New Year's Greetings(年始のご挨拶) [税金]

Happy New Year. I would like to congratulate you on the healthy new year.

Thank you very much for your kindness during last year and for your continued support this year. I wish you good health and development.

----------------------------------------------------------------------------------------------------

新年あけましておめでとうございます。 皆様には、健やかに新春を迎えられたことと、お慶び申し上げます。 旧年中はひとかたならぬご厚情をいただきありがとうございます。 本年も変わらぬお引き立ての程よろしくお願い申し上げます。 皆様のご健勝とご発展をお祈り申し上げます。

----------------------------------------------------------------------------------------------------

新年あけましておめでとうございます。 皆様には、健やかに新春を迎えられたことと、お慶び申し上げます。 旧年中はひとかたならぬご厚情をいただきありがとうございます。 本年も変わらぬお引き立ての程よろしくお願い申し上げます。 皆様のご健勝とご発展をお祈り申し上げます。

Don’t let scammers ruin holiday gift card giving [税金]

Taxpayers should watch out for gift card scams especially during the holiday season.

The IRS never asks for or accepts gift cards as payment for a tax bill.

Common holiday scams

Scammers may try to trick taxpayers into falling for the gift card scam. With this scam, criminals may impersonate government or collections officials and send official-looking requests for gift cards to resolve an outstanding debt or issue. The scammer may ask the victim to purchase the gift cards from different stores to avoid the suspicion of store employees. Once the taxpayer buys the gift cards, the scammer will ask the taxpayer to provide the gift card number and PIN.

Scammers could also:

•Send emails that appear to be from a legitimate company but are not.

•Pose as an IRS agent and call the taxpayer stating that the taxpayer is linked to criminal activity.

•Threaten or harass the taxpayer by telling them that they must pay a fake tax penalty.

How to tell if it's really the IRS

The IRS will never:

•Call to demand immediate payment using a specific payment method such as a gift card, prepaid debit card or wire transfer. Generally, the IRS will first mail a bill to any taxpayer who owes taxes.

•Demand that taxpayers pay taxes without the opportunity to question or appeal the amount they owe. All taxpayers should be aware of their rights.

•Threaten to bring in local police, immigration officers or other law enforcement to have the taxpayer arrested for not paying.

•Threaten to revoke the taxpayer's driver's license, business licenses or immigration status.

What to do if targeted by a scam

Anyone who has been a target of a scam should contact the Treasury Inspector General for Tax Administration to report a phone scam. Use the IRS Impersonation Scam Reporting webpage or call 800-366-4484. Taxpayers targeted by scams can also report to the Federal Trade Commission or visit their state attorney general.

(Source of quote)

IRS Tax Tip 2024-91, Dec. 3, 2024

The IRS never asks for or accepts gift cards as payment for a tax bill.

Common holiday scams

Scammers may try to trick taxpayers into falling for the gift card scam. With this scam, criminals may impersonate government or collections officials and send official-looking requests for gift cards to resolve an outstanding debt or issue. The scammer may ask the victim to purchase the gift cards from different stores to avoid the suspicion of store employees. Once the taxpayer buys the gift cards, the scammer will ask the taxpayer to provide the gift card number and PIN.

Scammers could also:

•Send emails that appear to be from a legitimate company but are not.

•Pose as an IRS agent and call the taxpayer stating that the taxpayer is linked to criminal activity.

•Threaten or harass the taxpayer by telling them that they must pay a fake tax penalty.

How to tell if it's really the IRS

The IRS will never:

•Call to demand immediate payment using a specific payment method such as a gift card, prepaid debit card or wire transfer. Generally, the IRS will first mail a bill to any taxpayer who owes taxes.

•Demand that taxpayers pay taxes without the opportunity to question or appeal the amount they owe. All taxpayers should be aware of their rights.

•Threaten to bring in local police, immigration officers or other law enforcement to have the taxpayer arrested for not paying.

•Threaten to revoke the taxpayer's driver's license, business licenses or immigration status.

What to do if targeted by a scam

Anyone who has been a target of a scam should contact the Treasury Inspector General for Tax Administration to report a phone scam. Use the IRS Impersonation Scam Reporting webpage or call 800-366-4484. Taxpayers targeted by scams can also report to the Federal Trade Commission or visit their state attorney general.

