CurrentC, Walmart-Led Competitor To Apple Pay, Has Already Been Hacked

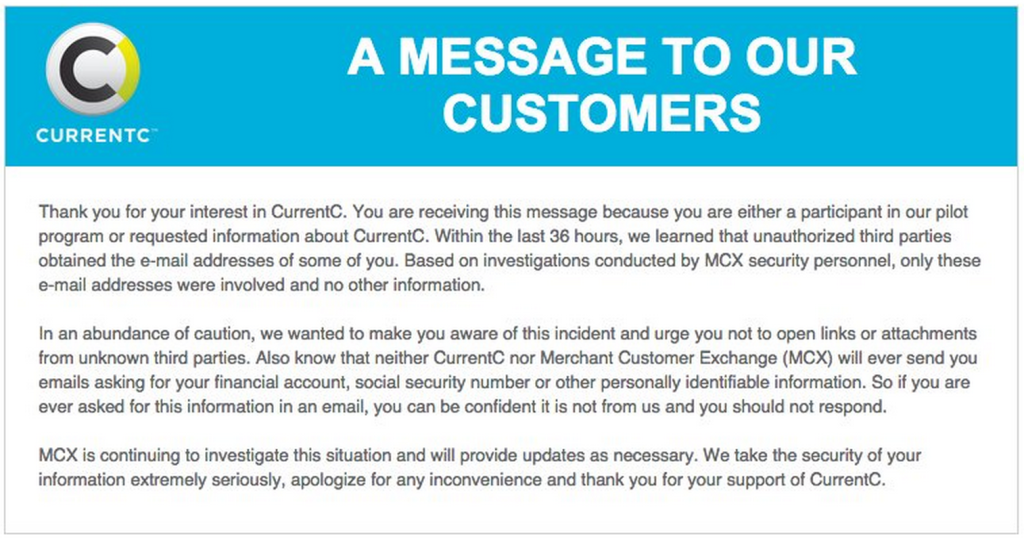

BusinessInsider reports that people who signed up for the beta test of the CurrentC app have received e-mails alerting them to the fact “that unauthorized third parties obtained the e-mail addresses of some of you.”

A rep for the service then confirmed that it learned of the breach in the last 48 hours. The rep tried to minimize the scope of the hack by claiming that “Many of these email addresses are dummy accounts used for testing purposes only. The CurrentC app itself was not affected.”

While the stolen data is just e-mail addresses and not more sensitive information like payment or account data, it does call into question the security of CurrentC, which is being developed by the Walmart-led Merchants Consumer Exchange (MCX), a coalition aiming to, among other things, reduce swipe fees, the amount of money that retailers pay to banks and credit cards for handling transactions.

CurrentC would not only cut out the middle man and allow stores to keep more of the money from each purchase, it would also allow the retailers to better track users’ shopping and buying habits, presumably across multiple stores.

There is still little doubt that Walmart and the other MCX retailers will ultimately launch CurrentC, but if consumers don’t choose to use it, the service could end up in the trash bin of retail history.

After all, people don’t need a mobile payment system, especially one that provides no more privacy than shopping with a credit card. And while the stores might benefit from saving the few percentage points they currently pay in swipe fees, there is no indication that these savings will be passed on to shoppers.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.