This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report focuses on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rules provide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

Asset write-downs are reductions in the book value of an asset that occur when the fair value of an asset has declined significantly below its carrying value. The value of the asset is reduced on the balance sheet, and the write-down is charged against income.

For debt investors, which GAAP was primarily designed for, write-downs are analytically helpful. They provide a more accurate assessment of the liquidation value of a company’s assets. For equity investors, on the other hand, write-downs are not helpful because they distort the return on invested capital (ROIC) of a company.

Write-downs allow management to erase equity from the balance sheet, which inflates any return on asset/capital metric. So, we add back asset write-downs (after tax) to our measure of invested capital. And we keep those write-down in invested capital to ensure our measure of invested capital holds companies accountable for all the capital invested in their business over their operating lives.

We also remove the write-down expense (after tax) from net operating profit after tax (NOPAT).

Without careful footnotes research, investors would never know that reported assets exclude a significant portion of invested capital due to asset write-downs for nearly 3,000 companies.

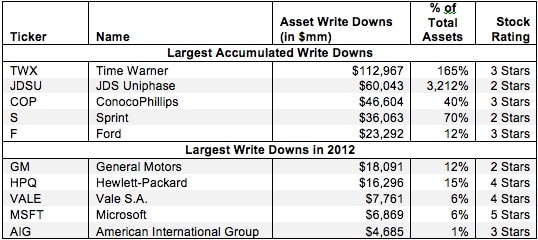

Figure 1 shows the five companies with the largest accumulated write-downs added back in our invested capital calculation and the five companies that wrote down the most amount of assets in 2012.