Is a business coach really worth the investment? Execs often seek coaches to bolster aspects of their work, like communication skills and their productivity. At least anecdotally, these skills do appear to get better with coaching — a survey from the nonprofit International Coach Federation found that 80% of execs who hired a coach saw an improvement in their confidence.

Will Foussier, an ex-financial analyst and the founder of AI-powered coaching business AceUp, says that he tried workplace coaching himself years ago and experienced many benefits.

“Back in 2015, I was transitioning from my career as a financial analyst to work for a nonprofit organization, the Clinton Global Initiative,” Foussier told TechCrunch. “By working with the right expert, I quickly developed new skills that transformed my performance and ability to collaborate with others in the workplace.”

Finding and vetting a business coach wasn’t easy, though, Foussier says. And the coaching talent he did find was ultimately quite pricey.

So along with entrepreneur Rohit Begani, Foussier decided to start Boston-based AceUp with the goal of making business coaching more accessible.

“Organizations, especially at the enterprise level, are often plagued with countless team challenges, each more complex than the last,” Foussier said. “I believe you must invest in your teams and bring data-centricity to coaching to effectively pinpoint improvement areas, business impact, and ensure teams progress in alignment with the organization’s needs.”

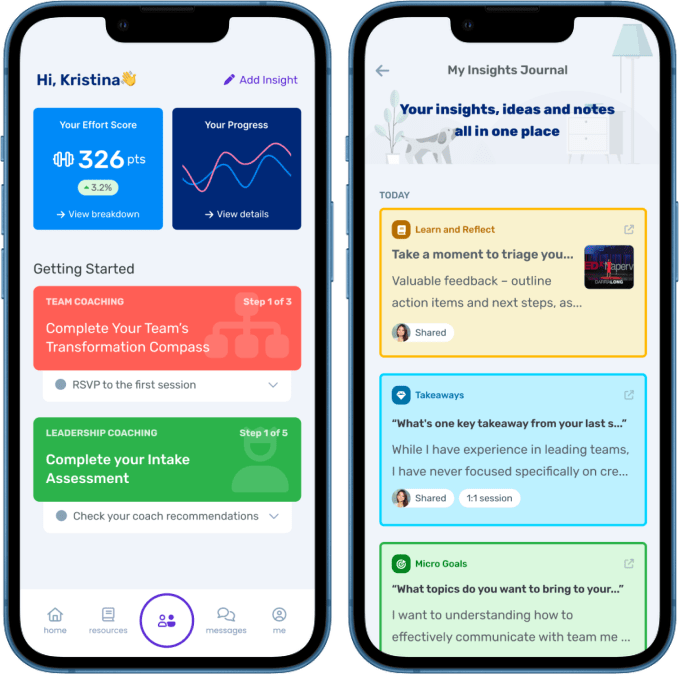

Foussier, who has degrees in organizational behavior and hospitality management, incubated AceUp at Techstars. The startup sells a business performance analytics platform alongside coaching services, and works to assess a company’s strengths and weaknesses as well as identify growth opportunities (for instance, reskilling and upskilling employees via assessments, e-learning courses, and reviews). Managers using the platform get algorithmic recommendations for individual teams — and even individual employees, if they wish — that align with the org’s broader goals.

“AceUp reports on outcomes and identifies and highlights the particular actions and behaviors that led to measurable changes at the team or cohort level,” Foussier said. “It provides an organizational and departmental heat map that highlights core strengths and areas for growth.”

Foussier argues that this “data-centric” approach gives AceUp a leg up over rivals like BetterUp, HumanQ and Adecco Group’s Ezra in the approximately $14 billion market for business coaching.

AceUp charges $20 per employee per month on the low end, with “expert-led” solutions at the C-suite level costing $1,595 and up per employee per month. It employs business coaches on a contract basis; according to Glassdoor, AceUp coaches earn $42,000 to $79,000, which is a bit below the range listed on ZipRecruiter ($58,000 to $130,000).

“Primarily, our buyers are human resources and learning and development executives seeking transformational change at scale, while our users span the entire employee base of an organization,” Foussier said. “We have over 3,500 coaches globally that bring our solutions at scale within the largest organizations.”

It’s worth noting that mileage varies with business coaches.

According to a 2020 academic study, only 58% of business execs who’ve tried a coaching service would recommend that service to others. And in a poll conducted by online learning platform edX last year, 51% of managers said that their company’s learning and development programs felt like a “waste of time.”

Foussier asserts that AceUp delivers results, though, and points to the startup’s growing client base as evidence.

AceUp serves around 100 companies at present, including LVMH, L’Oréal, IBM, BNP, John Deere, and WM. The startup recently opened a satellite office in Paris, and this month, AceUp closed a $22.5 million Series A funding round led by PJC, with participation from Gaingels Ventures, Launchpad Venture Group, Techstars Ventures, and Water Bear Ventures.

To date, AceUp, which has a staff of around 50, has raised $25 million. Foussier claims that the nine-year-old business is profitable.

“The broader slowdown in the tech sector has influenced our activities, particularly with mid-market tech companies,” Foussier said. “Nevertheless, our profitability has positioned us well to manage these changes effectively. We have redirected our focus towards large global enterprises, which has introduced greater stability and accelerated our growth strategy.”

Correction: An earlier version of this story listed SpaceX as a customer based on information from an AceUp representative. However, the company does not currently have an active contract with SpaceX.