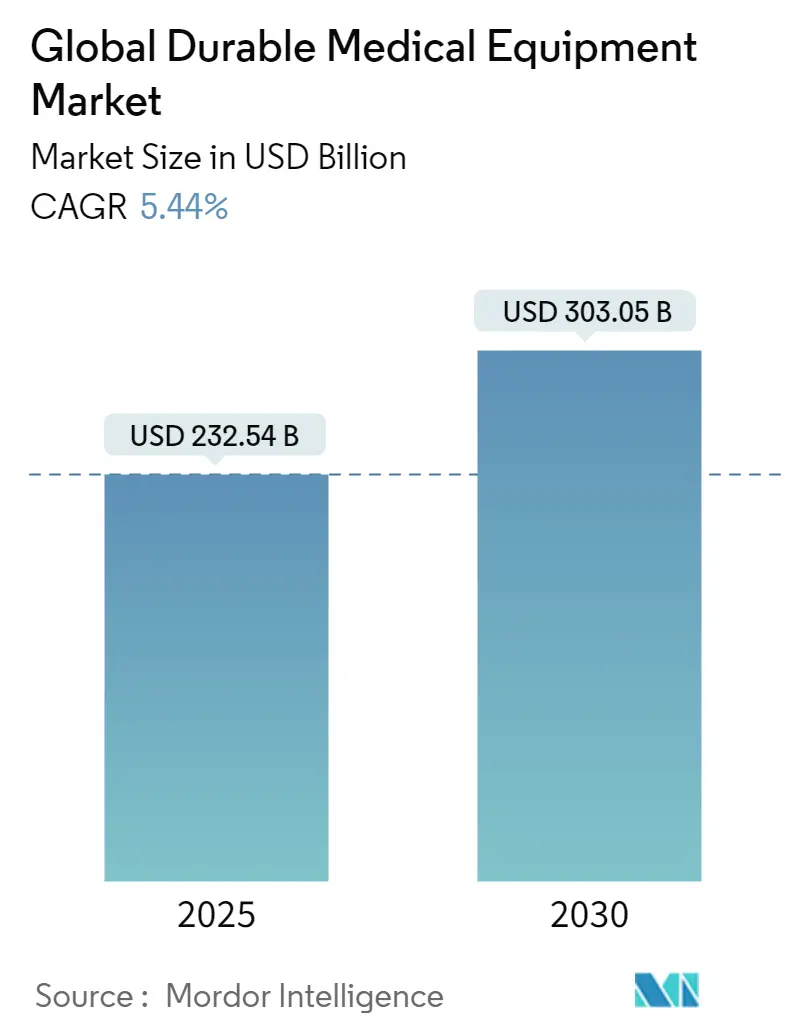

| Study Period | 2019 - 2030 |

| Market Size (2025) | USD 232.54 Billion |

| Market Size (2030) | USD 303.05 Billion |

| CAGR (2025 - 2030) | 5.44 % |

