Simple interest is a method used to determine the interest amount on a principal sum based on a specified interest rate and duration of time.

Simple interest is a widely used concept across various industries, including banking, finance, and automotive sectors. It serves as a fundamental method for calculating interest on loans, investments, and financing options, enabling consumers and businesses to understand the cost of borrowing or the returns on investments.

In this article, we will discuss more about Simple Interest in detail, including its formula, examples, and how to find simple interest.

Simple Interest Definition

Simple Interest is the method of calculating the interest where we only take the principal amount each time without changing it with respect to the interest earned in the previous cycle.

In simple terms, we can say that simple interest is the interest earned only because of the principal amount whereas compound interest is the interest earned on both principal and the previous interest earned.

Let us suppose we invest 100 rupees for 2 years at a rate of 10% for both simple interest and compound interest. Then for simple interest, the interest is calculated for 10% of 100 for the first year and similarly 10% of 100 for the second year.

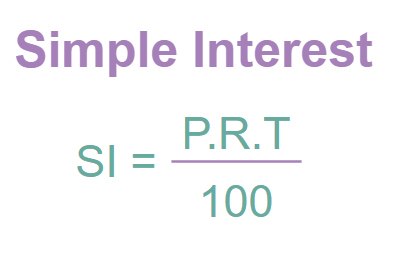

The formula to calculate Simple Interest is:

Where,

- P is the Principal amount

- R is annual Rate of Interest

- T is the Time for which principal is invested

Principal

The principal is the amount borrowed or invested. It is denoted by the letter “P”. The principal remains constant while calculating simple interest whereas in compound interest the principal increase after every cycle.

Rate

The rate of interest at which the principal amount is invested or borrowed for a specific period of time is called the rate. For Example, the rate of interest can be 5%, 10%, or 13%. Here the interest rate can be represented by “R”.

Time

The duration during which the principal is borrowed or invested is referred to as time. Time is symbolized by “T”.

Amount

When a person acquires a loan from a bank, he or she is required to repay the principal borrowed plus the interest amount and the total amount repaid is referred to as the Amount. It is denoted by the letter “A”.

Thus,

- A = P + SI

- P = A – SI

- A = P(1 + RT/100)

How to Find Simple Interest?

Simple interest on any sum of money is calculated using the steps discussed below,

- Step 1: The principal(P), Rate of interest(R) and time(T) of loan amount is noted.

- Step 2: Use the formula SI = (P×R×T/100) to calculate Simple Interest

- Step 3: Use all the values from Step 1 and substitute them in Step 2.

- Step 4: Simplify the value obtained in Step 3 to get required simple interest.

Let’s consider an example to understand the procedure better.

Example: Find the SI on rupees 10000 deposited for 3 years at 5% per annum.

Solution:

Given,

- P = Rupees 10,000

- R = 5% per annum

- T = 3 years

Thus, SI = (P×R×T/100)

⇒ SI = (10000×5×3)/100 = 1500

Thus the interest earn is rupees 1,500

Simple Interest vs Compound Interest

Let’s understand the difference between simple interest and compound interest through the table given below:

|

Simple Interest vs. Compound Interest

|

|

Simple Interest

|

Compound Interest

|

| Simple interest is calculated on the original principal amount. |

Compound interest is calculated on the accumulated sum

of principal and interest. |

|

Simple Interest can be calculated using the following formula:

SI = P × R × T

|

Compound Interest can be calculated using the following formula:

CI = P [(1 +R/100)T – 1]

|

| Principle remains constant throughout the tenure. |

Principle amount changes every year in the tenure. |

| It is equal for every year on a certain principle. |

It is different for every span of the time period as it is

calculated on the amount and not the principal. |

Applications of Simple Interest

Following are five most popular real-life applications of simple interest:

- Bank Loans: Many individuals in India take out loans from banks for various purposes such as buying a house, a car, or funding education. Banks typically calculate the interest on these loans using simple interest. Borrowers need to understand how much interest they will be paying over the loan term.

