Will PSX sustain its bullish momentum in 2025?

Ammar, Akbar, and Anthony each had Rs1 million and chose to invest in the Pakistan Stock Exchange on January 1, 2024. Ammar, enjoying a Magnum, opted for Unilever Pakistan Foods. Feverish Akbar, popping antibiotics, went for GlaxoSmithKline. Anthony, acting on a whim, closed his eyes and randomly picked Al Shaheer Corporation.

By the last Friday of 2024, their fortunes had diverged. Ammar shrugged off a Rs64,000 loss, while Anthony wept over a staggering Rs436,000 hit. Meanwhile, Akbar, celebrating a resounding Rs3.5 million profit, treated his friends to a lavish dinner.

Their contrasting outcomes reflect the broader trends that shaped the PSX in 2024 — a year of booming rallies, sectoral highs, and optimism that had gainers and losers. The stock rallies have been the talk of investor circles in 2024, but the question remains whether the bullish trend is sustainable.

Trading at a discount

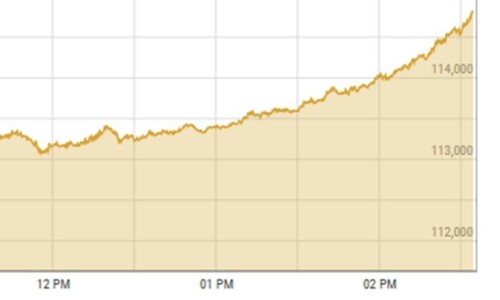

The KSE-100, trading at 64,662 on January 1, 2024, rose to 115.259 by December 30. The historic performance earned PSX recognition as the world’s best-performing stock market in 2024, according to Bloomberg.

However, despite being in a cycle of making historic records, breaking them and setting new ones, the market is still below its last peak in 2017.

“The stock market is still trading at a 50 per cent discount in dollar terms compared to previous peaks when it was at $100 billion in 2017. We expect a sharp rally in 2025, assuming there is no political upheaval,” said Ali Nawaz, CEO of Chase Securities.

The decline since 2017, as highlighted in a LinkedIn post by Sohail Mohammed, CEO of Topline Securities, can be attributed to factors such as the rupee’s devaluation, large dividend payouts, and fewer new listings.

Market corrections

Small investors and brokerage houses alike seem to expect the rallies to continue, the reasoning being that the decline in interest rates will push money out of T-bills and Pakistan Investment Bonds and into the stock market.

Another reason is that the PSX has a price-to-earnings (PE) ratio of around 6, less than 8.3x, the mean for the last decade. Mathematically, a PE ratio is the price per share divided by earnings per share. A high PE ratio indicates that investors expect the company to make more profits in the future.

No one is under the illusion that Pakistan’s economy has fundamentally improved. Some cautious investors have stayed out of the market, fearing it to be a bubble. However, Mr Nawaz points towards the corporate earnings that have risen sharply in the last four to five years, but although the earnings per share have improved, they were not reflected in the prices.

This was owing to a range of local and global issues, starting from the pandemic in 2019, followed by the Russia-Ukraine war and the resultant commodity price shocks that led to a near-default situation, as well as the 2022 floods.

As the economy stabilises, companies’ share prices better reflect their corporate earnings, hence the slew of rallies in the PSX, explains Mr Nawaz.

Sentiments on the ground

Background conversations with the average Ammar Akbar Anthony investing in the PSX, revealed a range of sentiments. Satisfaction for being able to recoup past losses, regret for getting in too late or leaving the rally too early, optimism that the ride will continue into 2025, and fear that this was all a bubble waiting to collapse.

The last concern stems from the general understanding at the educated grassroots level that Pakistan has stabilised but not reformed structurally.

However, the restrictions on purchases of the dollar and its relative stability have made it a less lucrative investment.

An increase in tax compliance and the Federal Bureau of Revenue’s valuation of property rates has stemmed the flow of money into real estate. Discontinuation of high denomination unregistered prize bonds has removed another investment avenue.

