Daily Top 5 Daily Top 5 |

EV funding slows down; cloud kitchens chart a comeback

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

Funding for India’s EV sector has nearly halved between 2022 and 2024. This and more in today’s ETtech Top 5.

Also in the letter:

■ Tata Digital funding may delay

■ PayU's Vijay Agicha quits

■ India’s startup milestones in 2024

India's electric vehicle (EV) sector saw a sharp decline in funding, plummeting by nearly 50% between 2022 and 2024, as investors called for improved profitability and unit economics.

Driving the news:

Growth slowdown: Electric vehicle sales rose 24.5% this year to 1.9 million units, although growth slowed from the previous year's 50% spike, data from the government's Vahan portal reveals.

In the electric two-wheeler segment, overall sales reached 1.13 million vehicles in 2024, up from 860,000 in 2023.

Global picture: Globally, EV sales growth is slowing due to high prices, limited charging infrastructure and regulatory uncertainties, although volumes continue to rise.

Road ahead: Investors and stakeholders told us that they are bullish on the EV industry, buoyed by the government's goal of 30% EV penetration in new registrations by 2030.

Also Read: PM E-DRIVE scheme: New plan to subsidise charging stations for 2 and 3-wheelers

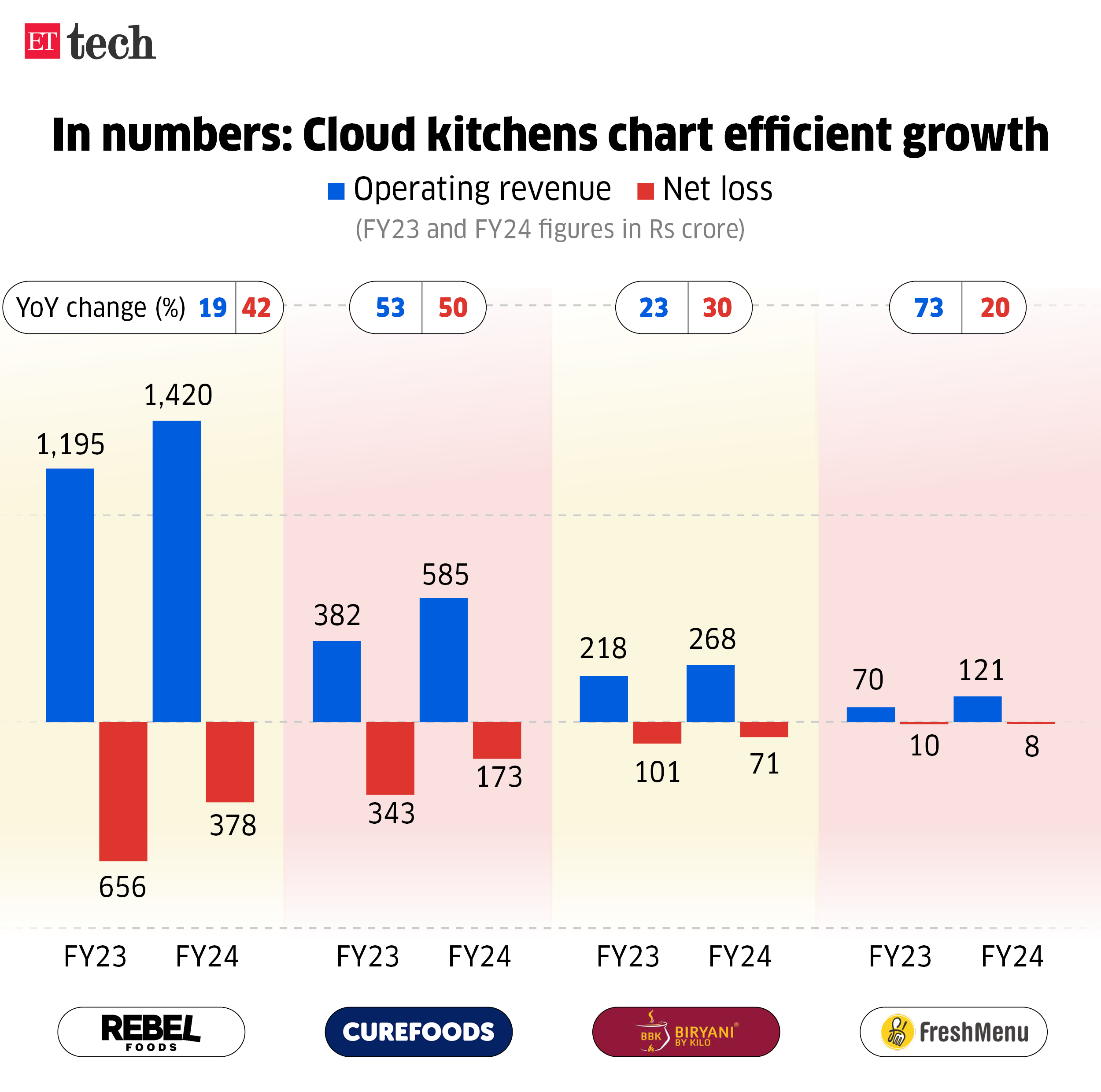

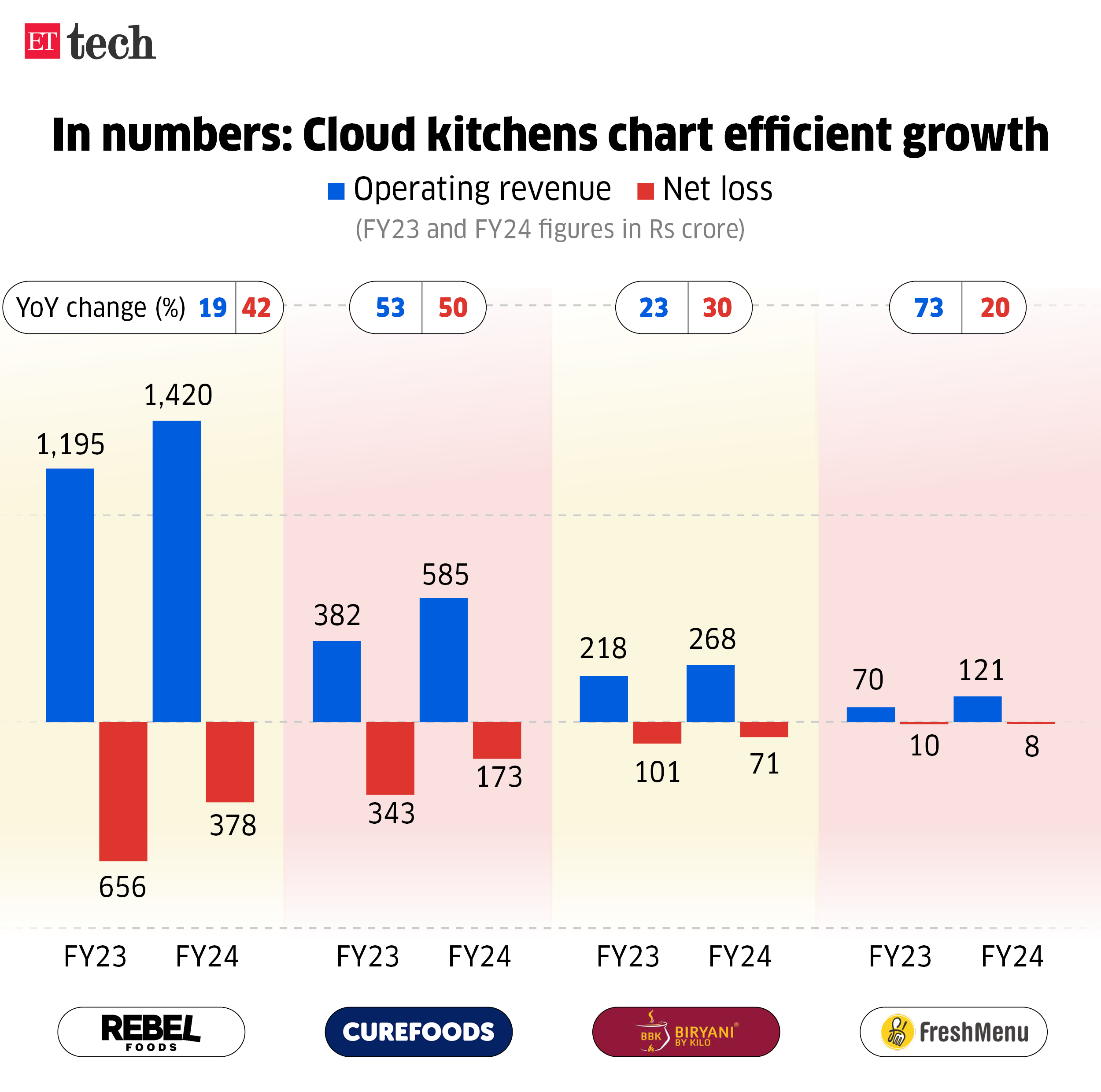

India's cloud kitchen startups saw a turnaround in FY24, with most recording significant revenue growth and narrowing their losses.

Comeback:

But, how? These firms reined in expenses this fiscal, including those on marketing and employees.

Big picture: Industry executives said inflation was a concern for the sector this year. Prices of raw materials such as edible oil, wheat and vegetables were the most impacted.

