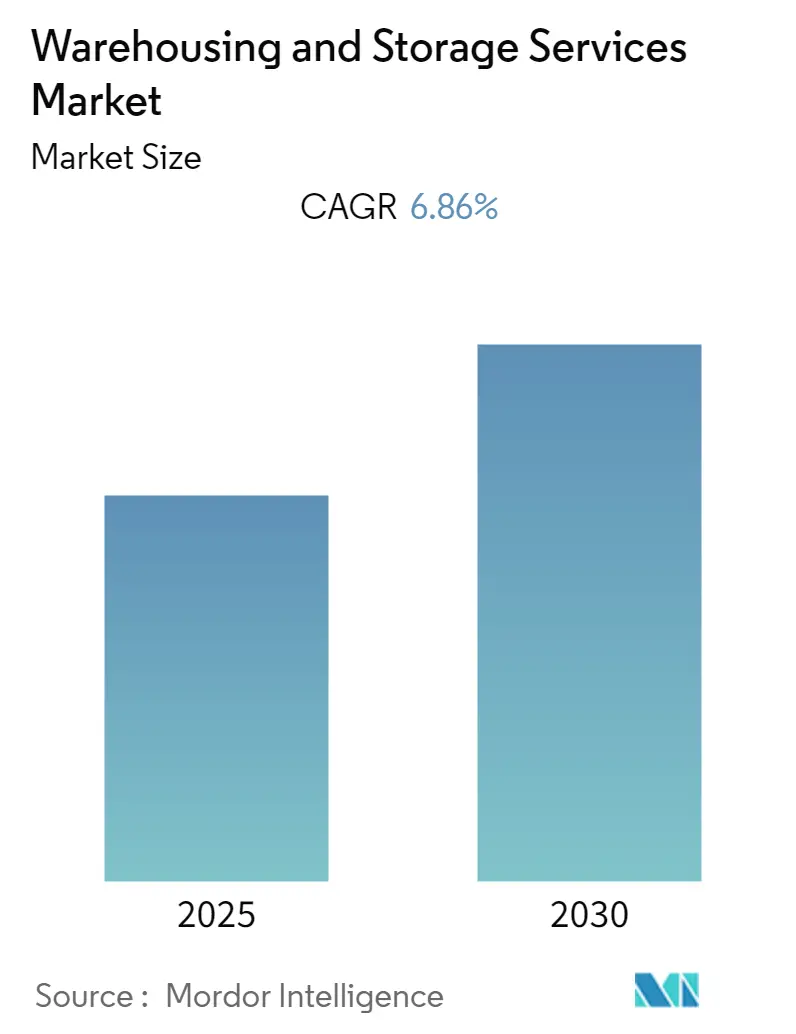

Warehousing and Storage Market Size

| Study Period | 2019 - 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 - 2030 |

