Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

-

Will customized solution for your needs

-

Empowering users with user-friendly features

-

Driving success across diverse industries, everywhere.

Grab a chance to avail 6 Months of Performance Module for FREE

Book a free demo session & learn more about it!

EXCLUSIVE NEW YEAR OFFER

Unlock 6 Months of FREE Performance Management with any Superworks plan!

Optimize Workforce Management

Automate Payroll & Compliance

Enhance Employee Engagement

Delay in Salary Payment? See How to Manage it With Payroll Software!

- salary payment

- 8 min read

- October 27, 2023

The delay in your salary payment is a stressful time especially if you’re an owner of a business. Employees might not feel confident regarding their job and could begin looking for employment in different companies. This can lead to a poor employees’ experience. It also affects the credibility and worth of the business.

But, now you can easily manage, let’s check how? We have amazing solution for you- HR Payroll Software or Payroll management system.

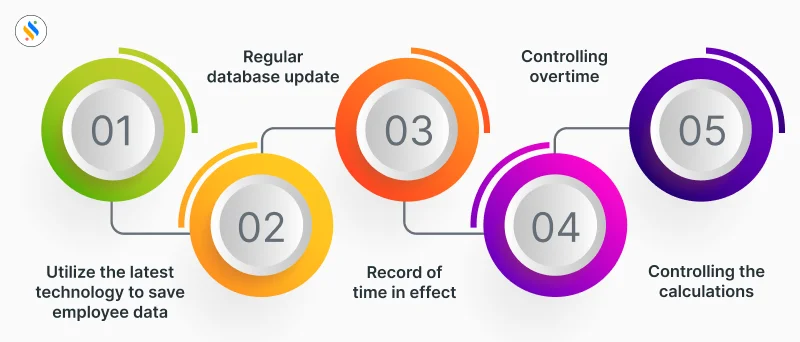

Best 5 methods to ensure your salary payment and avoid the delays:

Here are the methods!

1. Utilize the latest technology available to save employee information

Older HR Technology can take a while to process. An example of this is the paper-based management system. If you look at it, storing the personal information of employees in a register book can be exhausting work. There is always someone to confirm the information on a daily basis.

Additionally, it takes longer time than normal to calculate your salary. This means that you could miss a few pages in the registrar’s database which could lead to delayed salary payment. Therefore, to prevent this you should use an employee management software integrated with the payroll software that will store details of the employees online. In this way, there will be no confusion within the company.

2. Regular database update

In the past, all information was stored in a document, i.e. paper-based. If you’re searching for crucial data it is time-consuming. Updates to databases with irregular data can lead to errors in calculations and payment and cause a major misperception in the business. This can be easily done if you have cloud based database.

Therefore, in order to be safe from this, we might require updating our current database on a regular basis with accurate and precise employee salary activity so that the results are up-to-date with accurate information.

3. Record of time in effect

Sometimes, delay in salary payment start when you actually record the time, particularly when you’re using time cards made of paper. Uncorrected or incorrect interpretations in data entry can cause over or underpayment of an employee.

For instance the handwriting of an employee could be difficult to read or a supervisor could miss-read or forget and record their hours incorrectly. These situations can lead to complex legal issues when employees feel that they’re not paid enough. To prevent this from happening it is essential to have an effective time management system to prevent any conflicts between the employer and employee.

Read more: Payroll Outsourcing Service and Payroll Software- What to Pick!

Searching for Best HR and payroll software? – Your search ends here!

Explore Superworks – the comprehensive HRMS software in India renowned for its outstanding features and benefits. With Superworks, say goodbye to tedious, time-consuming routine operations once and for all.

Now is the time to enhance your competitive edge with Superworks!

4. Controlling overtime

Overtime management is a task that many companies fail. Paper-based management of overtime is the same as having no overtime management since it isn’t able to count the exact and precise time. Implementing a time-tracking process for your employees can be an efficient method to keep track of the data when someone logs in and leaves.

The Overtime Management System feature allows users to define and set up the overtime rules, such as minimum and maximum overtime hours as well as calculation methods that apply to weekly time off holidays and overtime times easily.

In addition, it enables the approval authority to approve/reject/forward an employee’s overtime hours based on the company’s rules and regulations. Additionally, with the aid of reports on overtime you can look up the specifics of hours worked as well as overtime hours and off-hours for the week, and holiday overtime hours for every employee and for each day within the timeframes you choose.

Overtime management isn’t an easy job and shouldn’t be overlooked. This is a major factor in the process of salary payment.

5. Making the calculations

Every employee has numerous pay records that have to be analyzed each time a payroll transaction takes place. In particular, the company should determine if the employee has purchased life insurance, medical insurance or if they have taken out loans from the company. These data must be handled in a careful and appropriate manner. The possibility of errors in salary calculation making handling this data manually risky.

To avoid this kind of errors, and make the calculation right, you can use the automated payroll tool or salary calculation tool.

Therefore it is necessary for the small business to have an automated system to store the database of information for every employee. Thus, the pertinent details as well as the details for each employee must be regularly updated after completing the outsourcing payroll process every month.

Conclusion

In the end, solving the issue of delayed wage payments is vital to ensure employees’ satisfaction and the atmosphere that is conducive to work. Adhering to salary payment rules in India, businesses can dramatically improve their payroll processes and decrease the chance of delays by implementing these ideas in practice. The complete payroll software that Superworks offers agile hrms has been designed to swiftly reduce the time spent on the process of salary payment. Payroll concerns should not hinder the growth of your business.

Discover the top-quality service Superworks will provide you by contacting Superworks right now. If you sign up to our monthly newsletter, you can be informed about important issues. Be sure that your employees are paid quickly and correctly with Superworks!

Also see: software payroll online

Complete Guide to Creating an Effective HR Policy List

Best Payroll Practice for Accurate Employee Payments

How Salary Making Software Transforms Payroll from Calculation to Pay?