For years, investors have turned to traditional vehicles like stocks, bonds, and mutual funds to build assets. While these remain popular, alternative investments—such as private equity, real estate, and hedge funds—have recently gained traction among those seeking greater diversification, risk management, and higher returns. Although these asset classes offer potential rewards, they also carry distinct risks. Understanding the advantages and trade-offs of alternative investments can help investors make informed decisions for long-term financial goals.

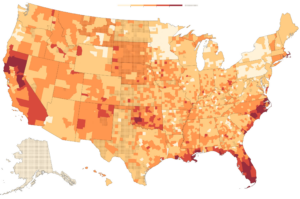

A key benefit of alternative investments is the diversification they bring to a portfolio. Unlike traditional stocks and bonds, which tend to follow market cycles, alternative assets often generate returns from sources less tied to market movements. For instance, real estate generates income from rent, which often behaves independently of equity markets. Private equity, with its longer hold periods and less frequent valuations, tend to be less vulnerable to short-term market fluctuations. By incorporating assets that don’t move in lockstep with traditional markets, investors can reduce the portfolio volatility.

Alternative investments are also known for their potential to deliver higher returns. Private equity, for instance, seeks capital growth by investing in companies undergoing significant transformations. Real estate tends to appreciate during inflationary periods, offering protection against the erosion of purchasing power. Meanwhile, hedge funds use strategies like leverage, short selling, and derivatives to generate returns in various market conditions. By incorporating these diverse sources of return alongside traditional investments, investors can significantly strengthen their overall portfolio strategy.

However, these benefits come with notable risks that individual investors must carefully consider. One major distinction between alternatives and traditional investments is the lack of liquidity. Unlike stocks or bonds, which can be sold quickly in public markets, private equity and real estate investments may take years to realize a return, locking up funds for extended periods. Investors must carefully assess their liquidity needs.

The complexity of alternative assets is another important consideration. These investments often involve sophisticated strategies, like hedge funds using derivatives, which can be difficult to understand. Also, they often lack the transparency of public markets, making it harder to track performance or assess risks accurately.

In addition to complexity, these assets often operate in less regulated environments, making them more susceptible to changes in laws and regulations that could affect returns and liquidity. The lack of a consistent regulatory framework across different jurisdictions adds another layer of complexity when evaluating these opportunities.

Overall, a strategy that balances both the risks and rewards of alternatives can strengthen a portfolio. By working with a financial advisor, investors can navigate the complexities of alternative investments and tailor allocations to match their objectives. For those prepared to embrace these complexities, alternatives can serve as valuable tools for building a more resilient, diversified investment strategy.