| CAGR | 6.86 % |

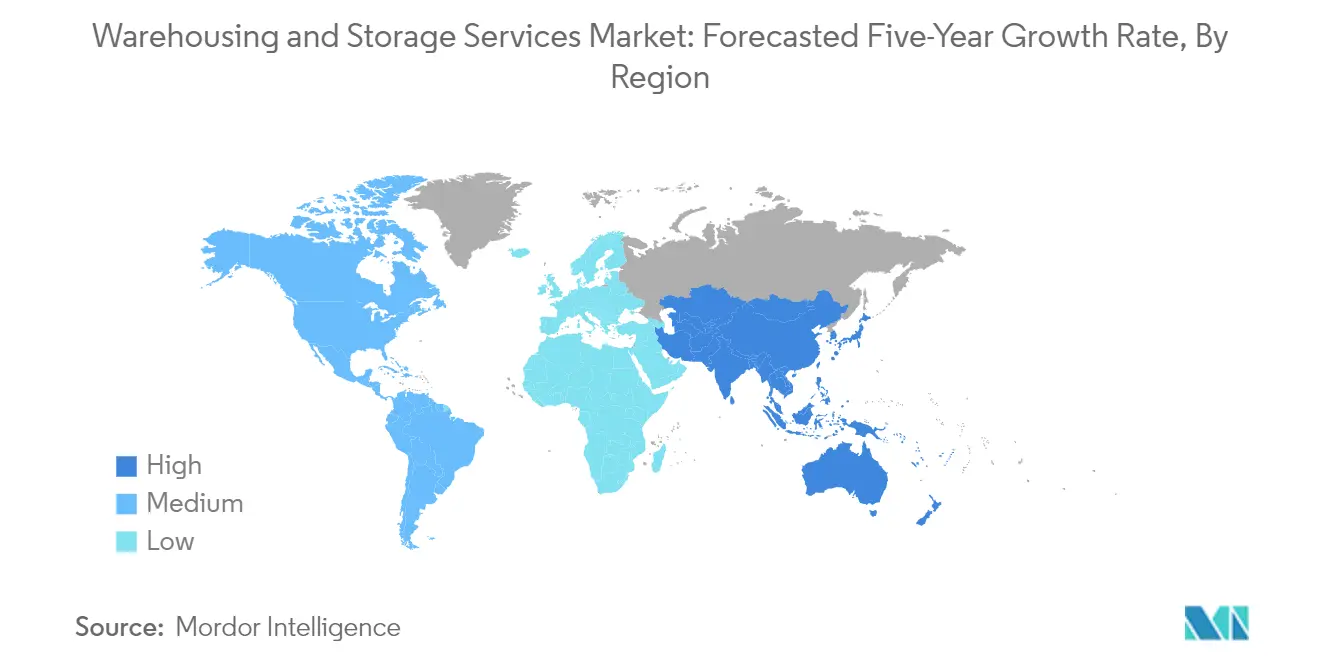

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

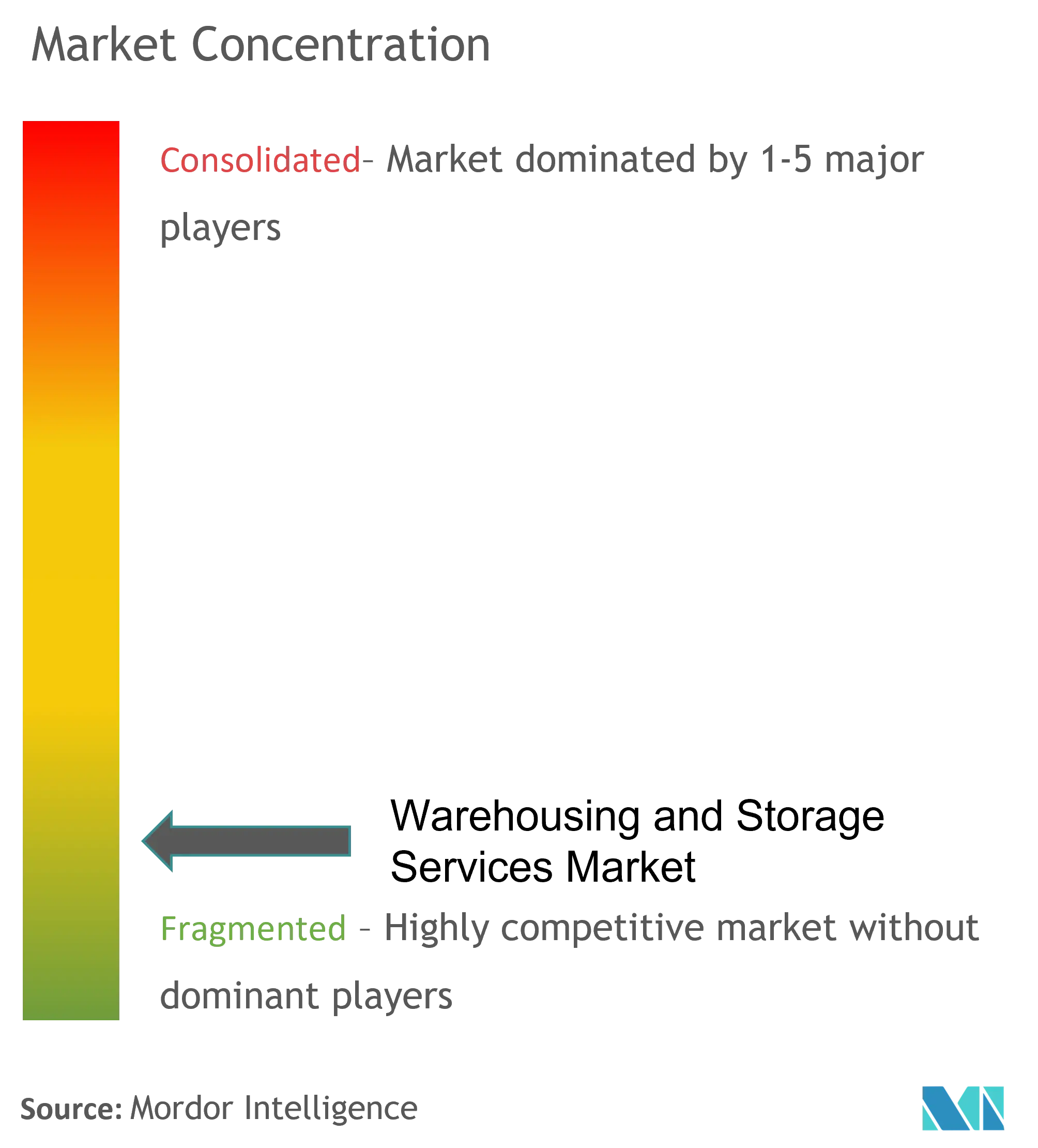

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Warehousing and Storage Market Analysis

The Warehousing and Storage Services Market is expected to register a CAGR of 6.86% during the forecast period.

The warehousing services and storage services industry is undergoing significant transformation driven by supply chain reconfiguration and technological integration. Modern warehouses are increasingly adopting sophisticated solutions like Warehouse Management Systems (WMS), GPS tracking, RFID technology, and automated systems to optimize operations and enhance visibility across the supply chain. The integration of logistics storage services has become crucial as companies strive to meet accelerated delivery timelines and manage complex inventory flows. Industry analysis indicates that e-commerce operations require approximately three times more logistics space compared to traditional storefronts, fundamentally changing warehouse design and operational requirements.

The industry is witnessing a notable shift toward smaller, strategically located urban warehouses to support rapid delivery capabilities and minimize transportation costs. This trend is particularly evident in the development of last-mile delivery hubs and micro-fulfillment centers positioned near major population centers. The focus on urban warehousing is complemented by the emergence of multi-story facilities and the repurposing of existing retail spaces for distribution purposes. Industry forecasts suggest an additional requirement of 75-100 million square feet of industrial freezer/cooler space will be needed over the next five years to meet the growing demand for temperature-controlled supply chain storage.

Automation and smart warehouse technologies are revolutionizing the industry landscape, with companies investing in robotics, artificial intelligence, and Internet of Things (IoT) solutions to enhance operational efficiency. These technological advancements are enabling real-time inventory tracking, predictive maintenance, and automated picking and packing processes. The implementation of warehouse execution systems is becoming increasingly critical for coordinating various automated components and optimizing workflow management. The industry is seeing a rise in "automation as a service" models, allowing facilities to scale their technological capabilities based on demand fluctuations.

