Trending

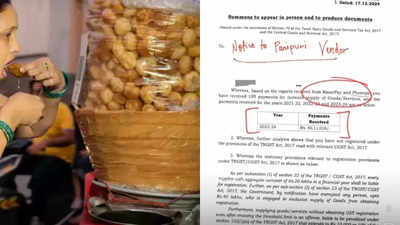

Pani puri vendor receives GST notice for Rs 40 lakh transactions; internet mocks with "career change" suggestions

Pani Puri vendors in India are receiving GST notices as their digital transactions exceed Rs 40 lakh. The humor-infused reaction on social media highlights the impact of digital payments on small businesses, pushing them into the formal economy. This development underscores the significant shift towards greater tax compliance among traditionally informal street vendors.

Social media has been swept away by this newest and funniest news: GST notices for Indian Pani Puri vendors. Their annual digital transactions on platforms like RazorPay and PhonePe have crossed Rs 40 lakh, and so here they come – the notices. While the news is something significant, the creativity and wit used in the humorous social media posts are the interesting part of it. People joke about imagining those street vendors to be future corporate giants, where some are proposing "export opportunities" and "foreign collaborations." This light response shows the rapid impact of digital payments on small businesses and the sudden integration of these businesses into the formal economy.

Pani Puri, also known as Gol Gappa or Phuchka is cherished for its burst of flavours and sensory delight. Be it any part of India, Pani Puri or Gol Gappa is one of the most preferred snack. This snack is made of crispy and hollow puris which are prepared with wheat flour or semolina and are enjoyed with a filling of spicy potatoes and matra, and tangy tamarind water and spicy chutneys. This puri explodes in mouth a variety of flavours that provide an instant satisfaction. People love this snack as it offers a perfect balance of sweet, sour, spicy, and crunchy taste. The experience of eating them, popping an entire puri in your mouth before it spills, is as fun as it is delicious. It’s also a social food, often enjoyed with friends and family at street-side stalls, adding to its charm.

Often, people add boiled potatoes along with boiled matra/chickpeas or black chana. This mixture is then mixed with a variety of spices like chaat powder, a bit of garam masala, red chilli powder and salt. While the news has brought a wave of good-natured jokes on social media, where many have been joking that these vendors are now becoming corporate behemoths, it also depicts a bigger trend where small business firms start entering into the formal economy. The increasing usage of digital payments is seamlessly getting these vendors into India's tax system and thus initiating much more discussion on the informal sector in India.

Poll

What role do Digital Payments play in the Growth of Street Vendors?

Pani puri vendors face GST notices as digital payments push them into the formal economy

In a twist of events, Pani Puri vendors all over India are now at the center of a new controversy that involves Goods and Services Tax notices. These street food vendors who traditionally operated in the informal sector are now getting official tax notices after their business transactions, which were once done in cash, started getting processed digitally. With the increasing popularity of digital payment platforms like PhonePe, RazorPay, and UPI, many small vendors have unknowingly crossed the Rs 40 lakh revenue threshold that triggers the requirement for GST registration.

This development has sparked widespread discussion on social media, with many reacting humorously to the idea of a Pani Puri seller turning into a corporate giant. But beneath the comedy lies a massive shift in the Indian economy: the slow incorporation of small-scale businesses into the formal, tax-paying sector. As the digital economy expands, these vendors, once flying below the radar of tax authorities, are being slowly brought into the fold, with questions regarding the future of small-scale businesses in a rapidly digitizing world.

GST notice to Pani puri vendor goes viral on social media

The spread of memes, jokes about "export units," and "foreign collaborations," and even witty remarks about Pani Puri becoming a global export demonstrates how vital social media is to make even a mundane issue like tax compliance a comedy show. While one would find practical advice on GST registration, others joked about using multiple QR codes to circumvent the system or even to change careers to leave the tax burden.

This joke about these reactions points to a deeper issue: as digital payments expand, small businesses are being drawn into the formal tax system, and it raises questions about the future of the informal sector in India's growing digital economy.

GST registration for street vendors: What you should know?

In India, a street vendor, as a rule, is exempted from GST or income tax unless the street vendor's turnover exceeds a threshold amount. The GST threshold will be Rs 40 lakh; it means if vendors like who sell Pani Puri on a small-scale are doing business by collecting less amount of money at times, may get exempt from GST. Using the digital medium, such systems like UPI are gaining increasing usage, because every small-transaction adds upon rapidly and it pushes the businesses towards taxable entities.

Similarly, when the income exceeds Rs 2.5 lakh annually in order to be taxed when a person is under 60 years of age. Most street vendors, especially operating cash or having minimal digital transactions, tend to be below this figure and do not require tax pay.

Vendors making more than Rs 40 lakh or whose annual incomes exceed the threshold for taxation pay GST and income tax as is applicable. Such a change has become all the more relevant, especially in recent times with greater digital payments gaining traction and improved access of authorities to monitor the flow.

How digital payments are pushing street vendors into the GST system?

Many street vendors still rely on cash transactions, which are harder to trace and typically exempt from tax filings. Cash payments help small businesses stay off the radar of tax authorities, meaning that vendors can often operate without being required to pay GST or income tax.

However, as more consumers opt for transactions on digital platforms of PhonePe or RazorPay, the informal, cash-based economy is shrinking in size, and the authorities now can track even the smallest purchases. This in turn has further led to greater tax notices served to street sellers who may or may not realize they have already crossed the level for GST registration.

Also Read | Would you pay Rs 13,000 for an avocado toast? This Surat vendor's avocado toast brings luxury to the streets

End of Article

FOLLOW US ON SOCIAL MEDIA

Visual Stories

Tired of too many ads?go ad free now