When it comes to market capitalization, Nvidia is currently the second-biggest public company in the world, behind Apple. That’s why all eyes are on Nvidia these days.

And now, as Bloomberg spotted, China Central Television, a public TV broadcaster, is reporting that China’s market regulator has opened a probe into Nvidia’s acquisition of Mellanox.

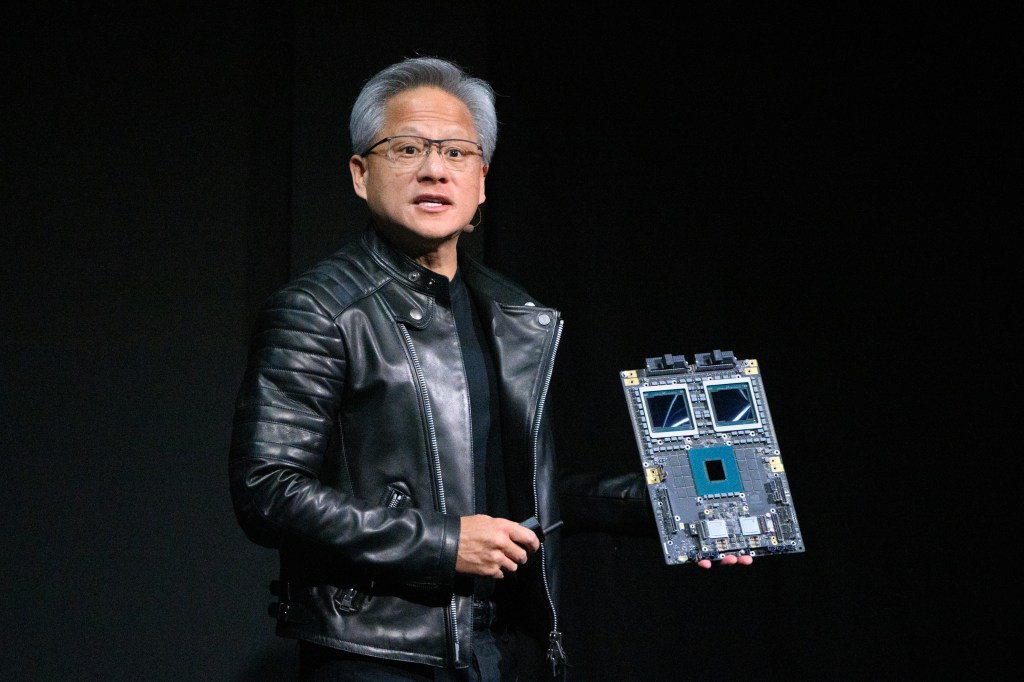

If that name doesn’t sound familiar, in 2019, Nvidia spent nearly $7 billion to acquire Mellanox, an Israel-based company working on high-performance chips for supercomputers. The Chinese government approved the acquisition in exchange for several commitments.

Among other things, Nvidia (and Mellanox) promised that they would share information about new products with Nvidia’s rivals within 90 days of release. Similarly, Nvidia also agreed to let Chinese chipmakers test their products with Mellanox’s technology in order to make sure that they work well.

Nvidia is currently in an uncomfortable position, as Washington has implemented restrictions on semiconductor manufacturers — including Nvidia. They can’t sell their most advanced AI chips to Chinese companies.

This has led to retaliations from the Chinese government. For instance, China banned some sales of Micron products following a cybersecurity probe. Today’s investigation seems to be the latest twist in the ongoing economic conflict that opposes China and the U.S. over key technologies, including state-of-the-art GPUs for generative AI training and inference.

Financial analysts estimate that the top 7 big tech companies will report profit growth of 18% in 2025. But if you remove Nvidia from that group, profits will only grow by 3% in 2025. That shows how important artificial intelligence has become for economic growth.

Last week, the Biden administration announced wider trade bans on advanced technology, with a specific focus on chips that can be used for military equipment and artificial intelligence.