Sustainability and energy efficiency have emerged as key priorities in warehouse development and operations. Modern facilities are incorporating green building practices, energy-efficient lighting systems, and renewable energy solutions to reduce their environmental impact and operating costs. The industry is also witnessing increased adoption of electric material handling equipment and the implementation of smart energy management systems. This focus on sustainability extends to the optimization of space utilization and the development of more efficient industrial storage solutions, as companies seek to maximize the utility of available warehouse space while minimizing their carbon footprint.

Warehousing and Storage Market Trends

Rising Popularity of Omnichannel

The omnichannel supply chain has emerged as a transformative force in the warehousing industry, with online marketplaces accounting for 47% of global digital purchases, followed by retailer websites/apps at 26% and brand websites/apps at 18%. This shift has fundamentally changed how warehouses operate, as businesses must now maintain inventory across multiple channels while ensuring seamless integration between online and offline operations. The transformation has led warehouses to adopt sophisticated inventory management services that can track products across various touchpoints, from brick-and-mortar stores to e-commerce fulfillment centers, enabling retailers to become "price makers" rather than "price takers."

The implementation of omnichannel strategies has significantly decreased inventory holding costs through improved interoperability between various channels and enhanced visibility technologies. Warehouses are increasingly leveraging voice picking, vision picking, and real-time location systems (RTLS) to support this integrated approach, allowing for better inventory tracking and faster order fulfillment across all channels. The ability to fulfill orders from the nearest location has not only reduced shipping costs but has also improved customer satisfaction, leading to higher retention rates and repeat purchases, ultimately driving the demand for more sophisticated warehousing services.

