Emerging Economies in Insurance – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

The BRICS (Brazil, Russia, India, China, and South Africa) nations have long been at the forefront of the emerging economies in insurance trends. China and India are a hotbed for insurtech deals and innovation and are expected to witness strong CAGR growth in premiums up to 2025. Much of the innovation coming from insurtechs in emerging economies is around microinsurance. This is most established within the health sector, with cheap policies giving people usually priced out of financial services basic cover. Moreover, leading insurers have a huge opportunity in emerging economies, due to generally loosening restrictions, the sheer size of populations, and the potential for large growth—given the high levels of underinsurance.

The emerging economies in insurance intelligence report provides a briefing on the BRICS nations’ insurance market. The report also presents key technology, macroeconomic and regulatory trends impacting the insurance theme. Further, the industry analysis section discusses early use cases, and value chain analysis of emerging economies in insurance sector.

Emerging Economies in Insurance Market Analysis

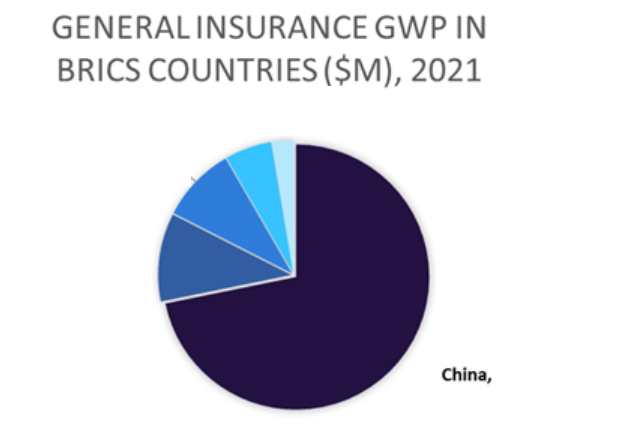

China was the second largest insurance market in the world, as of 2020. However, it is still defined as an emerging economy due to its vast and untapped potential. Brazil and India are also emerging markets with large populations that both have significant general insurance markets. Russia is next but has suffered considerably since it invaded Ukraine.

The insurance market analysis in emerging economies also covers:

- Mergers & acquisitions

- Company filing trends

- Social Media trends

- Timeline

- Case studies

Emerging Economies in Insurance Market Analysis

For more emerging economies in insurance market analysis, download a free report sample

Key Trends Impacting the Emerging Economies in the Insurance Theme

The main trends shaping the emerging economies in insurance theme are classified into three categories: technology trends, macroeconomic trends, and regulatory trends.

- Technology Trends – The key technology trends impacting the insurance theme are advent of 5G networks, implementation of AI, and blockchain technologies, and the rising digitalization in emerging economies.

- Macroeconomic Trends – The report analyses several macroeconomic trends impacting the insurance theme, including the cost-of-living crisis, rise in aging population, and effect of COVID-19. Additionally, high unemployment rates, China’s property crisis, the Russia/Ukraine conflict, and rising urbanization are some of the macroeconomic trends.

- Regulatory Trends – The key regulatory trends impacting the insurance theme are the introduction of revised health insurance regulations, December 2020, The China Banking and Insurance Regulatory Commission (CBIRC) foreign ownership changes, Foreign ownership in insurance companies operating in India, and microinsurance in South Africa. Other regulatory trends include the SUSEP (Superintendence of Private Insurance) provided guidelines for segmentation rules in the Brazilian insurance industry, and the authorized use of telemedicine in Brazil.

For more insights on key trends impacting the insurance sector in emerging countries, download a free report sample

The Emerging Economies in Insurance Value Chain Analysis

The emerging economies in insurance value chain comprises five segments: product development, marketing, and distribution, underwriting and risk profiling, claims management, and customer service. Each aspect of this value chain is important in emerging economies. Insurers are often targeting new consumers, and new markets, so product development can be a way to stand out, while claims management and customer service can be essential to leave a good impression, keeping customers happy and potentially spreading via word of mouth.