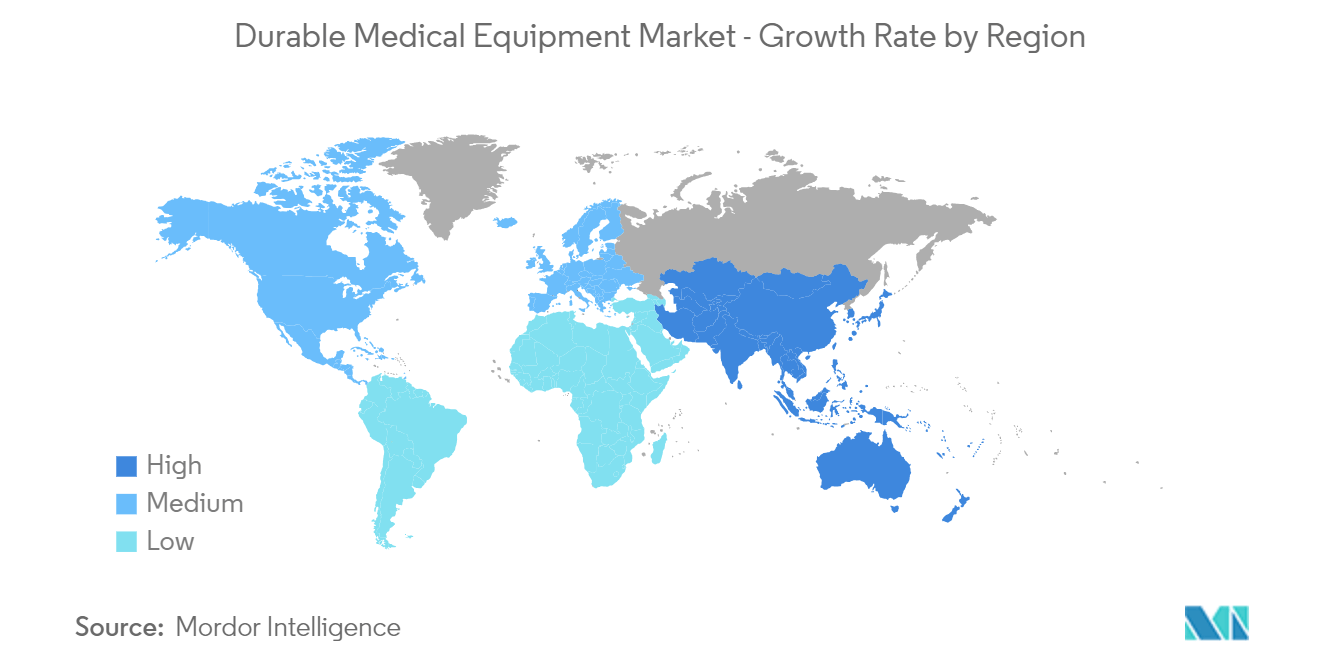

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

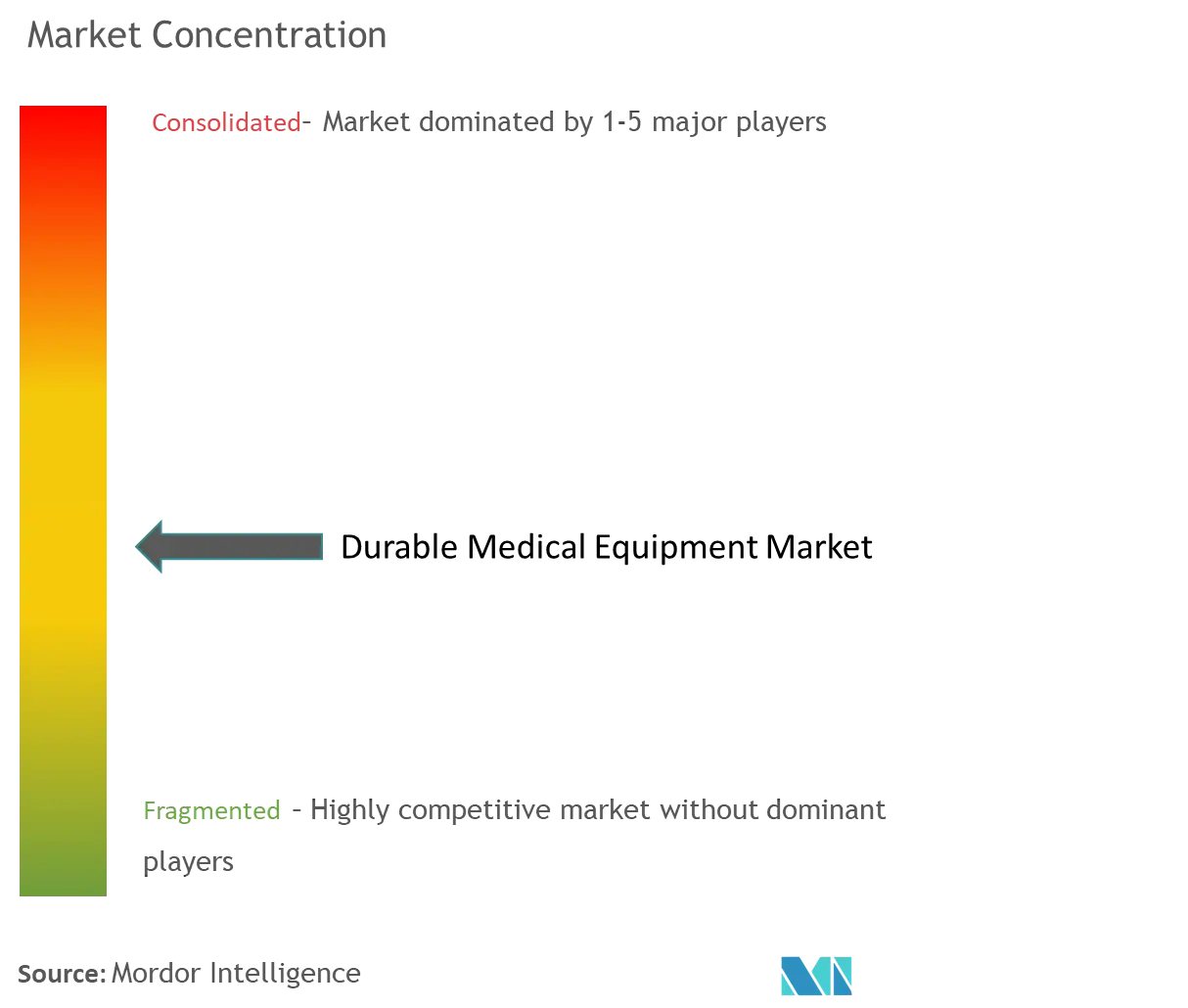

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Durable Medical Equipment Market Analysis