That leaves gold and crypto, both of which had a good run in 2024. However, aside from the instruments of the Pakistan Mercantile Exchange, gold investments are generally by households and not institutions. People prefer to buy physical gold. Having gold biscuits, reminiscent of Bollywood’s 90s villain, is hardly a practical form of keeping assets at home. While Pakistan has a high adoption rate of cryptocurrencies, its trading is a legal issue.

Hence, money flowed into the stock market, driving the bulls. As big money, in the form of institutional buying, drove the index up, the retail investors followed.

Macro shifts and sectoral winners

Given the overall market performance, there were more winners than losers. According to a note by Topline Securities, pharmaceuticals, jute, and transport were the best-performing sectors in 2024 as their market cap increased by 198pc, 182pc, and 130pc, respectively. Pharmaceuticals posted a strong performance due to the improved financial results after a decline in raw material prices, stable currency, lower inflation and deregulation of non-essential drugs.

Some energy-linked companies have done well because of the dynamics of oil prices and dollar depreciation. During the pandemic in 2020, as transport ground to a halt, crude oil sunk to as low as negative $40 — negative because the cost of storage and inventory maintenance outstripped demand, forcing sellers to pay buyers to offload oil.

However, the Russia-Ukraine conflict triggered an energy shock, reversing this trend and propelling crude prices past $100 per barrel in 2022. Currently, oil trades between $70 and $80.

The sustained strength of the dollar over recent years has bolstered the revenues of PSX heavyweights like OGDCL and PPL, whose income streams are dollar-denominated. As the dollar appreciates, so too do their earnings.

Furthermore, such companies have historically struggled with circular debt, as the government sold electricity below cost, causing delays in cash flow. The IMF has insisted that costs be passed on to consumers — hence the sky-high tariffs and resultant inflation but increased liquidity and stabilised revenue streams.

Monetary policy — the interest rate set by the central bank — is a favoured tool to control inflation and is one used by central banks globally. To curtail record-high inflation, the State Bank of Pakistan resorted to a record high monetary policy rate of 22pc.

The commercial banks lending to the government were the biggest beneficiaries. Banks invested in truckloads of T-bills and PIBs, and their profits increased 2x-3c over the last few years, but their share prices did not rise proportionately owing to the political turmoil, explains Mr Nawaz. As the market re-rates itself, the financial sector’s share prices rose, driving up the index.

Peer comparison

John Koch, senior investment analyst at US-based iSectors, considers the PSX market undervalued, even after the strong performance in 2024. Comparing PSX’s price-to-earnings ratio and price-to-book ratio to other emerging market indices, Mr Koch says the ratios look favourable for Pakistan compared to peers.

Why, then, can Pakistan not attract investment into the stock exchange from abroad?

Mr Koch answers, saying that geopolitical tensions are important concerns. “One development which could significantly boost Pakistan’s economic outlook is the discovery of substantial oil reserves in territorial waters. If these reserves prove to be good and the proper infrastructure is developed, which has long been an issue for Pakistan, then the country could become largely energy independent. For now, one must remain sceptical of Pakistan’s ability to refine any oil that it discovers,” he says.

“If political, military, and economic stability can improve, foreign investment would likely increase. Broad instability makes Pakistan a risky investment. It is a difficult cycle for any country to escape,” he adds.

“Currency stability is extremely crucial,” adds Sean Pinch, Associate Investment Analyst at iSectors. A large portion of the returns earned from investing in foreign markets, especially those in developing countries, can be attributed to the movement of the foreign currency against the domestic currency of the country in which the investor resides. The PSX has been much more volatile compared to the MSCI Frontier Markets Index, and a more stable currency would go a long way in helping to reduce that volatility, he explains.

What will 2025 hold?

A time-travelling DeLorean from ‘Back to the Future’ would be one surefire way to know how the PSX will act in the new year.

Broadly, the consensus is that the bull run will continue. However, political stability has often been a mirage in Pakistan, leading to economic instability. If all things remain the same, there will be more Akbars than Anthonys in the PSX roulette.

Header image: This image was generated using AI from Meta.

Dear visitor, the comments section is undergoing an overhaul and will return soon.