Growth in the E-commerce Industry

The explosive growth of e-commerce has fundamentally transformed warehousing requirements, with major retailers expanding their distribution networks to meet growing consumer demands. For instance, Walmart's strategic network of 31 dedicated e-commerce fulfillment centers and 4,700 stores within 10 miles of 90% of the U.S. population demonstrates the scale of infrastructure needed to support modern e-commerce operations. This expansion has led to the development of both mega-fulfillment centers exceeding 1 million square feet and smaller facilities strategically located near urban centers, creating unprecedented demand for varied storage services.

The evolution of e-commerce has necessitated the development of more sophisticated warehousing solutions, particularly in handling returns and managing inventory across multiple channels. Warehouses are increasingly adopting automation and sortation equipment to minimize labor requirements and reduce product touches, while implementing labor management systems to track and monitor productivity. The industry has also witnessed a significant shift toward waveless picking systems, which continuously evaluate order pools and automatically release work based on variables such as order priorities and facility processing capacities, enabling more efficient e-commerce fulfillment operations.

Pooled Warehousing

Pooled warehousing has emerged as a revolutionary approach in the logistics industry, where multiple supply chain players share warehouse facilities to optimize transportation methods and reduce logistics costs. This collaborative model has gained particular traction in the agri-foods industry and selective sectors such as perfumes, DIY products, and household electronics, where manufacturers, though sometimes competitors, often serve complementary product lines to the same customer base. The shared infrastructure model enables businesses to split the burden of logistics tasks while maintaining high service quality and reducing individual operational costs.

The pooled warehousing model offers significant advantages through the development of multi-temperature warehouses, allowing different products with varying storage requirements to be housed in a single facility. This approach has proven particularly effective for third-party logistics providers (3PLs) who can now offer new services for managing multiple clients' activities within the same warehouse while efficiently limiting risks associated with client loss. The model also enables real estate cost sharing between several clients, making it an attractive option for businesses looking to optimize their warehousing expenses while maintaining access to state-of-the-art facilities and technology-driven inventory management systems.

Segment Analysis: By Type

General Warehousing and Storage Segment in Global Warehousing and Storage Services Market

General warehousing and storage continues to dominate the global warehousing and storage services market, commanding approximately 54% of the total market share in 2024. This segment's prominence is primarily driven by the rapid growth of e-commerce across the globe, particularly in categories such as apparel and accessories, fashion, consumer electronics, home and garden, and sports goods. The segment has shown remarkable resilience and adaptability, with many facilities implementing advanced warehouse management systems and automation technologies to improve operational efficiency. The growing demand for urban logistics solutions and the trend toward multi-channel distribution strategies have further strengthened this segment's position in the market.

Refrigerated Warehousing and Storage Segment in Global Warehousing and Storage Services Market

The refrigerated warehousing and storage segment is experiencing the most dynamic growth in the market, with projections indicating continued robust expansion through 2024-2029. This accelerated growth is being driven by increasing demand from the pharmaceutical, food and beverage industries, and the expanding cold chain logistics sector. The segment's growth is further bolstered by the rising consumer preference for fresh and frozen foods, coupled with stringent regulations regarding temperature-controlled storage of pharmaceutical products. The expansion of online grocery delivery services and the increasing need for vaccine storage facilities have created additional growth opportunities in this segment.

Remaining Segments in Warehousing and Storage Services Market

The farm product warehousing and storage segment plays a crucial role in the agricultural supply chain, offering specialized agricultural storage solutions for agricultural commodities. This segment has evolved significantly with the integration of advanced monitoring systems and climate control technologies to maintain optimal storage conditions for various agricultural products. The segment's importance has been heightened by the growing focus on food security and the need for efficient agricultural supply chain management, particularly in major agricultural producing regions. The development of smart storage solutions and the implementation of sustainable practices have further enhanced the segment's value proposition in the overall warehousing market.

Segment Analysis: By Ownership

Private Warehouses Segment in Warehousing and Storage Services Market

Private warehousing dominates the global warehousing and storage services market, commanding approximately 50% market share in 2024. These warehouses are typically established by private enterprises for their specific purposes, offering highly flexible and customizable storage solutions that can be tailored to the nature of products being stored. Private warehouses are strategically located to address the requirements of manufacturing and commercial units, providing enterprises with complete control over their storage operations. These facilities can be either self-operated or managed by third-party logistics providers (3PLs), making them particularly attractive for large enterprises with substantial warehousing requirements. The segment's prominence is further strengthened by major international conglomerates in the construction and manufacturing sectors who own significant warehousing spaces, contributing to its market leadership position.