(Source of quote)

IRS Tax Tip 2024-91, Dec. 3, 2024

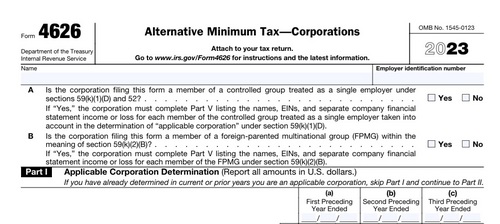

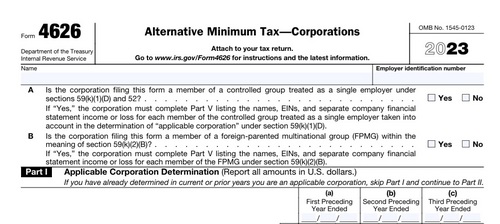

Corporate alternative minimum tax [税金]

The Inflation Reduction Act of 2022 created the corporate alternative minimum tax (CAMT), which imposes a 15% minimum tax on the adjusted financial statement income (AFSI) of large corporations for taxable years beginning after Dec. 31, 2022.

CAMT generally applies to large corporations with average annual financial statement income exceeding $1 billion.

The Department of the Treasury and the Internal Revenue Service today granted a filing exception for tax-exempt organizations; they do not have to file Form 4626, Alternative Minimum Tax – Corporations, for tax year 2023.

CAMT generally applies to large corporations with average annual financial statement income exceeding $1 billion.

The Department of the Treasury and the Internal Revenue Service today granted a filing exception for tax-exempt organizations; they do not have to file Form 4626, Alternative Minimum Tax – Corporations, for tax year 2023.

Extension filers: Gather all tax info before filing [税金]

The deadline for taxpayers with an extension to file is around the corner – on Tuesday, Oct. 15. It's important for taxpayers to gather all their records and get copies of any missing documents before they sit down to prepare their return, whether they are filing on their own or working with a professional tax preparer. This helps them file a complete and accurate tax return.

What documents to gather

Here's the information taxpayers may need. Not all information applies to all taxpayers.

•Social Security numbers of everyone listed on the tax return.

•Bank account and routing numbers for direct deposit or information to make a tax payment.

•Forms W-2 from employer(s).

•Forms 1099 from banks, issuing agencies and other payers covering such payments as unemployment compensation, dividends and distributions from a pension, annuity or retirement plan.

•Form 1099-K or 1099-MISC or other income statement for workers in the gig economy.

•Form 1099-INT for interest received.

•Other income documents and records of virtual currency transactions.

•Form 1095-A, Health Insurance Marketplace Statement.

•Information to support claiming other credits or deductions such as receipts for child or dependent care, college expenses or donations.

(Source of quote)

Tax Tip 2024-79

What documents to gather

Here's the information taxpayers may need. Not all information applies to all taxpayers.

•Social Security numbers of everyone listed on the tax return.

•Bank account and routing numbers for direct deposit or information to make a tax payment.

•Forms W-2 from employer(s).

•Forms 1099 from banks, issuing agencies and other payers covering such payments as unemployment compensation, dividends and distributions from a pension, annuity or retirement plan.

•Form 1099-K or 1099-MISC or other income statement for workers in the gig economy.

•Form 1099-INT for interest received.

•Other income documents and records of virtual currency transactions.

•Form 1095-A, Health Insurance Marketplace Statement.

•Information to support claiming other credits or deductions such as receipts for child or dependent care, college expenses or donations.

(Source of quote)

Tax Tip 2024-79

A guide to withholding, estimated taxes and ways to avoid the estimated tax penalty [税金]

The IRS has seen an increasing number of taxpayers subject to estimated tax penalties, which apply when someone underpays their taxes. The penalty amount varies but can be several hundred dollars.

The IRS urges taxpayers to check into their options to avoid these penalties. Adjusting withholding on their paychecks or the amount of their estimated tax payments can help prevent penalties. This is especially important for people in the gig economy, those with more than one job and those with major changes in their life, like a recent marriage or a new child.

There are some simple tips to help taxpayers.

The IRS urges taxpayers to check into their options to avoid these penalties. Adjusting withholding on their paychecks or the amount of their estimated tax payments can help prevent penalties. This is especially important for people in the gig economy, those with more than one job and those with major changes in their life, like a recent marriage or a new child.

There are some simple tips to help taxpayers.

Things for extension filers to keep in mind as they prepare to file [税金]

Many people requested an extension to file their tax return after the usual deadline. These filers have until Oct. 15, 2024, to complete and file their tax return. The IRS suggests that those who already have the forms and information they need file now – there's no advantage to waiting until the deadline and filing now saves the worry that they may miss the deadline.

There are a few things extension filers should know as they get ready to file.

There are a few things extension filers should know as they get ready to file.

What taxpayers should do if they receive mail from the IRS [税金]

IRS sends notices and letters when it needs to ask a question about a taxpayer’s federal tax return, let them know about a change to their account or request a payment. Don’t panic if something comes in the mail from the IRS – they’re here to help.

When a taxpayer receives mail from the IRS, they should:

When a taxpayer receives mail from the IRS, they should:

U.S. taxpayers living and working abroad face June 17 deadline to file their 2023 tax returns [税金]

The Internal Revenue Service reminds taxpayers living and working outside the United States to file their 2023 federal income tax return by Monday, June 17.