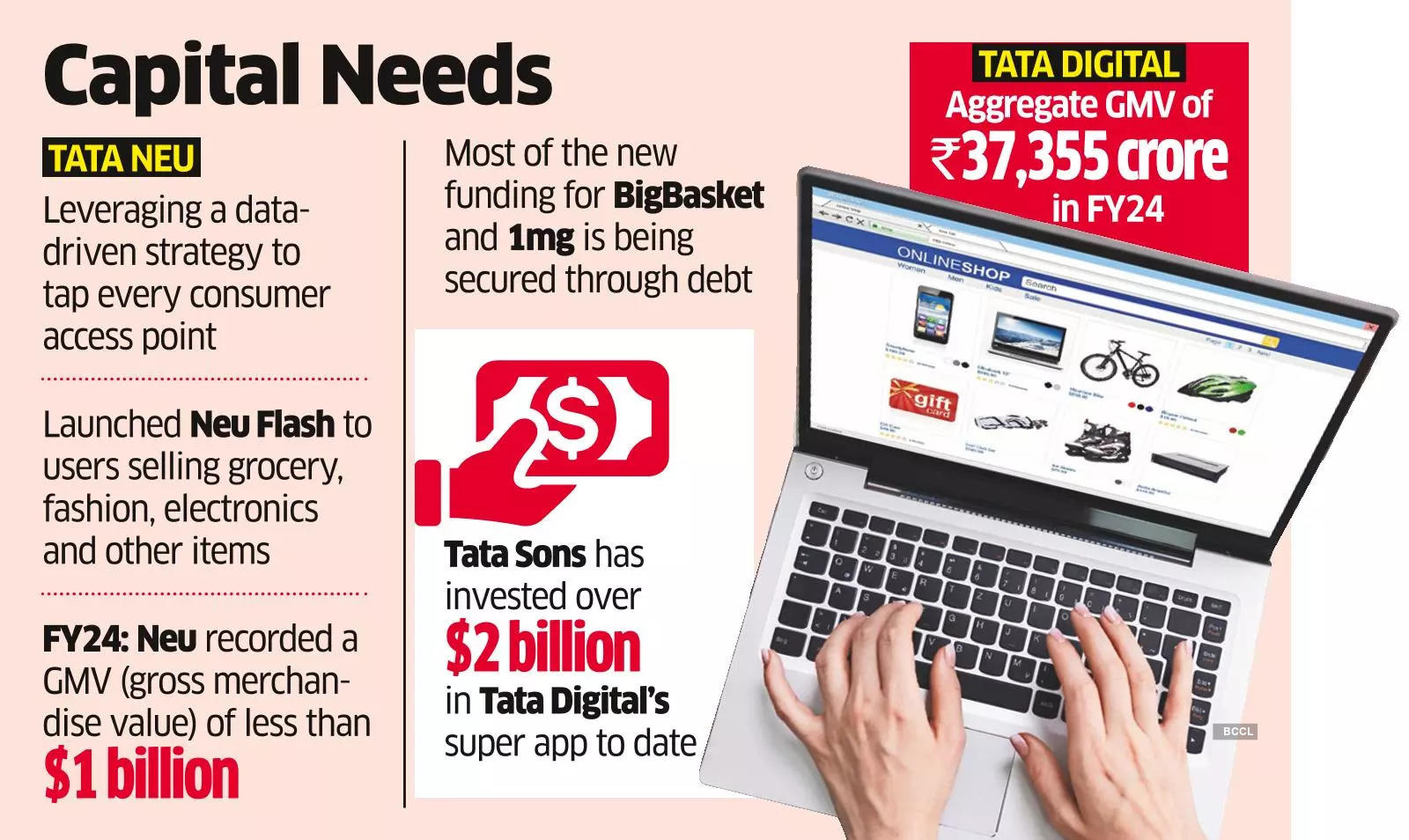

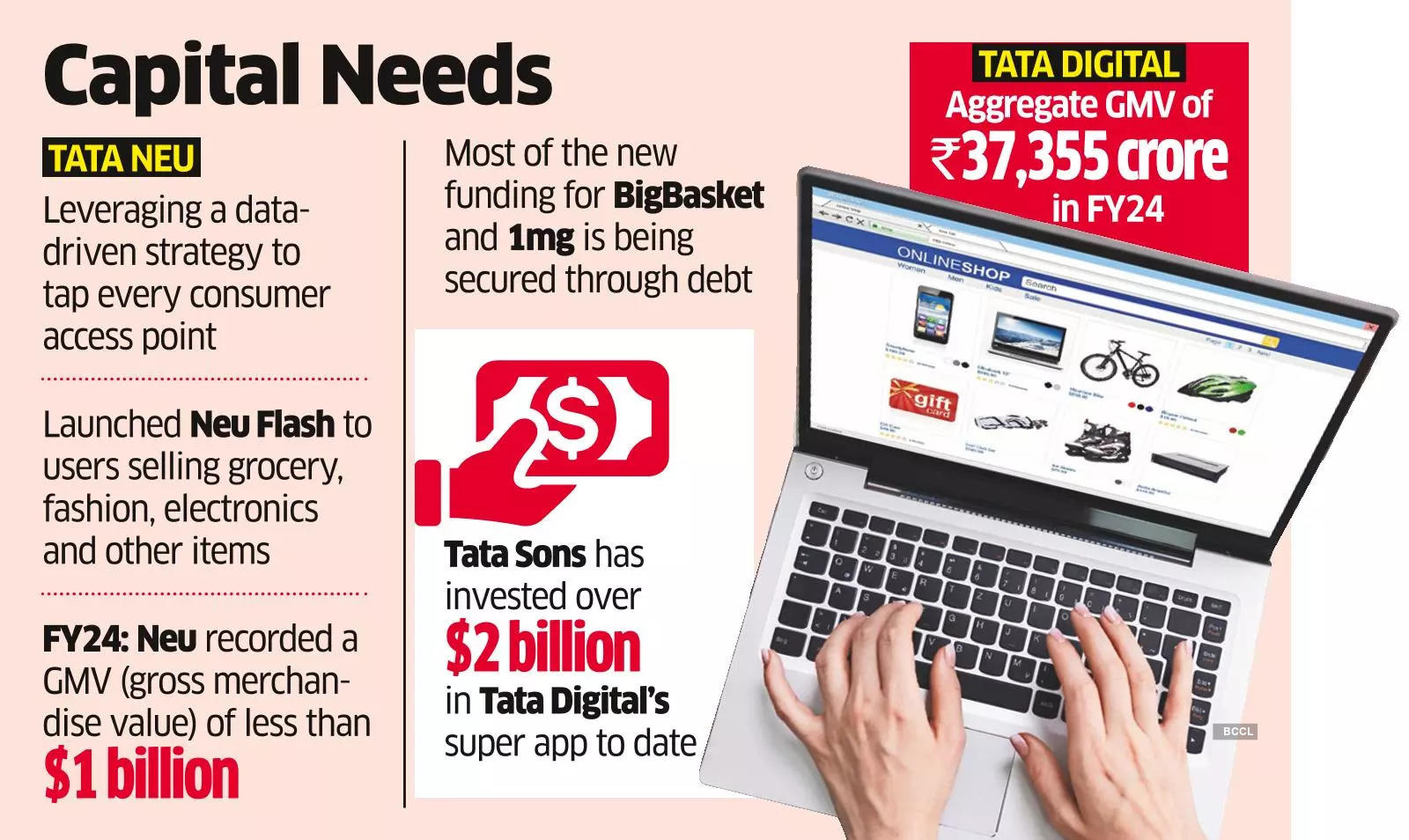

Tata Sons may infuse the next round of capital into its ecommerce business, Tata Digital, only in mid-2025. Until then, the new commerce entity will have to rely on internal funding and debt financing to fuel growth.

What is happening: CEO Naveen Tahilyani has asked all business heads to concentrate on growth after having enforced stricter spending, emphasised better execution, accountability and return on capital.

Zoom in: Tata Neu is using a data-driven approach to tap every consumer access point within the system, including partnerships with external entities. As a part of this strategy, new funding for BigBasket and 1mg is being obtained via debt rather than fresh equity infusion. Tata Sons has invested over $2 billion in Tata Digital till date.

Driving performance: Tahilyani is pushing performance by offering Esops to top performers and building a culture of accountability.

Vijay Agicha, chief investment and transformation officer of Naspers-backed PayU, has stepped down from his role, according to sources.

Driving the news: Agicha’s departure comes just months after Suresh Rajagopalan, former CEO of PayU-owned Wibmo, a provider of authentication services for online digital payments, left the company.

Sources added that Agicha may join an investment firm to focus on fintech investments.