Bonded Warehouses Segment in Warehousing and Storage Services Market

Bonded warehouses are emerging as the fastest-growing segment in the warehousing and storage services market, with projections indicating robust growth through 2024-2029. These facilities operate under the regulatory supervision of customs agencies in foreign countries, offering unique advantages such as deferred payment of customs duties until goods are released. The segment's growth is being driven by increasing cross-border trade, e-commerce expansion, and the rising need for efficient international supply chain solutions. Bonded warehouses are particularly gaining traction in emerging economies where cross-border trade is expanding rapidly. The segment's appeal is further enhanced by its ability to help businesses save money in the short term, manage supply effectively, and ensure expedited customs clearance, making it an increasingly attractive option for importers and exporters looking to optimize their international trade operations.

Remaining Segments in Warehousing and Storage Services Market by Ownership

Public warehousing represents a significant segment in the warehousing and storage services market, offering accessible storage solutions for manufacturers, wholesalers, exporters, importers, and government agencies. These facilities are typically established by government entities and licensed to private third-party players, including cooperative societies, providing both short-term and long-term storage options on a month-to-month basis. Public warehouses are particularly advantageous for small business owners due to their relatively low storage costs and flexible space allocation. Their strategic locations near transportation hubs and the provision of various value-added services make them an integral part of the global warehousing ecosystem, especially for businesses looking to outsource their warehousing needs without significant capital investment.

Segment Analysis: By End-User Industry

Manufacturing Segment in Warehousing and Storage Services Market

The manufacturing segment continues to dominate the global warehousing and storage services market, holding approximately 33% market share in 2024. This significant market position is driven by increasing demand from the automotive, electronics, and industrial manufacturing sectors requiring sophisticated warehousing solutions. The segment's prominence is further strengthened by the growing adoption of automation and smart warehousing technologies in manufacturing facilities, enabling improved inventory management and operational efficiency. Manufacturing companies are increasingly outsourcing their warehousing needs to specialized service providers to optimize their supply chain operations and reduce operational costs. The rise of Industry 4.0 and smart manufacturing practices has also contributed to the segment's dominance, as manufacturers require more advanced warehousing solutions to support their digitalized operations.

Healthcare Segment in Warehousing and Storage Services Market

The healthcare segment is emerging as the fastest-growing segment in the warehousing and storage services market, with projections indicating robust growth from 2024 to 2029. This exceptional growth is primarily driven by the increasing demand for specialized pharmaceutical warehousing facilities for pharmaceutical products, medical devices, and healthcare supplies. The segment's expansion is further fueled by stringent regulatory requirements for healthcare product storage, growing adoption of temperature-controlled warehousing solutions, and the rise in pharmaceutical manufacturing activities globally. The implementation of advanced warehouse management systems (WMS) in healthcare facilities is also contributing to this growth, as these systems help optimize inventory management and ensure compliance with quality control standards. Additionally, the increasing focus on maintaining efficient healthcare supply chains and the growing trend of outsourcing warehousing operations in the healthcare sector are expected to sustain this segment's rapid growth trajectory.

Remaining Segments in End-User Industry

The warehousing and storage services market encompasses several other significant segments, including consumer goods, food and beverages, retail, and other miscellaneous industries. The consumer goods segment is characterized by the growing demand for omnichannel distribution capabilities and e-commerce fulfillment centers. The food and beverages segment is driven by the need for specialized temperature-controlled storage facilities and strict compliance with food safety regulations. The retail segment continues to evolve with the changing landscape of online and offline retail operations, requiring more sophisticated warehousing solutions. These segments collectively contribute to the market's diversity and demonstrate the varied applications of warehousing services across different industries, each with its unique storage requirements and operational challenges.

Warehousing and Storage Services Market Geography Segment Analysis

Warehousing and Storage Services Market in North America

North America represents a mature and highly sophisticated warehousing and storage services market, commanding approximately 25% of the global market share in 2024. The region's dominance is driven by the robust e-commerce sector, with web-based shopping becoming increasingly popular across all customer segments. The market is characterized by advanced automation technologies, sophisticated warehouse management systems, and a strong focus on operational efficiency. The demand for outsourcing warehousing services continues to grow, particularly from manufacturing companies expanding their production and operational capacities. The region's warehousing infrastructure is notably advanced in terms of technology adoption, with widespread implementation of IoT, automation, and real-time tracking systems. The United States leads the regional market, supported by its extensive logistics network and strategic positioning of warehouses near major population centers. The market is witnessing a significant shift toward smaller, urban warehouses to facilitate faster last-mile delivery services, particularly in response to evolving consumer expectations for rapid order fulfillment.

