- BRICS nations will build Bitcoin mining and AI computing facilities, potentially contributing to a Bitcoin upsurge in the future.

- The upcoming US presidential elections on November 5 will play a large role in Bitcoin’s performance. While volatility is assured, the trend should be bullish.

- Other pro-Bitcoin factors include a potential golden cross and Anthony Scaramucci’s prediction of $BTC reaching $170K by 2026.

BRICS nations decided to build Bitcoin mining industries and AI computing facilities at the latest summit in mid-October.

Is this a good thing for Bitcoin?

I believe it is, and it’s not the only positive factor. The biggest impact on Bitcoin’s short- and mid-term performance could come from the US elections on November 5.

Other positive influences include:

- Anthony Scaramucci’s prediction of $BTC hitting $170K by 2026

- MicroStrategy’s plan to invest another $42B in Bitcoin over the next three years

- China’s quantitative easing (QE) could drive significant Bitcoin interest

- A golden cross performance pattern spotted in Bitcoin charts

It’s an interesting time for Bitcoin, so let’s discuss what’s most likely to happen.

BRICS to Focus on Bitcoin Mining – Good Sign

According to Cointelegraph, Russia will legalize Bitcoin and crypto mining on November 1, likely in an attempt to reduce its reliance on the US dollar.

This month’s BRICS summit took this to a new level as Russia plans to build Bitcoin mining facilities in other BRICS countries.

Matthew Sigel (VanEck’s Head of Digital Assets) says there’s a global urgency to ‘circumvent the irresponsible fiscal policy that we’ve been running in the US.’

Russia’s plan should have a positive impact on Bitcoin. A large part of the network’s hashrate originates in the US, where energy costs aren’t exactly small.

Other regions with lower energy costs will become focal interest points for Bitcoin miners, potentially driving the asset’s price upward.

On the other hand, this might not apply to Russia, as electricity is becoming more expensive. The ruble’s devaluation and excessive electricity demand are the likeliest culprits.

Is Bitcoin’s Upsurge Written in Stone Already?

Several correlations appeared on our radar, and they all point to an epic future for Bitcoin.

| Bitcoin Performance Factor | Details |

| Anthony Scaramucci’s $170K prediction by 2026 | SkyBridge Capital’s Anthony Scaramucci predicted Bitcoin will reach $170K by 2026, largely driven by financial US shifts and strategic inflation. Scaramucci also expects the US government to avoid a financial disaster. |

| MicroStrategy’s three-year plan to buy $42B worth of $BTC | MicroStrategy plans to buy $42B in $BTC over the next three years. This should lead to a massive upsurge in Bitcoin’s demand and performance. |

| China’s quantitative easing policy | BitMEX founder Arthur Hayes thinks China’s quantitative easing policy will flood the market with yuan, making $BTC an appealing prospect for investors. He compares this with the US’s credit expansion during the COVID-19 pandemic, which was ultimately beneficial for Bitcoin’s store-of-value prospect. |

| A golden cross in Bitcoin’s charts | CryptoQuant analyst Yonsei Dent spotted a potential golden cross in Bitcoin’s active addresses metric. This could mean strong investor participation and bullish momentum. Transaction volumes are double that of the 2021 price cycle, which shows significant market engagement. |

Bitcoin is currently $72,630, an 8.6% increase in the last week and a 13.65% surge in the last month. After crossing the psychological $70K threshold, $BTC’s continued pump seems unavoidable.

X user Mikybull Crypto also noticed the same golden cross as Yonsei Dent, while the short moving average crossed the long-term moving average (a bullish signal).

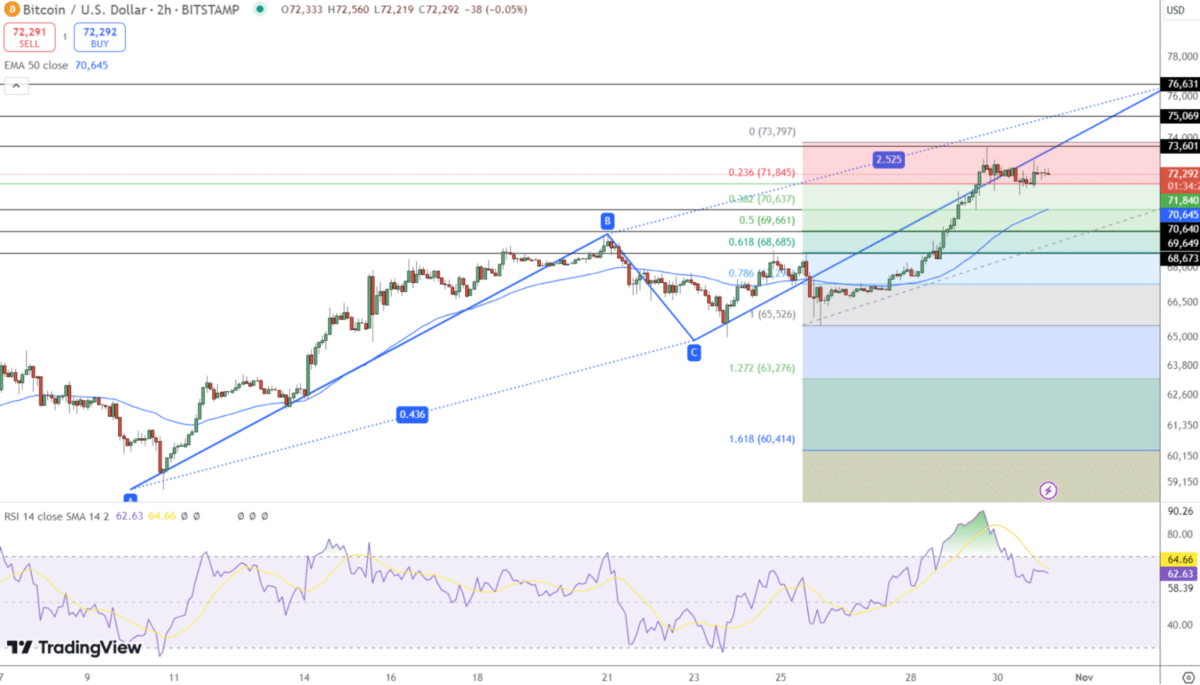

According to Cryptonews, Bitcoin’s 23.6% Fibonacci retracement at $71,850 serves as critical support. This means $BTC could shoot above $73.6K, $75K, and eventually $76K if it maintains this level.

On the other hand, Ali Martinez (crypto analyst) mentioned $BTC typically dropped in value after the last three US presidential elections.

What We Think – Bitcoin’s Heading Up, Despite Potential Volatility

Depending on the result of the US elections, Bitcoin might be in for rough times. Volatility is all but assured.

But looking at all the positive headwinds, an upsurge past $75K and $76K, potentially heading to $100K, is far from a dream.

References

Add Techreport to Your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe nowOur editorial process

The Tech Report editorial policy is centered on providing helpful, accurate content that offers real value to our readers. We only work with experienced writers who have specific knowledge in the topics they cover, including latest developments in technology, online privacy, cryptocurrencies, software, and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards, and every article is 100% written by real authors.

Question & Answers (0)