Attempting to time the market can be a fool’s errand. Waiting for the next crash could result in lost opportunities. Assuming stocks can only rise could result in a disastrous portfolio.

Rather than trying to time the market, investors can weather any storm by finding high-quality yield. In a recent training, The Secret Safe Haven in a Stormy Market, we highlighted the importance of dividends in generating higher long-term returns. But, identifying quality dividends is the key, and that research is not as easy as it might seem. As diligent investors know, getting an accurate measure of cash flow takes a lot of work because the reported earnings can be so misleading.

By leveraging our proven-superior fundamental data, we can identify which companies, out of the 3,400+ under coverage, generate real cash. Only by understanding the true cash flows of a business can investors know if a company can support its dividend or if that high yield is headed for a cliff.

This week’s Long Idea provides investors the potential for a 10% yield, yet trades at a steep discount to its no-growth value. Best of all, the business generates more than adequate cash flows to support the yield. Even if the stock doesn’t rise as fast as the market, investors can get paid while they wait for the market to realize the true strength of this business.

Our process for picking stocks is about as rigorous as it gets, and we’re proud to show our work. We’re not giving you the ticker for this pick, but we are happy to share large excerpts from the report.

The information below comes from the recent update on our thesis for this stock, available to Pro and Institutional members. And, you can buy the full report a la carte here.

This stock presents quality Risk/Reward based on the company’s:

- position to profit from rising oil production,

- exposure to oil and gas production without the costly expenditures,

- investments in expanded export capacity,

- quality yield supported by strong cash flows, and

- cheap valuation.

What’s Working

Oil Production Continues to Rise

U.S. oil production has increased from 7.4 million barrels per day in October 2013 to 13.5 million barrels per day in October 2024. See Figure 1.

Additionally, The U.S. Energy Information Administration (EIA), in its October 2024 Short-Term Energy Outlook, projects global crude oil production to grow 2% year-over-year (YoY) in 2025.

The EIA projects global liquid fuel consumption will increase by 0.9 million barrels per day in 2024 and 1.3 million barrels per day in 2025.

Figure 1: U.S. Oil Production: October 2013 – October 2024

Source: EIA

Expanding Capacity

The company’s management believes replacing international coal supply with U.S.-sourced liquified natural gas (LNG) could make the most meaningful impact to near-term CO2 reduction efforts. McKinsey agrees, as it has stated “natural gas can play a critical role in decarbonizing U.S. power supply”.

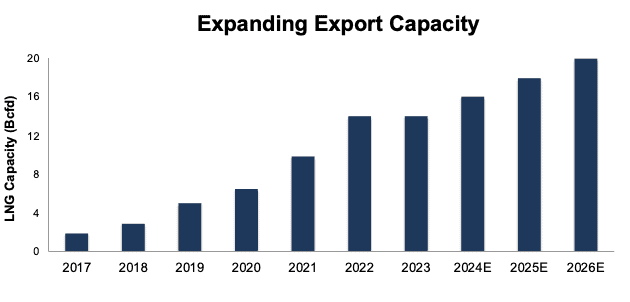

To meet ongoing demand for such U.S. LNG exports, this company is investing to increase its export capacity. The company currently has multiple projects under construction that will bring an additional 8 billion cubic feet per day (bcfd) of export capacity online by the end of 2025. See Figure 2.

Figure 2: LNG Export Capacity: 2017-2026E

Sources: New Constructs, LLC and company filings

Profits Still Near Records

While profits are down from record 2022 levels, this company continues to generate strong Core Earnings. In the TTM ended 2Q24, the company’s Core Earnings were $313 million, which are higher than any year except 2022 and 2023 in our model.

The company has grown revenue by 1% compounded annually and Core Earnings by 4% compounded annually over the past decade. See Figure 3.

The company has also improved net operating profit after-tax (NOPAT) margin from 48% in 2019 to 66% in the TTM and ROIC from 11% to 21% over the same time.

….there’s much more in the full report. You can buy the report a la carte here.

Or, become a Professional or Institutional member – they get all Long Idea reports.