Warehousing and Storage Services Market in Europe

The European warehousing and storage services market has demonstrated robust growth, recording an impressive expansion of approximately 19% between 2019 and 2024. The market is characterized by increasing investments in automation and digital transformation initiatives across warehousing operations. The region's warehousing sector is experiencing significant evolution in response to changing retail patterns and the growth of e-commerce platforms. Major developments are concentrated in key logistics hubs across Germany, France, the Netherlands, and the United Kingdom, with particular emphasis on developing sustainable and energy-efficient warehousing solutions. The market is witnessing a notable trend toward the adoption of multi-modal optimization strategies, enabling sophisticated planning across regions and transport modes. European warehouses are increasingly focusing on implementing advanced technologies such as automated storage and retrieval systems, robotics, and artificial intelligence to enhance operational efficiency. The region's strong focus on sustainability and environmental regulations is driving innovations in green warehousing solutions and eco-friendly storage practices.

Warehousing and Storage Services Market in Asia-Pacific

The Asia-Pacific warehousing and storage services market is positioned for exceptional growth, with projections indicating a robust growth rate of approximately 8% during the period 2024-2029. The region's warehousing sector is undergoing significant transformation, driven by rapid urbanization and the expansion of e-commerce platforms. The market is characterized by increasing investments in modern warehousing facilities, particularly in emerging economies such as India, China, and Southeast Asian nations. Technological advancement in warehouse operations, including the adoption of automation and digital solutions, is reshaping the industry landscape. The region is witnessing a surge in demand for specialized warehousing services, particularly in the cold storage market segment, driven by growing consumer preferences for fresh and frozen products. Urban warehousing solutions are gaining prominence, especially in densely populated metropolitan areas, as companies strive to optimize last-mile delivery operations. The market is also seeing increased adoption of sustainable warehousing practices and green building standards in response to growing environmental consciousness.

Warehousing and Storage Services Market in Latin America

The Latin American warehousing and storage services market is experiencing significant transformation, primarily driven by the rapid expansion of e-commerce and digital retail platforms. The region is witnessing increased investments in modern warehousing facilities, particularly in major economic centers of Brazil, Mexico, and Colombia. Market dynamics are shaped by the growing demand for efficient distribution networks and the need for specialized storage solutions. The warehousing sector is gradually adopting advanced technologies and automation solutions to enhance operational efficiency and meet evolving customer expectations. Regional players are focusing on developing integrated warehousing solutions that combine traditional storage with value-added services. The market is characterized by increasing partnerships between local and international logistics providers, fostering knowledge transfer and technological advancement. Infrastructure development and modernization initiatives are creating new opportunities for warehouse expansion and optimization across the region.

Warehousing and Storage Services Market in Middle East & Africa

The Middle East and African warehousing and storage services market is demonstrating significant potential for growth, driven by increasing investments in logistics infrastructure and the expansion of retail and e-commerce sectors. The region is witnessing a transformation in warehousing operations, with a particular focus on developing modern storage facilities equipped with advanced technologies. The market is characterized by growing demand for specialized storage solutions, particularly in the Gulf Cooperation Council (GCC) countries. Warehousing operations are evolving to support the region's economic diversification initiatives and growing international trade activities. The sector is seeing increased adoption of automated warehousing solutions and digital management systems to enhance operational efficiency. Regional governments' initiatives to establish logistics hubs and free trade zones are creating new opportunities for warehouse development and expansion. The market is also witnessing growing demand for cold storage facilities, particularly in response to the region's climatic conditions and expanding food and pharmaceutical sectors.

Warehousing and Storage Industry Overview

Top Companies in Warehousing and Storage Services Market

The warehousing services market features prominent players like DHL Group, XPO Logistics, Ryder System, Americold Logistics, and Lineage Logistics leading the industry through continuous innovation and strategic expansion. Companies are increasingly focusing on technology integration, implementing automated systems, robotics, and advanced warehouse management solutions to enhance operational efficiency. The industry is witnessing a significant shift toward smart warehouses with real-time inventory tracking capabilities and predictive analytics. Market leaders are actively pursuing geographical expansion through both organic growth and strategic acquisitions, particularly in emerging markets. There is also a growing emphasis on developing specialized storage solutions, particularly in temperature-controlled warehousing, to cater to evolving customer demands in the pharmaceutical and food industries. Companies are increasingly adopting sustainable practices and green technologies while expanding their last-mile delivery capabilities to support the booming e-commerce sector.