The Global Durable Medical Equipment Market size is estimated at USD 232.54 billion in 2025, and is expected to reach USD 303.05 billion by 2030, at a CAGR of 5.44% during the forecast period (2025-2030).

The major factors responsible for the high growth of the durable medical equipment market are the increasing prevalence of chronic and lifestyle-related disorders, technological advancements in portability, patient comfort, and utilities, and increasing demand and Funding for monitoring and therapeutic devices.

In addition, the rising focus on home care settings for managing medical conditions and illnesses in patient populations and the increasing awareness about elevating patients’ comfort are the key factors driving the global market for durable medical equipment (DME). According to the key facts updated by the WHO in March 2023, around 1.3 billion people are currently suffering from significant disabilities. This represents 16% of the global population or every 1 in 6 people. Hence, the high prevalence of disability worldwide is projected to drive the demand for personal mobility devices such as wheelchairs, walkers, crutch, and cane, among others, burgeoning the market growth.

Furthermore, the continuous technological advancements by manufacturers of DME are expected to open new opportunities for the studied market. For instance, in April 2023, Australian medical technology pioneer Control Bionics launched an autonomous driving wheelchair module at Deakin University’s new Digital Health Lab. The DROVE module was created with Deakin University’s Applied AI Institute (A2I2). This module can be retrofitted to powered wheelchairs, allowing users to move their chairs autonomously and precisely without a joystick. Moreover, in June 2022, European micro-mobility operator Dott partnered with Omni start-up to launch adapted e-scooters for wheelchair users. Hence, prominent players' rising product developments and partnerships to launch technologically advanced DMEs are projected to drive market growth during the forecast period.

Therefore, the market is expected to project significant growth over the forecast period due to the factors above. However, the high cost, pricing, and reimbursement issues hinder the expansion of the durable medical equipment market.

Durable Medical Equipment Market Trends

The Vital Sign Monitor Segment is Expected to Grow Significantly During the Forecast Period

