We are not tax professionals; rather, we work with CPAs and estate attorneys for each client’s unique circumstances.

- Making informed decisions around tax planning is a critical and increasingly nuanced component of investment management.

- Creating investment strategies tailored to unique circumstances, with tax-efficient planning, allows our Investment Management team at Conservest Capital Advisors, Inc. to maximize returns. A plethora of tax considerations are taken into consideration when building a portfolio, and advanced planning can have a profound impact on outcomes.

- This article examines the type of taxes relevant to investments and estates. The estate tax exemptions are scheduled to sunset in 2025 are of paramount importance. The record-high thresholds enacted in 2017 will be reduced by more than half if Congress does not extend them.

Investment income taxes include:

- Capital gains, dividends, and interest income. Capital gains: Your cost basis is the original purchase price plus fees that you paid for an investment. In some cases, you may need to adjust and increase or decrease your original cost basis to account for dividend reinvestment, stock splits, and other corporate action activity.

- Net investment income tax (NIIT) is the 3.8% surtax applied to investors that have high income thresholds on investment income. The NIIT applies to interest, dividends, short- and long-term capital gains, rents and royalties, and passive business income.

- Certain investors may be subject to Alternative minimum taxes (AMT) as well as foreign and unrelated business taxes depending on allocation and tax brackets.

The Tax Cuts and Jobs Act (TCJA) of 2017

- The TCJA, enacted in 2017, was the largest tax overhaul since 1986, where substantial changes were made to income taxes for individuals and corporations with the intention of stimulating the economy.

What changed at the corporate level?

- Reduction of corporate income tax rate to 21%

- Redesign of international tax rules

- Deductions for pass-through income

- Ability to expense equipment investment

What changed at the individual taxpayer level?

- The elimination of personal and dependent exemptions

- The elimination of the tax on those who do not secure adequate health insurance coverage.

- Increased: the standard deduction, estate tax exemption, and the individual alternative minimum tax exemption that allows for a sizable exclusion of gifts/estates from taxation.

- TCJA retains the 0, 15, and 20% preferential tax rates on long-term capital gains and qualified dividends, the 3.8 percent net investment income tax, and the individual alternative minimum tax (AMT), albeit at higher exemption.

- The estate tax exemption was doubled and adjusted for inflation so that today’s numbers are: $13.61 million for single filers and $27.22 million for couples. The exemption amounts are applicable to gifts and estate taxes combined so that any portion of the exemption you use for gifting will reduce the amount you can use for the estate tax.

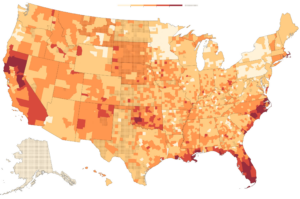

- Almost all of the individual income tax and estate tax provisions expire after 2025, while most of the corporate provisions are permanent. Barring an extension of TCJA, the exemption will revert to an inflation-adjusted $7 million for single filers and $14 million for couples at the end of 2025.

Ways to Give Assets Tax-Free

Using the annual gift tax exclusion to gift assets now rather than from the estate.

Using the lifetime gift and estate tax exemption. Utilizing irrevocable gifts, in this instance, allows for control over how assets are invested and, in some cases, distributed.

Making direct payments to medical and educational providers on behalf of a loved one

The current gift tax exclusion amount is 18,000 per individual or $36,000 per couple per year. The investor would not incur gift taxes, nor would the recipient if staying within these limits. Anything more than the yearly limit is deducted from your lifetime gift and estate tax exemption.

Proper Placement of Asset Allocations

Taxable brokerage accounts are ideal for longer-term investments in individual stocks that pay qualified dividends, exchange-traded funds (ETFs), and low-turnover funds. Municipal bonds are also best held in this entity.

Tax-deferred accounts are ideal for: shorter term equities, as well as taxable bond funds and higher-yielding assets such as REIT’s or high-yield bonds.

Tax-Loss Swaps

Utilize investment losses via loss harvesting within taxable accounts, avoiding the wash-sale rule. This can happen if you sell a security at a loss and buy the same or a “substantially identical” security within 30 days before or after the sale. Tax-loss harvesting allows for the reduction of capital gains realized in the same year by an equivalent loss with an ordinary income offset of up to $3,000 via deduction.

Qualified Opportunity Fund Investment (QOZ)

To defer taxes in a qualified opportunity fund, you need to invest within 180 days of the sale. An investment into a QOZ fund allows you to defer taxes on a capital gain to 2027 and overall benefits are substantial. Generally, you could expect between 40-50% higher after-tax returns over non-QOZ investments.

If you maintain the investment until 2028 you have a 10% reduction on the capital gain tax from the portion shielded.

If you maintain it over 7 years, you gain a 15% reduction on the capital gain tax from the amount shielded.

Donor Advised Fund (DAF)

The DAF tool maximizes write-off potential, allowing you to contribute and take the full tax write-off in a high capital gain year where for example, you have substantial income to report.

Determining an amount that you would want to gift over your lifetime and allocating this amount to the DAF will allow you to take the write-off in a year to grow and generate contributions over many years is desired.

The most advantageous way to give to a DAF is your highly appreciated stock. Once the gift is made it is irrevocable and will continue with the flexibility to time charitable gifts.