The Emerging Economies in Insurance Value Chain

For more insights on emerging economies in insurance value chain, download a free report sample

Leading Public Companies Associated with The Emerging Economies in Insurance Theme

Some of the leading public companies making their mark within the emerging economies in insurance theme:

- AXA

- Allianz

- AIA

- Aon

- Chubb

- ICICI Lombard

- Munich Re

- Tokio Marine

Leading Private Companies Associated with The Emerging Economies in Insurance Theme

Some of the leading public companies making their mark within the emerging economies in insurance theme:

- BIMA

- Digit

- JaSure

- Naked

- Onsurance

- Pineapple

- Toffee

To know more about leading companies in emerging economies in insurance theme, download a free report sample

Emerging Economies in Insurance Sector Scorecard

GlobalData uses a scorecard approach to predict tomorrow’s leading companies within each sector. The sector scorecards help to determine which companies are best positioned for a future filled with disruptive threats. Each sector scorecard has three screens:

- The thematic screen shows who are the overall leaders in the 10 themes that matter most, based on the thematic engine.

- The valuation screen shows whether publicly listed players appear cheap or expensive relative to their peers, based on consensus forecasts from investment analysts.

- The risk screen shows who the riskiest players in each industry are, based on the assessment of four risk categories: operational risk, financial risk, industry risk, and country risk.

Emerging economies in insurance is a theme that impacts many of the sectors we cover. In this section, we focus specifically on the non-life and life sectors.

Non-Life Insurance Sector Scorecard – Thematic Screen

To know more about sector scorecards related to Emerging economies in insurance, download a free report sample

Emerging economies in insurance Market Report Overview

| Report Pages | 52 |

| Regions Covered | Global |

| Emerging Economies in Insurance Trends | Technology, Macroeconomic, and Regulatory |

| Value Chain Analysis | Product Development, Marketing, And Distribution, Underwriting and Risk Profiling, Claims Management, And Customer Service |

| Leading Public Companies | AXA, Allianz, AIA, Aon, Chubb, ICICI Lombard, Munich Re, and Tokio Marine |

| Leading Private Companies | BIMA, Digit, JaSure, Naked, Onsurance, Pineapple, and Toffee

|

Reasons to Buy

- Benchmark yourself against the rest of the market.

- Ensure you remain competitive as new markets open up to the global insurance industry.

- Understand any key innovations originating from these emerging markets.

- Discover the key players in this theme, including insurers, startups, and technology providers.

Allianz

AXA

Bupa

Dai-Ichi Life

Garmin

Ping An

Zhong An

Munich Re

Swiss Re

AIG

Tokio Marine

GAZ Industry

New India Assurance

ICICI Lombard

Porto Seguro

MAPFRE

CPIC

Pineapple

BIMA

Toffee

OnSurance

ThinkSec

Table of Contents

Frequently asked questions

-

What are the key technology trends impacting the emerging economies in insurance?

The key technology trends impacting the insurance theme are advent of 5G networks, implementation of AI, and blockchain technologies, and the rising digitalization in emerging economies.

-

What are the key macroeconomic trends impacting the emerging economies in insurance?

The macroeconomic trends impacting the insurance theme are the cost-of-living crisis, rise in aging population, and effect of COVID-19. Additionally, high unemployment rates, China’s property crisis, the Russia/Ukraine conflict, and rising urbanization are some of the macroeconomic trends.

-

What are the key regulatory trends impacting the emerging economies in insurance?

The key regulatory trends impacting the insurance theme are the introduction of revised health insurance regulations, December 2020, The China Banking and Insurance Regulatory Commission (CBIRC) foreign ownership changes, Foreign ownership in insurance companies operating in India, and microinsurance in South Africa. Other regulatory trends include the SUSEP (Superintendence of Private Insurance) provided guidelines for segmentation rules in the Brazilian insurance industry, and the authorized use of telemedicine in Brazil.

-

What are the key segments of the emerging economies in insurance value chain?

The emerging economies in insurance value chain comprises five segments: product development, marketing, and distribution, underwriting and risk profiling, claims management, and customer service.

-

Which are the leading public companies associated with the emerging economies in insurance theme?

Some of the leading public companies making their mark within the emerging economies in insurance theme are AXA, Allianz, AIA, Aon, Chubb, ICICI Lombard, Munich Re, and Tokio Marine.

-

Which are the leading private companies associated with the emerging economies in insurance theme?

Some of the leading private companies making their mark within the emerging economies in insurance theme are BIMA, Digit, JaSure, Naked, Onsurance, Pineapple, and Toffee.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Related reports

View more Financial Services reports