This deadline applies to both U.S. citizens and resident aliens abroad, including those with dual citizenship.

Qualifying for the June 17 extension

U.S. citizens or resident aliens residing overseas or on duty in the military outside the U.S. are allowed an automatic two-month extension to file their tax return and pay any amount due. A taxpayer qualifies for the June 17 extension to file and pay if:

•They are living outside of the United States and Puerto Rico and their main place of business or post of duty is outside the United States and Puerto Rico, or

•They are serving in the military outside the U.S. and Puerto Rico on the regular due date of their tax return.

To use the automatic two-month extension, taxpayers must attach a statement to their tax return explaining which of the two situations listed earlier applies.

This deadline applies to both U.S. citizens and resident aliens abroad, including those with dual citizenship.

Qualifying for the June 17 extension

U.S. citizens or resident aliens residing overseas or on duty in the military outside the U.S. are allowed an automatic two-month extension to file their tax return and pay any amount due. A taxpayer qualifies for the June 17 extension to file and pay if:

•They are living outside of the United States and Puerto Rico and their main place of business or post of duty is outside the United States and Puerto Rico, or

•They are serving in the military outside the U.S. and Puerto Rico on the regular due date of their tax return.

To use the automatic two-month extension, taxpayers must attach a statement to their tax return explaining which of the two situations listed earlier applies.

IRS reminder to U.S. taxpayers living, working abroad: File 2023 tax return by June 17 [税金]

The Internal Revenue Service reminds taxpayers living and working outside the U.S. to file their 2023 federal income tax return by Monday, June 17, 2024. This deadline applies to both U.S. citizens and resident aliens abroad, including those with dual citizenship.

Taxpayers unable to file their tax returns by the June deadline can request a further extension to file, but not pay, until Oct. 15.

Qualifying for the June 17 extension

If a taxpayer is a U.S. citizen or resident alien residing overseas or is in the military on duty outside the U.S., on the regular due date of their return, they are allowed an automatic 2-month extension to file their return without requesting an extension. If they use a calendar year, the regular due date of their return is April 15, and the automatic extended due date would be June 15. Because June 15 falls on a Saturday this year, the due date is delayed until the next business day, June 17.

Qualifying for the June 17 extension

If a taxpayer is a U.S. citizen or resident alien residing overseas or is in the military on duty outside the U.S., on the regular due date of their return, they are allowed an automatic 2-month extension to file their return without requesting an extension. If they use a calendar year, the regular due date of their return is April 15, and the automatic extended due date would be June 15. Because June 15 falls on a Saturday this year, the due date is delayed until the next business day, June 17.

Get ahead of the tax deadline; act now to file, pay or request an extension [税金]

With the April 15 tax deadline approaching, the IRS reminds taxpayers there is still time file their federal income tax return and request direct deposit.

Taxpayers that owe on their tax return

IRS reminds people they can avoid paying interest and some penalties by filing their tax return and, if they have a balance due, paying the total amount due by the tax deadline of Monday, April 15. For residents of Maine or Massachusetts, the tax deadline is Wednesday, April 17, due to Patriot’s Day and Emancipation Day holidays.

Unable to file by the April 15 deadline?

Individuals unable to file their tax return by the tax deadline can apply for a tax-filing extension in the following ways:

•Individual tax filers, regardless of income, can request an automatic tax-filing a Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

•Make an electronic payment using Direct Pay, debit card, credit card or digital wallet and indicate the payment is for an extension.

•Mail Form 4868 by the tax deadline.

Things people should know when requesting a tax-filing extension:

•Tax-filing extension requests are due by the tax deadline date, and it does not give an extension of time to pay the taxes.

•Avoid some penalties by estimating and paying the tax due by the tax deadline.

(Source of quote)

IR-2024-88, April 2, 2024

Taxpayers that owe on their tax return

IRS reminds people they can avoid paying interest and some penalties by filing their tax return and, if they have a balance due, paying the total amount due by the tax deadline of Monday, April 15. For residents of Maine or Massachusetts, the tax deadline is Wednesday, April 17, due to Patriot’s Day and Emancipation Day holidays.

Unable to file by the April 15 deadline?

Individuals unable to file their tax return by the tax deadline can apply for a tax-filing extension in the following ways:

•Individual tax filers, regardless of income, can request an automatic tax-filing a Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

•Make an electronic payment using Direct Pay, debit card, credit card or digital wallet and indicate the payment is for an extension.

•Mail Form 4868 by the tax deadline.

Things people should know when requesting a tax-filing extension:

•Tax-filing extension requests are due by the tax deadline date, and it does not give an extension of time to pay the taxes.

•Avoid some penalties by estimating and paying the tax due by the tax deadline.

(Source of quote)

IR-2024-88, April 2, 2024