Leadership shifts: PayU has seen a wave of leadership changes following the sale of its global operations to Israel-based fintech firm Rapyd in August 2023. Key departures include:

Expansion plans: PayU, which is gearing up for a 2025 listing on Indian stock exchanges, has been sharpening its focus on the consumer segment through its LazyPay mobile application. While merchant payments remain central to its operations, PayU aims to leverage LazyPay to build a comprehensive consumer payment and credit business, Anirban Mukherjee, CEO of PayU said earlier.

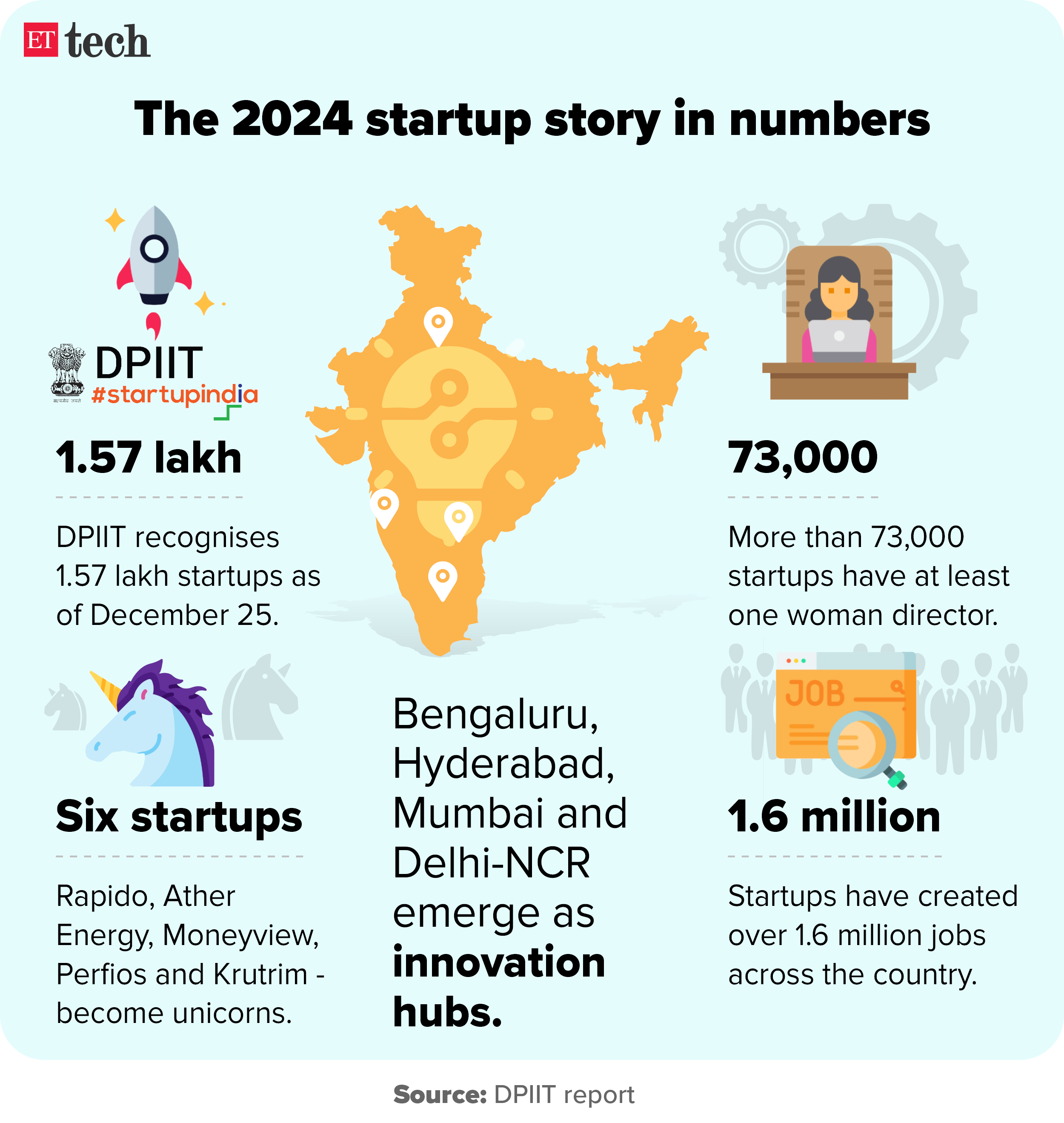

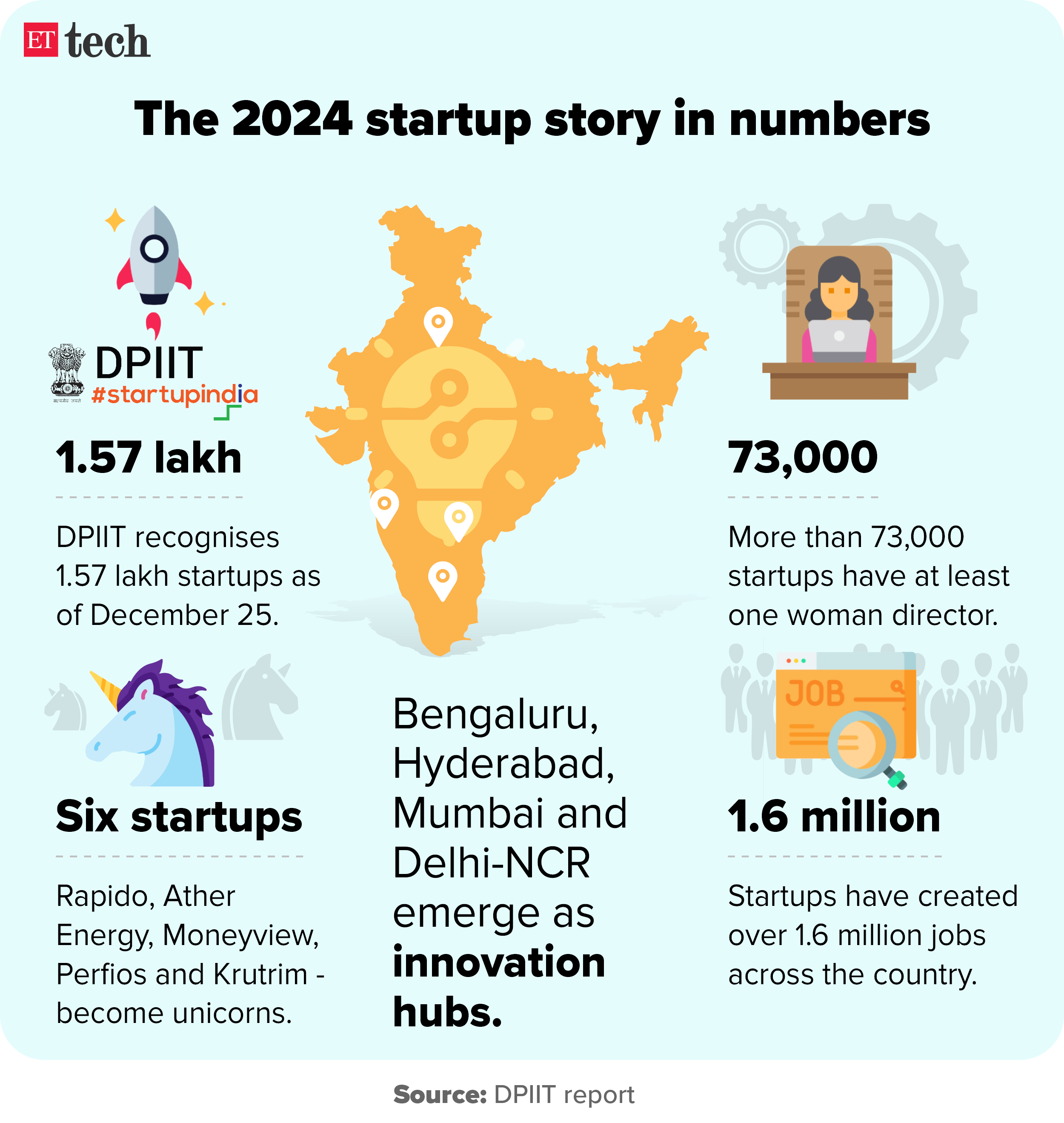

India’s startup ecosystem has created over 1.6 million jobs, with the Department for Promotion of Industry and Internal Trade (DPIIT) recognising 1.57 lakh startups as of December 25, 2024.

Tell me more: The role of women in Indian startups has grown considerably, with 73,000 firms having at least one woman director. India has emerged as the world’s third-largest startup hub boasting over 100 unicorns with Rapido, Ather Energy, Moneyview, Perfios and Krutrim being added to the list this year.

Read all the Year in Review stories here:

Today’s ETtech Top 5 newsletter was curated by Vaibhavi Khanwalkar and Blessy Reji in Bengaluru.

Also in the letter:

■ Tata Digital funding may delay

■ PayU's Vijay Agicha quits

■ India’s startup milestones in 2024

Year in Review: EVs lose the funding race as investors drive a hard bargain

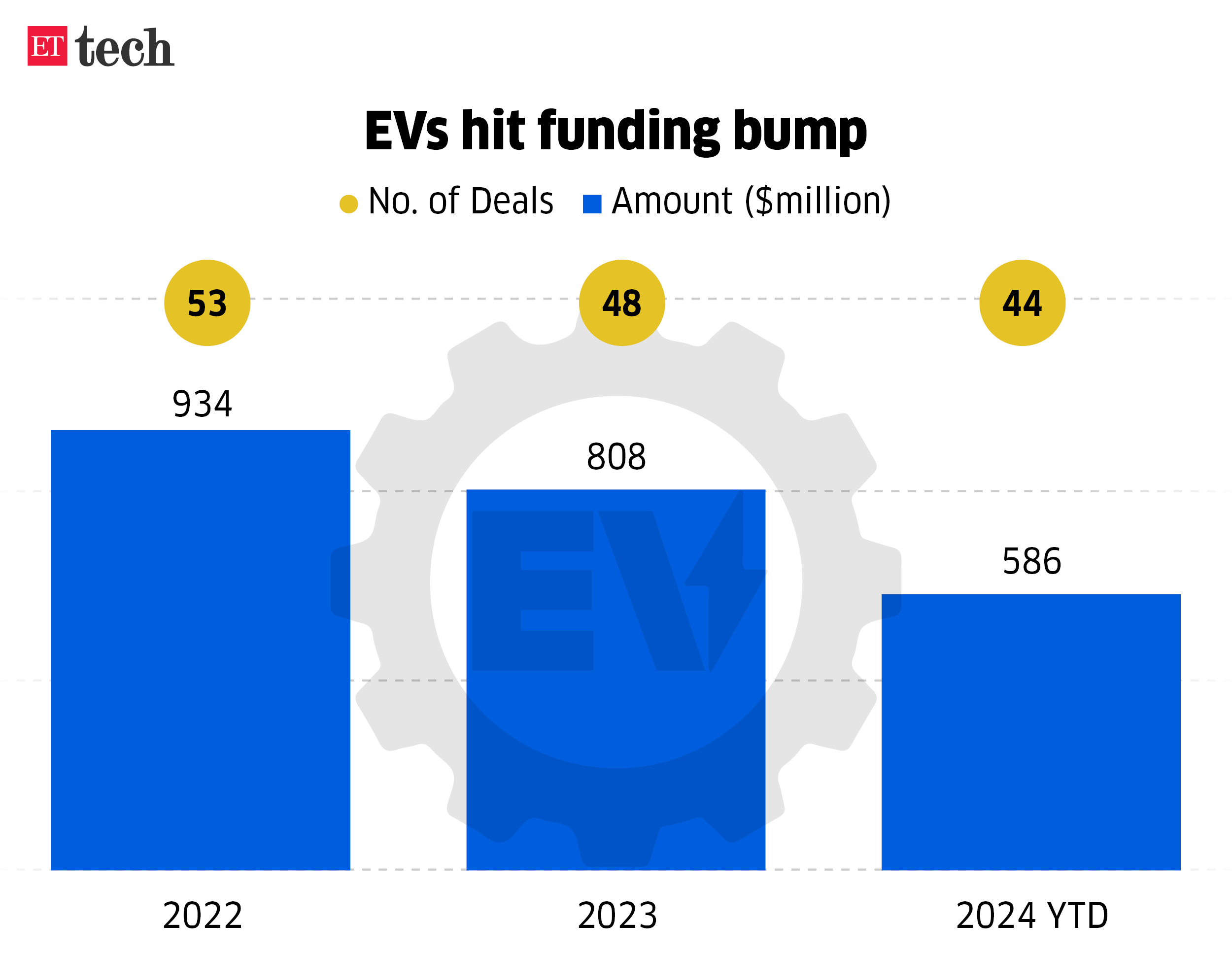

India's electric vehicle (EV) sector saw a sharp decline in funding, plummeting by nearly 50% between 2022 and 2024, as investors called for improved profitability and unit economics.

Driving the news:

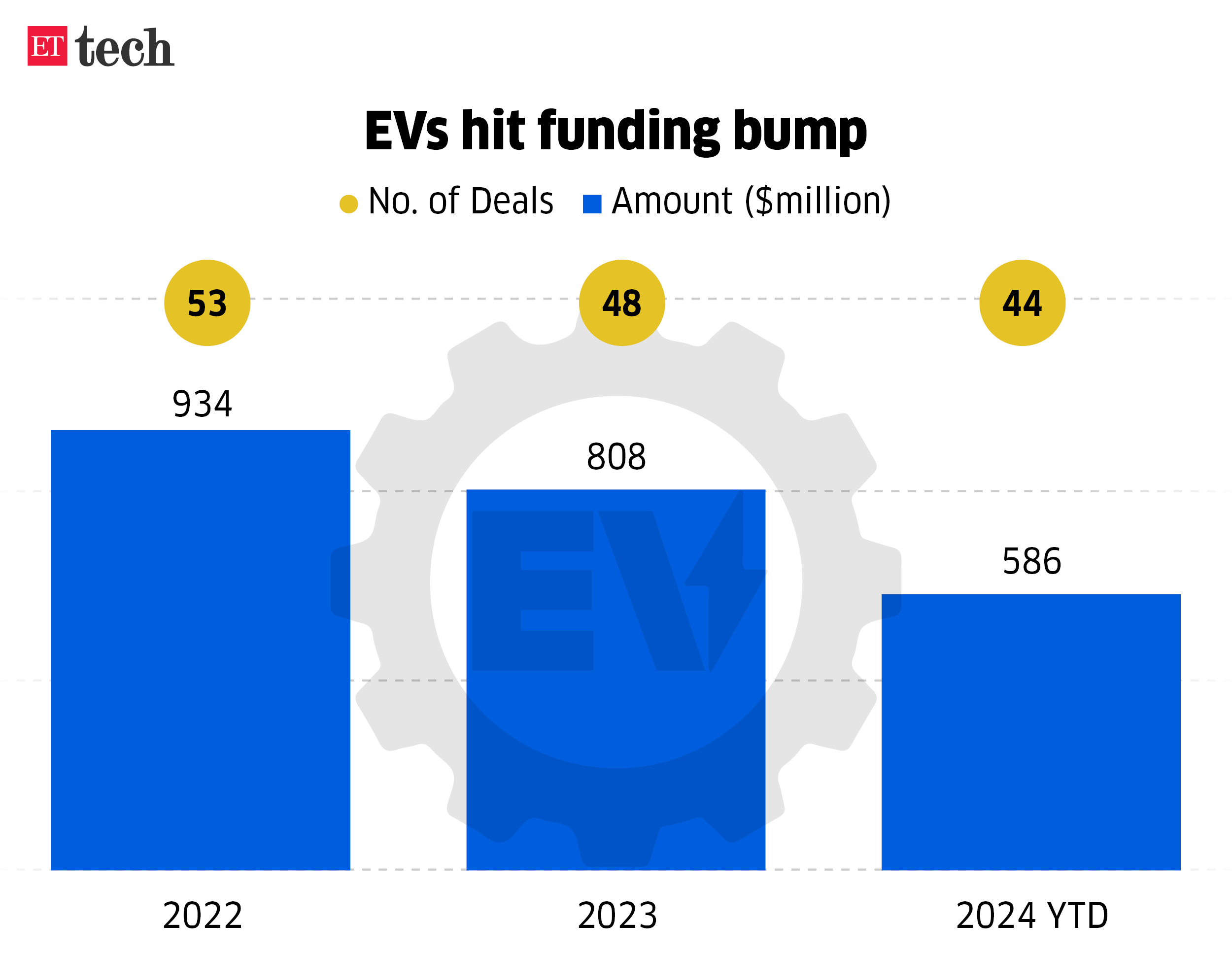

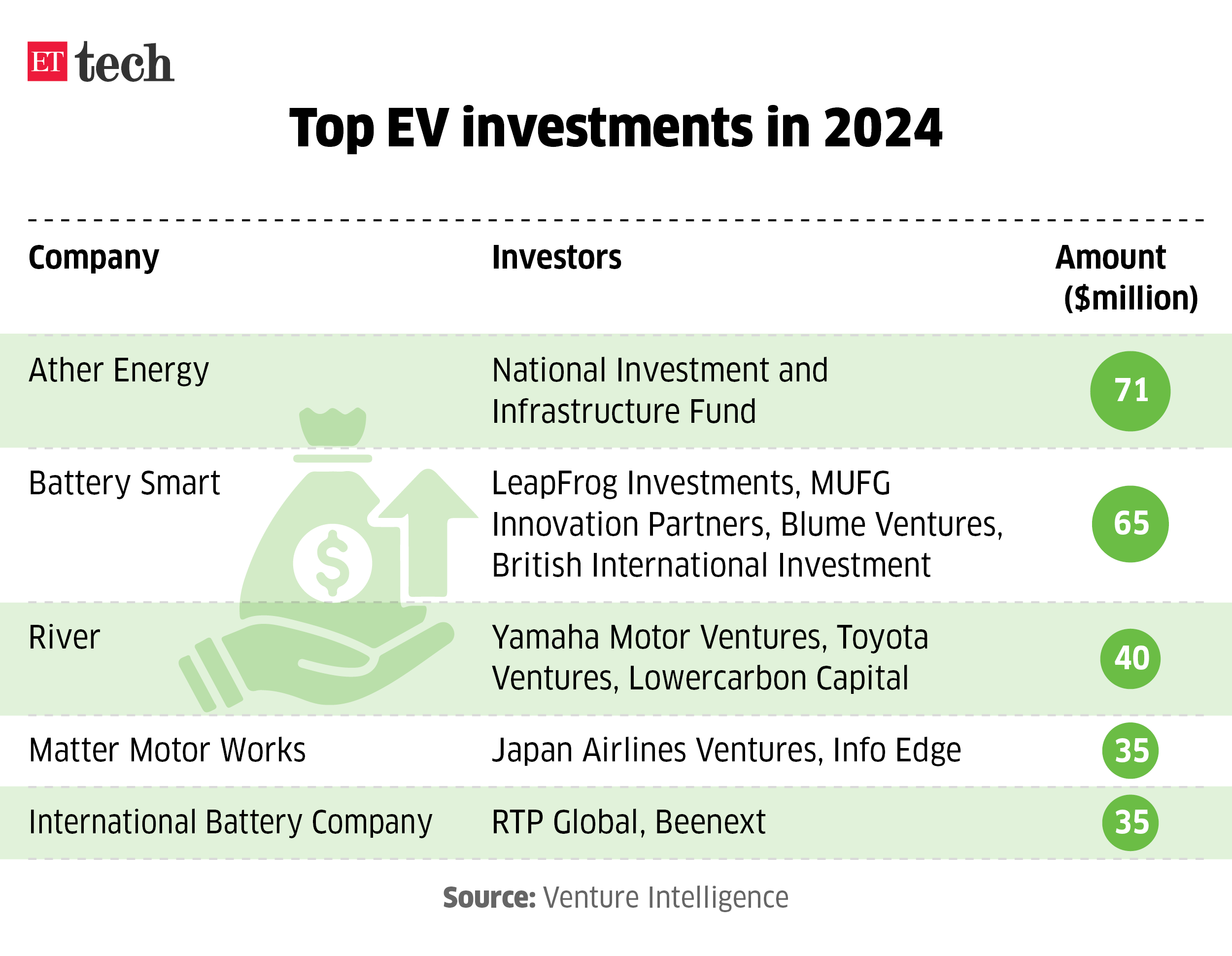

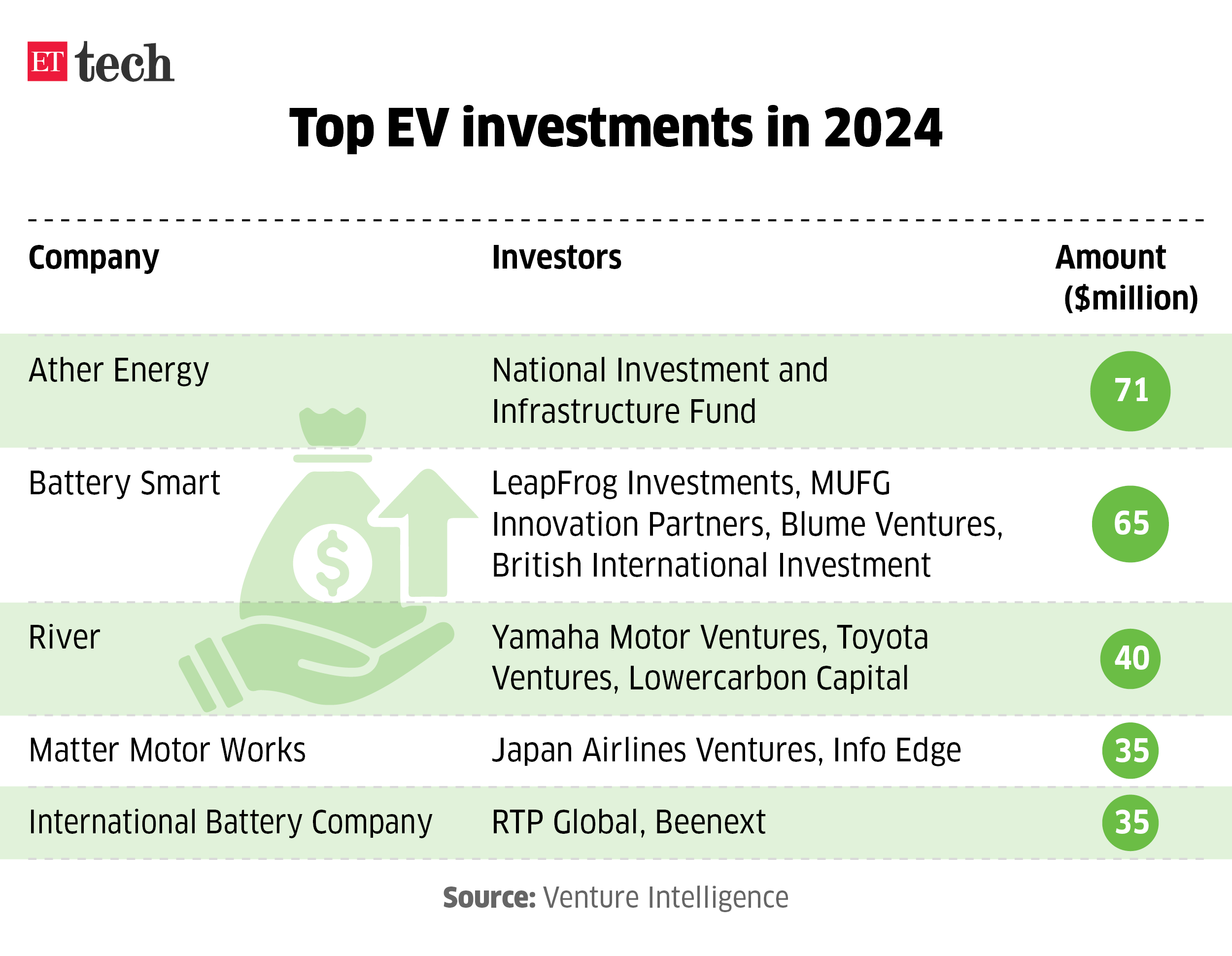

- According to data from Venture Intelligence, funding in the overall EV industry dropped to $586 million in 2024 from $808 million last year.