Dynamic Market Structure Drives Industry Evolution

The warehouse services industry exhibits a mix of global conglomerates and specialized regional players, creating a diverse competitive landscape. Large multinational corporations dominate the premium segment with their extensive networks and integrated logistics solutions, while regional specialists maintain strong positions in niche markets through local expertise and specialized services. The market is experiencing significant consolidation through mergers and acquisitions, particularly in the cold storage industry, as companies seek to expand their geographical footprint and service capabilities. The industry structure is evolving with the entry of technology-driven players who are disrupting traditional business models through innovative solutions and digital platforms. Traditional boundaries between pure-play warehousing providers and integrated logistics companies are increasingly blurring as players expand their service portfolios to offer end-to-end supply chain solutions.

The market demonstrates varying levels of consolidation across different regions and segments, with mature markets showing higher concentration levels compared to emerging markets. Major players are actively pursuing strategic acquisitions to strengthen their market position and acquire technological capabilities, particularly in automation and digital solutions. The industry is witnessing increased investment in specialized facilities, especially in pharmaceutical and food storage, driving further market consolidation. Regional players are forming strategic alliances and partnerships to compete with global players, while also focusing on service differentiation and customer relationship management. The market is seeing the emergence of new business models, including on-demand warehousing and shared storage solutions, which are reshaping competitive dynamics.

Innovation and Adaptability Drive Future Success

Success in the 3PL industry increasingly depends on companies' ability to adapt to rapidly evolving customer needs and technological advancements. Market leaders are investing heavily in automation and digital transformation to improve operational efficiency and service quality, while also focusing on developing sustainable and energy-efficient facilities. Companies are expanding their value-added services portfolio, including packaging, labeling, and inventory management, to create additional revenue streams and strengthen customer relationships. The ability to offer flexible and scalable solutions, particularly in supporting e-commerce operations, has become crucial for maintaining a competitive advantage. Market players are also focusing on developing specialized expertise in handling different product categories and maintaining compliance with evolving regulatory requirements, particularly in temperature-controlled storage.

Future success in the 4PL industry will require companies to balance operational efficiency with service customization while maintaining strong relationships with key customers. Players must develop robust risk management strategies to address potential disruptions in supply chains and changing regulatory landscapes. The ability to provide integrated solutions that combine storage with transportation and other logistics services will become increasingly important. Companies need to focus on building sustainable competitive advantages through technological innovation and operational excellence while maintaining flexibility to adapt to changing market conditions. Success will also depend on effectively managing relationships with both suppliers and customers, particularly in industries with high end-user concentration, while continuously monitoring and adapting to potential substitution risks from alternative storage services solutions.

Warehousing and Storage Market Leaders

-

XPO Logistics, Inc.

-

Ryder System, Inc.

-

FedEx Corp

-

DHL International GmbH

-

NFI Industries, Inc.

*Disclaimer: Major Players sorted in no particular order

Warehousing and Storage Market News

- September 2022 - Amazon.com Inc. introduced a new service to help its sellers tackle supply-chain issues by storing bulk inventory and easing distribution. The new service, called Amazon Warehousing and Distribution (AWD), provides its sellers with a pay-as-you-go service, helping them store and distribute their inventory within Amazon's fulfillment network.

- February 2022 - Amazon India leased a 154,000 warehouse facility in Pune for 20 years from IndoSpace, a real estate and logistics park developer. The company had made this agreement through its subsidiary Amazon Transportation Services. The acquisition is in line with the company's aggressive strategy to expand its warehouse and logistics capabilities in the country.

