We get the ISM manufacturing PMI later today and it can be a market-mover, but expectations of improvement are low and manufacturing is a small part of GDP, anyway. Besides, we have juicier things to think about.

Top of the list is the lower weekly unemployment claims yesterday to an 8-month low. This set off a new round of betting against Fed rate cuts. The Fed’s ruse of naming the labor market as a reason to cut rates has been exposed as just that, a ruse.

Because construction spending was higher than expected, we can expect the next Atlanta Fed GDPNow to show an increase. We get a new forecast today, after yesterday’s 2.6%, which was a revision from 3.1 percent on December 24. We now expect it to go back to 3% or more, compared to the Fed’s expectation of 2%.

A robust economy and a Fed on hold is a good thing unless you are trying to buy a new house. Mortgage rates have gone back to 7%.

The Fed is going to have a hard time justifying the next rate cut. The next Fed meeting is Jan 29 and the CME FedWatch tools shows a mere 11.2% now expect a rate cut at that meeting. We do not get the PCE release until a few days later (Jan 31).

As noted before, the other key central banks are all expected to cut this year. The number of cuts might be shaved as things develop, including eurozone inflation next week. In Japan, those betting on a BoJ rate hike have retreated but we are not seeing the dollar highs we had Christmas week. They are seemingly quite persistent. See the 2-hour chart.

Forecast

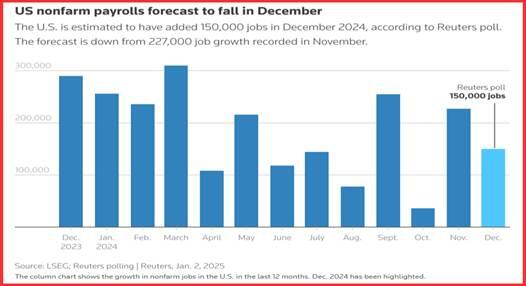

The dollar is on a roll with plenty of data backing up the idea that the economy is so strong it’s probably overheating. The Fed can’t cut rates under these circumstances. But wait, we get nonfamr payrolls next Friday and that has the potential to alter the outlook. See the chart from Reuters.

And we have various factors coming at us from left field, including whatever ridiculous things Trump will say as the Jan 20 inauguation comes closer. A rise in risk from US politial conditions does not harm the dollar, at least not in recent history and not yet. We must expect the customery pullback next week, though, so sttay alert.

Keeper Tidbit: The St. Louis Fed has the schedule for 2025 release dates of the PCE data.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD holds gains near 0.6250 but upside appears limited

AUD/USD remains on the front-foot near 0.6250 following the previous day's good two-way price swings amid confusion over Trump's tariff plans. The Aussie, meanwhile, remain close to over a two-year low touched last week in the wake of the RBA's dovish shift, China's economic woes and US-China trade war fears.

USD/JPY: Bulls retain control above 158.00, Japanese intervention risks loom

USD/JPY is off multi-month top but stays firm above 158.00 in the Asian session on Tuesday. Doubts over the timing when the BoJ will hike rates again and a broad-based US Dollar rebound, following Monday's Trump tariffs speculation-led sell-off, keep the pair supported ahead of US jobs data.

Gold traders appear non-committal ahead of US jobs data

Gold price is battling the short-term critical barrier at around $2,635 early Tuesday, consolidating the two-day corrective decline from three-week highs of $2,665. Gold traders refrain from placing fresh directional bets ahead of the top-tier US ISM Services PMI and JOLTS Job Openings data.

Ripple's XRP eyes rally to new all-time high after 40% spike in open interest

Ripple's XRP trades near $2.40, up 1% on Monday following a 40% surge in its futures open interest. The surge could help the remittance-based token overcome the key resistance of a bullish pennant pattern.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.