Powerful tools for fraud professionals

Radar for Fraud Teams helps you fine-tune how Radar operates, get fraud insights on suspicious charges, and assess your fraud management performance from a unified dashboard.

Radar for Fraud Teams

Customise Radar’s protection for your business

From writing rules to reviewing payments, everything can happen in the Dashboard – and there’s no code or lengthy setup required to get started. You can also easily integrate with existing workflows using webhooks and real-time notifications.

Choose your risk tolerance

Align your fraud strategy to your business model. You can choose how aggressively you want to block suspicious payments depending on your business’s appetite for risk.

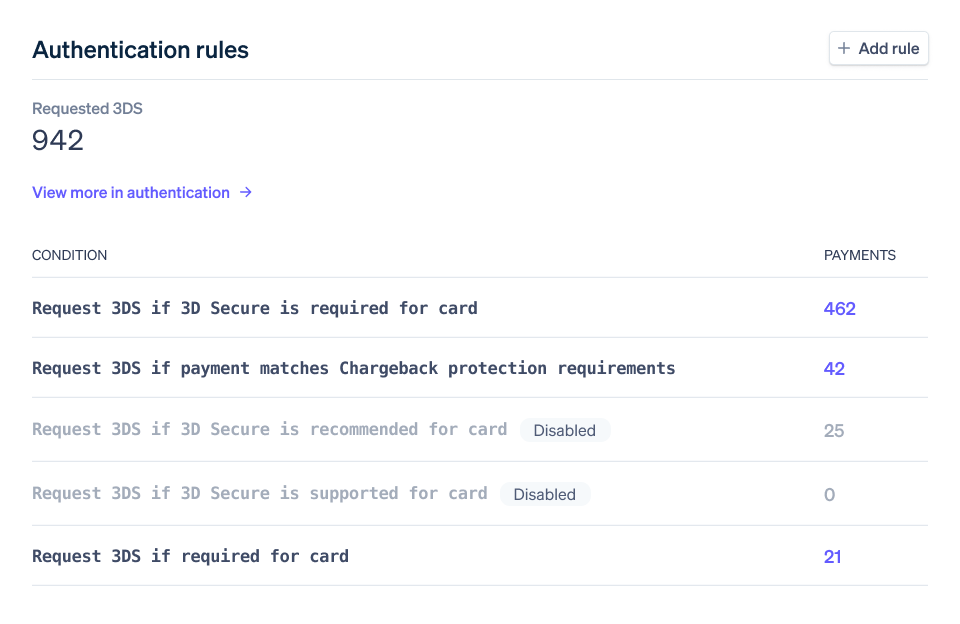

Make 3D Secure work for you

Use Dynamic 3D Secure to apply additional authentication based on your customer risk profile or SCA requirements.

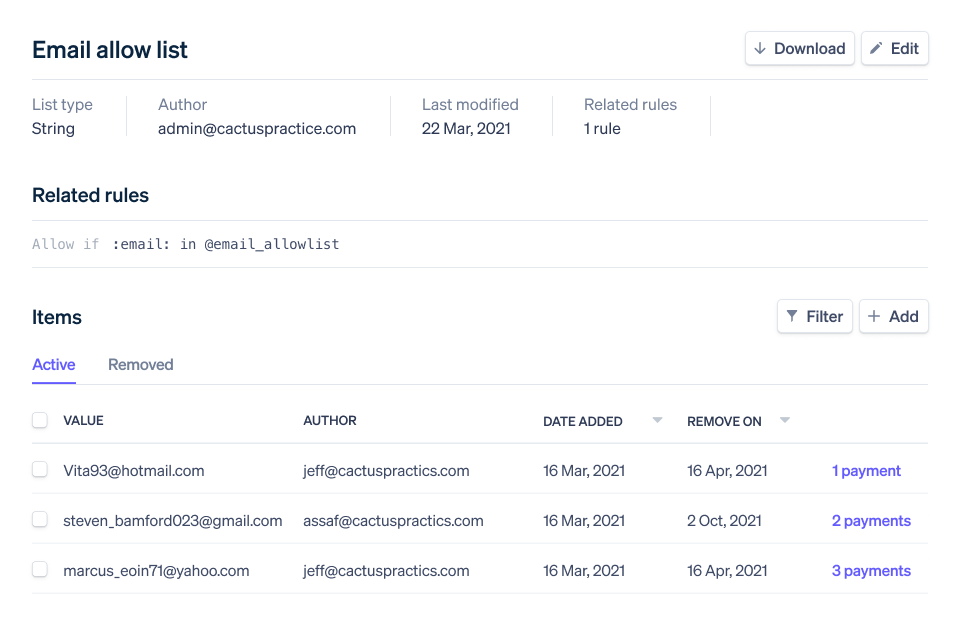

Prevent repeat mistakes

Set up block and allow lists using attributes including card numbers, emails and IP addresses.

Fine-tune protection with rules

Write custom rules to target specific fraud vectors, test rules to understand how they’ll perform before turning them on, and monitor performance so you can iterate on them.

Target fraud with custom rules

Build targeted fraud protection with rules using hundreds of rule attributes, including IP address, card details, behavioural signals, and metadata.

Write rules using natural language

Use the AI-powered Radar Assistant to easily translate natural language prompts into rules.

Backtest rules to anticipate their impact

Test how a new rule impacts your fraud strategy before you implement it using your historical data.

Quantify your rules performance

Measure the impact of your custom rules through a historical view and metrics on individual rule performance with near real-time data.

Take action

Save time on manual reviews

Improve your ability to detect fraud patterns and quickly take action. Stripe’s optimised workflows slash the time it takes to review payments.

Bust hidden networks of fraudulent actors

Prevent common fraud patterns, like card testing, by evaluating payments holistically rather than in isolation. We use device fingerprinting and identity resolution to help you catch repeat fraudulent actors.

Catch sophisticated fraudulent actors with advanced fraud insights

Fraudulent purchases often look atypical in comparison to legitimate ones. Our fraud insights make it easy to identify the root cause of fraud trends and identify common attributes linked to fraud. Risk scores provide transaction-level details to help you perform manual reviews. For example, you can compare the geolocated IP address and the credit card address, or look at how behavioural information, such as time to checkout, compares with legitimate buyers.

Stay ahead of the latest fraud trends

Learn about the global fraud trends we uncovered after analysing billions of attempted payments and surveying more than 2,500 business leaders.

Product resources

The state of online fraud

Radar cut our fraud rates by over 70% without any configuration, saving our pizzerias thousands of dollars every month and allowing us to focus on delivering the best local pizza experience possible.

We were on the cusp of losing the ability to process payments due to the number of fraudulent transactions – that’s when we started using Stripe Radar. With Radar, we were able to programmatically fight fraud and institute fine-grained ways to fight back against card testers.

Our team protects the Postmates platform from fraud while still providing a great customer experience. Radar hums in the background on every transaction and Radar’s models have been very helpful for separating good transactions from bad.

Radar automatically helped Watsi prevent more than $40M in fraudulent donations over just a two-month span.

Radar for Fraud Teams is built into Stripe.

Get access to advanced fraud protection designed for professionals who need greater control and customisable settings right from your dashboard.

3D Secure 2

Additional authentication can help separate customers from fraudsters. Read our guide on how the new version of 3D Secure can reduce fraud without compromising on user experience.

Always know what you pay

Integrated per-transaction pricing with no hidden fees.