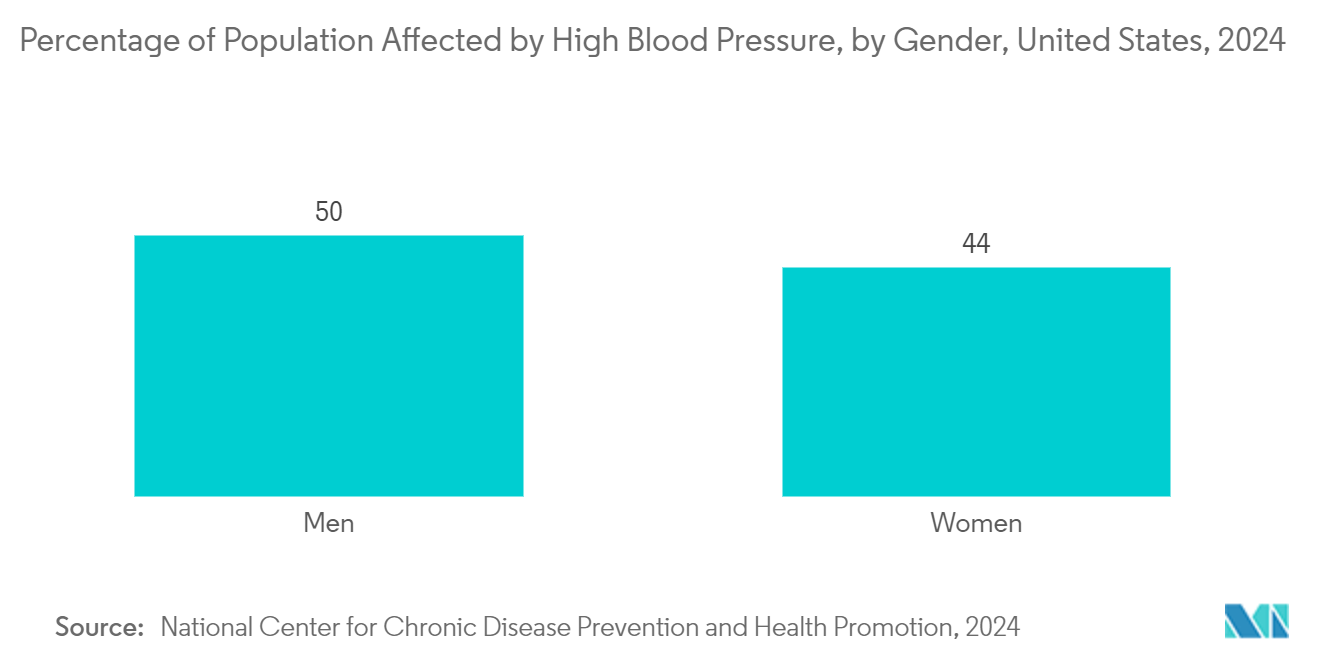

The vital signs monitor is a tool that helps to provide information to the medical and nursing staff about the patient’s physiologic condition. Nurses usually monitor these critical signs, including blood pressure (BP), heart rate (HR), respiratory rate (RR), oxygen saturation (SpO2), and core temperature. Consistent vital sign monitoring is critically important for early disease detection in patients in hospital settings.

The rising prevalence of cardiovascular diseases such as hypertension, atrial fibrillation, and stroke, among others, are contributing to the market growth. For instance, as per the data updated by the WHO in March 2023, approximately 1.28 billion adults aged 30–79 years worldwide have hypertension, most (two-thirds) living in low- and middle-income countries. Thus, the high prevalence of hypertension worldwide is likely to create a huge demand for various vital sign monitors for regular blood pressure monitoring.

In addition, with the rise in IoT-enabled consumer health wearables, the market is projected to grow significantly during the forecast period. It is now possible for a single wearable device to monitor a range of medical risk factors. These devices can give patients direct access to personal analytics that can contribute to their health, facilitate preventive care, and aid in managing an ongoing illness. For instance, in May 2023, Essence SmartCare launched VitalOn, a comprehensive remote patient monitoring (RPM) platform for active seniors and older adults living with chronic conditions. The system is always on, providing continuous monitoring and chronic conditions management for various healthcare needs at home and on the go. It continually gathers and analyzes patient data from multiple health and monitoring devices to facilitate proactive, predictive, and preventative care. Thus, launching such devices is expected to drive the studied segment. Moreover, several market players focus on developing and launching portable and affordable vital sign monitoring devices, making the segment competitive. For instance, in January 2022, Mindray launched its new VS 9 and VS 8 Vital Signs Monitors in Europe, Australia, and other selected regions.

Hence, the vital sign monitor segment will likely grow during the forecast period due to the high prevalence of hypertension and surging number of product launches by prominent players.

North America Holds a Significant Share and Expected to do Same Over the Forecast Period

The geographical analysis of the Durable Medical Equipment market shows that North America holds a significant market share in the global market. This is due to the rising prevalence of various chronic diseases in the region, the presence of prominent players, and the increasing number of product launches.

For instance, as per the data updated by the CDC in January 2023, approximately one in four adults (26%) adults in the United States are currently having some disability. According to the same source, around 11.1% of adults in the United States have difficulty climbing stairs or walking. Hence, the large proportion of people in the country suffering from various physical disabilities is likely to create a huge demand for personal mobility and bathroom safety devices. In addition, as per the data updated by the CDC in January 2023, nearly half of the adults in the United States (47%, or 116 million) have hypertension. Thus, the large population in the country suffering from hypertension is likely to augment the demand for vital sign monitoring devices, thereby increasing the market growth.

Furthermore, the prominent players are doing various strategic collaborations or partnerships to bring advanced, durable medical equipment to the United States to uphold their position in the market. For instance, in August 2022, United Kingdom-based wheelchair manufacturer RGK and Sunrise Medical North America collaborated to launch RGK’s new window Octane Sub4, a rigid titanium wheelchair custom-fit to every user guaranteed to weigh less than 8.8 pounds. Hence, such collaborations are projected to create lucrative opportunities for market players to enter the North American region, thereby driving market growth.

Thus, the market is expected to grow significantly during the forecast period due to the rising prevalence of various chronic diseases in the region, the presence of prominent players, and the increasing number of product launches.

Durable Medical Equipment Industry Overview

The durable medical equipment market is highly competitive and has several major players. The existing major players in the durable medical equipment market employ robust competitive strategies, leading to an intense rivalry. Some key players in the market include Compass Health Brands, GE Healthcare, Getinge AB, GF Health Products Inc., and Medtronic PLC.