Warehousing and Storage Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

4.1 Market Overview

4.2 Industry Value Chain Analysis

4.3 Industry Attractiveness - Porter's Five Forces Analysis

4.3.1 Bargaining Power of Suppliers

4.3.2 Bargaining Power of Consumers

4.3.3 Threat of New Entrants

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

4.4 Impact of COVID-19 on the Market

5. MARKET DYNAMICS

5.1 Market Drivers

5.1.1 Rising Popularity of Omnichannel Distribution

5.1.2 Growth in the E-commerce Industry

5.2 Market Restraints

5.2.1 High Investment and Maintenance Costs

6. MARKET SEGMENTATION

6.1 By Type

6.1.1 General Warehousing and Storage

6.1.2 Refrigerated Warehousing and Storage

6.1.3 Farm Product Warehousing and Storage

6.2 By Ownership

6.2.1 Private Warehouses

6.2.2 Public Warehouses

6.2.3 Bonded Warehouses

6.3 By End-user Industry

6.3.1 Manufacturing

6.3.2 Consumer Goods

6.3.3 Food and Beverage

6.3.4 Retail

6.3.5 Healthcare

6.3.6 Other End-user Industries

6.4 By Geography

6.4.1 North America

6.4.2 Europe

6.4.3 Asia-Pacific

6.4.4 Latin America

6.4.5 Middle East & Africa

7. COMPETITIVE LANDSCAPE

7.1 Company Profiles

7.1.1 DHL International GmbH

7.1.2 XPO Logistics Inc.

7.1.3 Ryder System Inc.

7.1.4 NFI Industries Inc.

7.1.5 AmeriCold Logistics LLC

7.1.6 FedEx Corp

7.1.7 Lineage Logistics Holding LLC

7.1.8 NF Global Logistics Ltd

7.1.9 APM Terminals BV

7.1.10 DSV Panalpina AS

7.1.11 Kane Is Able Inc.

7.1.12 MSC - Mediterranean Shipping Agency AG

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. FUTURE OUTLOOK OF THE MARKET

Warehousing and Storage Industry Segmentation

Warehousing and storage services include storage space for companies' or organizations' property, including equipment, parts, products, and perishable goods. This often includes inventory management and distribution. The proper storage and tracking of inventory ensure delivery times are met, and asset management costs are reduced.

The report offers the market sizes, trends, and forecasts in value for segments by type, ownership, end-user industry, and geography. The scope of the study also includes an in-depth analysis of COVID-19 impact on the warehouse and storage services market. The market sizes and forecasts are provided in terms of value (USD) for all the above segments.

| By Type | |

| General Warehousing and Storage | |

| Refrigerated Warehousing and Storage | |

| Farm Product Warehousing and Storage |

| By Ownership | |

| Private Warehouses | |

| Public Warehouses | |

| Bonded Warehouses |

| By End-user Industry | |

| Manufacturing | |

| Consumer Goods | |

| Food and Beverage | |

| Retail | |

| Healthcare | |

| Other End-user Industries |

| By Geography | |

| North America | |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Warehousing and Storage Market Research FAQs

What is the current Warehousing and Storage Services Market size?

The Warehousing and Storage Services Market is projected to register a CAGR of 6.86% during the forecast period (2025-2030)

Who are the key players in Warehousing and Storage Services Market?

XPO Logistics, Inc., Ryder System, Inc., FedEx Corp, DHL International GmbH and NFI Industries, Inc. are the major companies operating in the Warehousing and Storage Services Market.

Which is the fastest growing region in Warehousing and Storage Services Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Warehousing and Storage Services Market?

In 2025, the North America accounts for the largest market share in Warehousing and Storage Services Market.

What years does this Warehousing and Storage Services Market cover?

The report covers the Warehousing and Storage Services Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Warehousing and Storage Services Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Warehousing and Storage Services Market Research

Mordor Intelligence provides a comprehensive analysis of the warehousing services industry. We leverage decades of expertise in storage services research. Our latest report examines the evolution of distribution center operations. It spans from traditional public warehousing to advanced smart warehouse solutions. The analysis covers the entire spectrum of services, including Third-Party Logistics (3PL) and Fourth-Party Logistics (4PL) providers. It also includes automated warehouse systems and specialized facilities like bonded warehouse and fulfillment center operations.

Stakeholders across the industry benefit from our detailed coverage of specialized segments. These include cold storage, pharmaceutical warehousing, and agricultural storage facilities. The report examines emerging trends in bulk storage, industrial storage, and retail warehousing. It also provides insights into inventory management services and contract warehousing solutions. Our analysis of logistics facility developments and supply chain storage innovations is available in an easy-to-read report PDF format for download. This offers actionable intelligence for businesses operating private warehousing facilities or managing refrigerated warehouse operations.