- The number of deals closed stood at 44, similar to a year ago.

- Most of the funding was seen in the original equipment manufacturing (OEM) space.

- Among the largest funding rounds this year was Ather Energy’s $71-million round.

Growth slowdown: Electric vehicle sales rose 24.5% this year to 1.9 million units, although growth slowed from the previous year's 50% spike, data from the government's Vahan portal reveals.

In the electric two-wheeler segment, overall sales reached 1.13 million vehicles in 2024, up from 860,000 in 2023.

Global picture: Globally, EV sales growth is slowing due to high prices, limited charging infrastructure and regulatory uncertainties, although volumes continue to rise.

Road ahead: Investors and stakeholders told us that they are bullish on the EV industry, buoyed by the government's goal of 30% EV penetration in new registrations by 2030.

Also Read: PM E-DRIVE scheme: New plan to subsidise charging stations for 2 and 3-wheelers

Cloud kitchen firms cut losses to cook up healthy numbers

India's cloud kitchen startups saw a turnaround in FY24, with most recording significant revenue growth and narrowing their losses.

Comeback:

- Rebel Foods, among the largest cloud kitchen startups, posted a 20% on-year revenue growth in FY24, cutting losses by 42%.

- Binny Bansal-backed Curefoods clocked a 53% topline growth, narrowing its loss by 53%.

- Freshmenu charted a comeback from almost shutting down in 2019 to crossing the Rs 100-crore revenue mark in FY24.

But, how? These firms reined in expenses this fiscal, including those on marketing and employees.

- Rebel Foods, which operates brands such as Faasos and Behrouz Biryani, cut its employee benefit expenses to Rs 394 crore from Rs 405 crore. It had laid off 2% of its workforce in January 2023.

- Curefoods nearly halved its marketing costs to Rs 53 crore during FY24, compared with Rs 107 crore in FY23.

Big picture: Industry executives said inflation was a concern for the sector this year. Prices of raw materials such as edible oil, wheat and vegetables were the most impacted.

Tata Sons may infuse fresh funds into ecommerce arm only by mid-2025

Tata Sons may infuse the next round of capital into its ecommerce business, Tata Digital, only in mid-2025. Until then, the new commerce entity will have to rely on internal funding and debt financing to fuel growth.

What is happening: CEO Naveen Tahilyani has asked all business heads to concentrate on growth after having enforced stricter spending, emphasised better execution, accountability and return on capital.

Zoom in: Tata Neu is using a data-driven approach to tap every consumer access point within the system, including partnerships with external entities. As a part of this strategy, new funding for BigBasket and 1mg is being obtained via debt rather than fresh equity infusion. Tata Sons has invested over $2 billion in Tata Digital till date.

Driving performance: Tahilyani is pushing performance by offering Esops to top performers and building a culture of accountability.

PayU’s chief investment officer Vijay Agicha quits

Vijay Agicha, chief investment and transformation officer of Naspers-backed PayU, has stepped down from his role, according to sources.

Driving the news: Agicha’s departure comes just months after Suresh Rajagopalan, former CEO of PayU-owned Wibmo, a provider of authentication services for online digital payments, left the company.

Sources added that Agicha may join an investment firm to focus on fintech investments.

Leadership shifts: PayU has seen a wave of leadership changes following the sale of its global operations to Israel-based fintech firm Rapyd in August 2023. Key departures include:

- Laurent Le Moal, PayU's global CEO since 2016, stepped back from day-to-day operations in October 2023.

- Akash Moondhra, global CFO, and Prashanth Ranganathan, PayU Finance CEO, both exited around the same time.

- Bob van Dijk, CEO and board member of Prosus and Naspers, announced his resignation in September 2023 after a decade-long tenure. Fabricio Bloisi succeeded him as CEO in March 2024.

Expansion plans: PayU, which is gearing up for a 2025 listing on Indian stock exchanges, has been sharpening its focus on the consumer segment through its LazyPay mobile application. While merchant payments remain central to its operations, PayU aims to leverage LazyPay to build a comprehensive consumer payment and credit business, Anirban Mukherjee, CEO of PayU said earlier.

Year in Review: India’s startup milestones by the numbers

India’s startup ecosystem has created over 1.6 million jobs, with the Department for Promotion of Industry and Internal Trade (DPIIT) recognising 1.57 lakh startups as of December 25, 2024.

Tell me more: The role of women in Indian startups has grown considerably, with 73,000 firms having at least one woman director. India has emerged as the world’s third-largest startup hub boasting over 100 unicorns with Rapido, Ather Energy, Moneyview, Perfios and Krutrim being added to the list this year.

Read all the Year in Review stories here:

- 2024 Year in Review | who’s in, who’s out: the biggest executive moves in Indian tech & startup sector

- Year in Review: These startups shut shop in 2024

- Year in Review: Startup funding freeze saw signs of thaw in 2024

- Year in Review: Zepto's growth, and big moves in quick commerce

- 2024 Year in Review: Controversies that riddled the startup ecosystem

- Year in Review: VC firms sit on a pile of cash but wary of backing startups

- Year in Review: At $5 billion, Indian startup’s exit street gets buzzier in 2024

Today’s ETtech Top 5 newsletter was curated by Vaibhavi Khanwalkar and Blessy Reji in Bengaluru.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.