and effort. So, let’s dive into the list and explore the best payroll software options available!

1. Super Payroll

Introducing a comprehensive HR and payroll software designed to cater to the needs of intelligent businesses. This online payroll software is equipped with a range of features to streamline and optimize payroll processing services. If you’re looking for a reliable solution to handle your payroll needs, this software is the answer. This software ensures accurate and efficient processing of your employees’ payroll, leaving you with more time and resources to focus on other important aspects of your business.

Features:

Systematic loan management

2-step Salary slip generation

Increased payroll and compliance accuracy

Accurate & quick bonus calculation

100% customizable salary structures

Reliable & real-time payroll insights

Smart compensation implementation

Auto-deduct TDS for employees

Auto-calculate CTC of new employees

2. ADP Workforce Now

You can simplify your company’s HR processes with ADP Workforce Now – an online best HR software created specifically for midsize companies. This platform integrates various features, such as benefits HR project management, payroll, talent management, and time and attendance, in a single dashboard.

Features:

Automated payroll processing

Different pay card options

Customizable earning and deduction

Employee self-service portal

Compliance tracking and reporting

Mobile payroll processing capabilities

Integration with other modules

Secure data storage and confidentiality

24/7 customer support and service

3. Oracle PeopleSoft

Oracle provides an extensive cloud platform for transitioning PeopleSoft to the cloud. The Oracle suite comprises various modules, including Payroll management Global Core HCM, Workforce Management, Talent Management, and other related features. This enterprise-grade cloud solution is designed to support and optimize critical payroll processes and enhance overall productivity.

Features:

Automated payroll with tax management

Direct deposit for salary management

Employee budget forecasting

Compliance payroll audits

Integration with other HR modules

Self-service benefits enrollment

Configurable payroll rules

Flexible payroll interfaces

4. Namely

Namely is a cloud-based HR platform that provides a suite of hr service outsourcing, including payroll management. Namely, online HR payroll software is designed to help businesses streamline their payroll processes by automating many of the time-consuming tasks involved in managing payroll.

Features:

Customizable payroll schedules

Payroll preview

Third-party integrations

Flexible pay types

HR compliance alerts

Dedicated support

Consolidated reporting

Automated deductions

5. BambooHR

BambooHR is a human resources management system that includes payroll management software as one of its features. The software is designed to help organizations streamline their payroll processes and manage employee records more efficiently.

Features:

Employee self onboarding

International payroll

Customizable payroll workflows

Employee self-service portal

Other software integration

Customizable reports

Automated payroll disbursement

6. Zenefits

Zenefits payroll software is designed to be easy to use and is suitable for businesses of all sizes. It provides features like direct deposit, time and attendance tracking, and customizable pay stubs. Additionally, the software is designed to integrate with other HR solutions, such as benefits administration and time tracking, to provide a comprehensive HR management system.

Features:

Automated payroll calculation

Built-in compliance

Customizable payroll reports

Automated tax filings

HRMS integration

Customizable payroll settings

Direct deposit

7. Rippling

Rippling is a suitable option for medium size businesses that have bigger budgets and a global workforce. Although the platform offers numerous robust payroll functionalities, buying the core workforce management platform is necessary to access the payroll module.

Features:

Integration with HRMS

Automated payroll compliance

Multi-country currency support

Real-time payroll preview

Employee self service portal

Automated onboarding

Customized payroll workflows

8. QuickBooks Payroll

QuickBooks simplifies the process of managing your business finances by allowing you to consolidate all of your transactions in one place. This makes it easier to complete your daily tasks with minimal effort required. Additionally, you can easily import information from a spreadsheet without any difficulty.

Features:

Automated payroll processing

Mobile payroll

Multi state payroll

Direct cheque to the account

Report & Analytics

Integration into other modules

Workers’ compensation

9. Paycor

Paycor is cloud-based HR payroll software that provides comprehensive payroll and HR solutions for small to medium-sized businesses. The software is designed to simplify the payroll process, save efforts and reduce errors by automating payroll-related tasks.

Features:

ACA( affordable care act) compliance

Automated tax filing

Workforce insights

Compliance protection

Insights & Reporting

Automated payroll disbursing

10. Gusto

Gusto provides small to medium-sized businesses with payroll, benefits, and compliance functionalities and prioritizes a user-friendly interface. It offers comprehensive payroll and HRMS solutions to help businesses manage their workforce and streamline their payroll processes.

Features:

Unlimited payroll runs

International contractors’ payments

State payroll taxes payments

PTO policies and reporting

Actionable team insights

Automated customizable reports

Workers’ compensation tracking

11. Keka

Keka payroll software offers a user-friendly interface and is accessible on multiple devices, including desktops, laptops, and mobile devices. Keka payroll software is suitable for businesses across various industries, including manufacturing, retail, and service-based industries. It aims to simplify HR payroll software operations while ensuring compliance with legal and regulatory requirements.

Features:

Configurable

salary structurePayroll calculations & preview

payslip on SMS and email

Scheduled performance bonuses

expense management integration

Budgeting and expense analytics

We have provided you with some of the best payroll software, now it’s your turn to take charge to choose one of them. From this section, you can choose one of the best HR payroll software.

Also, See: Unified HRMS With Payroll for Superior Employee Management

What Kind Of Buyer Are You?

Payroll software is an important component of many companies’ management software needs, but not always the only one. You need to check your requirements before you consider any HR payroll software as a service.

1. Small businesses

Small businesses can benefit from the payroll software but at affordable prices. Most small business owners prefer to manage payroll on their own, or they outsource payroll service. However, if they get the payroll management software at an affordable price then it is the cherry on the cake. Find the one with the crucial needs.You can als check payroll software price from here.

2. Midsize businesses

Midsize businesses with more than 50 employees may require more than basic payroll company functions. At this level, they consider the paid payroll software with advanced features also you can consider direct deposit employees’ bank accounts, best free app for expense tracking, tax compliance filing, and many others. As a result, these buyers in this category may want more comprehensive software.

3. Large businesses

Large business owners are seeking an enterprise resource planning (ERP) package that integrates a full-service payroll process, talent management, and possibly the human capital management system. This will ensure tight integration between HR payroll software and other HR functions, as well as accounting and other department-specific systems.

In Conclusion,

When considering online payroll processing software, the availability of advanced features also is a factor. Employees, HR department, leave application HR manager, or other persons may not be able to run payroll or perform tax filings, or consider statutory compliances. Better to upgrade payroll with Superworks – automated software.

Also see: hr and payroll service | software payroll online | payroll process in india | payroll software systems | hr payroll software companies | best payroll management software in india | payroll tools free

Complete Guide to Creating an Effective HR Policy List

Best Payroll Practice for Accurate Employee Payments

How Salary Making Software Transforms Payroll from Calculation to Pay?