- Fixed Deposits: When individuals invest their money in fixed deposits, banks pay them interest on the principal amount deposited. The interest earned is usually calculated using simple interest. Investors can use simple interest calculations to determine their returns over the FD tenure.

- Recurring Deposits: Similar to fixed deposits, recurring deposits (RDs) allow individuals to save money over a period of time. The interest earned on recurring deposits is also calculated using simple interest. Customers can calculate the maturity amount they will receive at the end of the RD tenure based on the monthly deposit and the applicable interest rate.

- Retail Installment Schemes: Many retail stores and businesses offer installment schemes for purchasing goods such as electronics, furniture, or appliances. These schemes often charge simple interest on the installment payments. Customers can understand the total amount they will pay over the installment period by calculating the simple interest component.

- Microfinance: In rural areas and small towns of India, microfinance institutions provide financial services to low-income individuals and entrepreneurs who may not have access to traditional banking services. The interest charged on microfinance loans is typically calculated using simple interest. Borrowers can determine the total repayment amount based on the principal borrowed and the applicable interest rate.

Simple Interest Solved Questions

Question 1: Rajesh takes a loan of Rs 20000 from a bank for a period of 1 year. The rate of interest is 10% per annum. Find the simple interest and the total amount he has to pay at the end of a year.

Solution:

Here,

- Loan Sum = P = Rs 20000

- Rate of Interest per year = R = 10%

- Time (T) = 1 year

SI = (P × R ×T) / 100

= (20000 × 10 ×1) / 100

= Rs 2000

Total Amount that Rajesh has to pay to bank at end of year

Amount = Principal + Simple Interest

= 20000 + 2000

= Rs 22,000

Question 2: A person borrowed Rs 60,000 for 4 years at the rate of 2.5% per annum. Find the interest accumulated at the end of 4 years.

Solution:

Given,

- Principal = Rs 60,000

- Rate of Interest = 2.5 %

- Time = 4 years

SI = (P × R ×T) / 100

= ( 60,000 × 2.5 × 4 ) / 100

= Rs 6000

Question 3: A person pays Rs 8000 as an amount on the sum of Rs 6000 that he had borrowed for 3 years. What will be the rate of interest?

Solution:

Amount = Principal + Simple Interest

SI = A – P

= 8000 – 6000

= Rs 2000

Time (t) = 3 years

Rate (R) = ?

SI = (P × R ×T) / 100

R = (SI ×100) /(P× T)

R = (2000 × 100 /(6000 × 3)

= 11.11 %

Thus, rate of interest R is 11.11 %.

Conclusion of Simple Interest

The interest accrued on a principal amount over a predetermined period can be easily calculated using the simple interest technique. It is determined by the length of the loan or investment as well as a set percentage of the principal known as the interest rate. Simple interest calculations are appropriate for fast estimations and straightforward financial transactions since they are simple to comprehend and compute.

Simple Interest – FAQs

What is simple interest?

The type of interest that is levied only on the principal amount and not on the aggregated interest amount is called simple interest. While calculating simple interest we do not add interest earned in the previous cycle to the amount in the next cycle.

The formula to calculate the Simple Interest is: SI = (P×R×T)/100

The formula to calculate the Compound Interest is: CI = A – P

Are home loans simple or compound interest?

Usually, all the loans given by financial institutions are compound interest. So home loans are generally of compound interest type.

What is the difference between simple and compound interest?

Basic difference between Simple Interest and Compound Interest is that in simple interest the interest is paid only on the principal value, whereas, for compound interest, the interest is paid both on the principal value and the interest earned in previous intervals.

What types of loans use simple interest?

Generally, all banks, financial institutions, and other money-lending companies apply compound interest on the loans as in this way they will earn will more interest from the customers. The calculations of compound interest are difficult and require a lot of calculation which is difficult for the common people to do.

So the loan disperses in the informal sector for a shorter period of time and is generally given on simple interest. For example, if a farmer wants to have a loan of 20,000 rupees for 3 months to prepare his crops he will go to a money lender who will give him the money at 3%-5% monthly interest. Here to make the calculations simpler these money lenders generally charge simple interest but at higher rates.