Durable Medical Equipment Market Leaders

-

Getinge AB

-

Medtronic PLC

-

Compass Health Brands

-

GF Health Product Inc.

-

GE Healthcare

- *Disclaimer: Major Players sorted in no particular order

Durable Medical Equipment Market News

- May 2024: Beurer India Pvt. Ltd launched a blood glucose monitor device retailing for INR 1,200 (USD 14.44), which will be available in the market by September 2024.

- March 2024: IIT Madras developed a customizable, indigenously-developed electric standing wheelchair known as NeoStand in India, which enables wheelchair users to transition from sitting position to standing.

Durable Medical Equipment Industry Segmentation

As per the report's scope, durable medical equipment (DME) is defined as devices and products that serve medical purposes and can tolerate frequent and subsequent usage. Patients now prefer to avail themselves of post-operative and long-term care at home.

The Durable Medical Equipment Market is Segmented by Device Type, End-User, and Geography. By Device Type, the market is segmented into Personal Mobility Devices, Medical Furniture and Bathroom Safety Devices, and Monitoring and Therapeutic Devices. By End-User, the market is segmented into Hospitals/Clinics, Ambulatory Surgical Centers, and Other End-Users. By Geography, the market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and South America. The report also covers the estimated market sizes and trends for 17 countries across major regions globally. The report offers the value (in USD) for the above segments.

| By Device Type | Personal Mobility Devices | Wheelchair |

| Crutch and Cane | ||

| Walker | ||

| Other Personal Mobility Devices | ||

| By Device Type | Medical Furniture and Bathroom Safety Devices | Medical Bed and Mattress |

| Commode and Toilet | ||

| Other Medical Furniture and Bathroom Safety Devices | ||

| By Device Type | Monitoring and Therapeutic Devices | Blood Glucose Monitor |

| Oxygen Equipment | ||

| Vital Sign Monitor | ||

| Infusion Pump | ||

| Other Monitoring and Therapeutic Devices | ||

| By End-User | Hospital/Clinic | |

| Ambulatory Surgical Center | ||

| Other End-Users | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Middle East and Africa | GCC |

| South Africa | ||

| Rest of Middle East and Africa | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America |

Global Durable Medical Equipment Market Research Faqs

How big is the Global Durable Medical Equipment Market?

The Global Durable Medical Equipment Market size is expected to reach USD 232.54 billion in 2025 and grow at a CAGR of 5.44% to reach USD 303.05 billion by 2030.

What is the current Global Durable Medical Equipment Market size?

In 2025, the Global Durable Medical Equipment Market size is expected to reach USD 232.54 billion.

Who are the key players in Global Durable Medical Equipment Market?

Getinge AB, Medtronic PLC, Compass Health Brands, GF Health Product Inc. and GE Healthcare are the major companies operating in the Global Durable Medical Equipment Market.

Which is the fastest growing region in Global Durable Medical Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Global Durable Medical Equipment Market?

In 2025, the North America accounts for the largest market share in Global Durable Medical Equipment Market.

What years does this Global Durable Medical Equipment Market cover, and what was the market size in 2024?

In 2024, the Global Durable Medical Equipment Market size was estimated at USD 219.89 billion. The report covers the Global Durable Medical Equipment Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Global Durable Medical Equipment Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Global Durable Medical Equipment Industry Report

The durable medical equipment market is segmented by device type, including personal mobility devices such as wheelchairs, crutches, canes, and walkers, as well as other personal mobility devices. It also covers medical furniture and bathroom safety devices, including medical beds, mattresses, commodes, toilets, and other related items. Additionally, the market includes monitoring and therapeutic devices like blood glucose monitors, oxygen equipment, vital sign monitors, infusion pumps, and other related devices.

The market is further segmented by end-users, including hospitals and clinics, ambulatory surgical centers, and other end users. Geographically, the market spans North America, Europe, Asia-Pacific, the Middle East and Africa, and South America. The market size and value are analyzed for each segment, providing a comprehensive industry analysis.

The industry analysis reveals key industry trends and market growth, offering valuable industry statistics and market data. The market report includes a market forecast, providing insights into the market outlook and market predictions. The report also highlights the market segmentation and market value, identifying market leaders and offering a detailed market review.

This industry report provides an in-depth industry overview and industry outlook, supported by industry research and industry information. The report example and report PDF offer a detailed market overview, including market segmentation and market growth. The research companies involved in this report provide extensive industry sales and industry size analysis, ensuring a thorough understanding of the market dynamics.

Overall, this comprehensive report offers valuable insights into the durable medical equipment market, including industry trends, market data, and market forecast, making it an essential resource for understanding the market's growth rate and market outlook.