Endpoint Detection and Response (EDR) Market Size

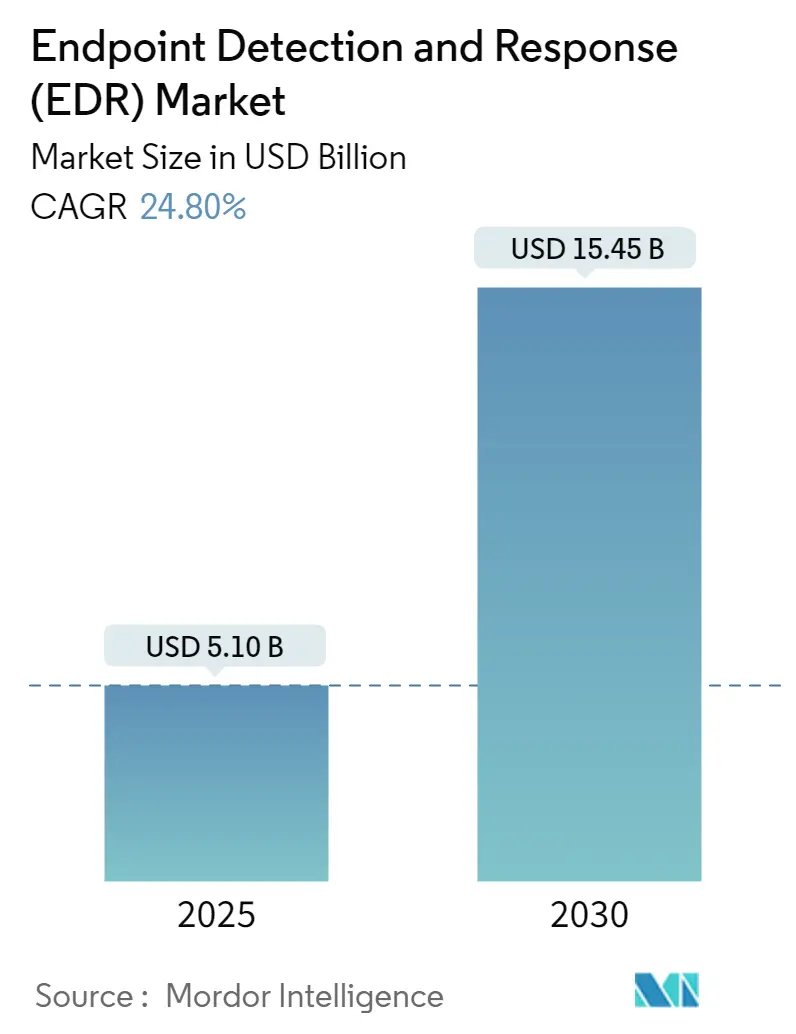

| Study Period | 2019 - 2030 |

| Market Size (2025) | USD 5.10 Billion |

| Market Size (2030) | USD 15.45 Billion |

| CAGR (2025 - 2030) | 24.80 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players_Market_company_logo.webp)

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Endpoint Detection and Response (EDR) Market Analysis

The Endpoint Detection and Response Market size is estimated at USD 5.10 billion in 2025, and is expected to reach USD 15.45 billion by 2030, at a CAGR of 24.8% during the forecast period (2025-2030).

The Endpoint Detection and Response (EDR) market is experiencing unprecedented growth amid escalating cybersecurity threats across industries. According to recent data, the United States alone witnessed 3,205 data compromises in 2023, marking a significant increase from 1,802 incidents in 2022. The financial services sector has emerged as particularly vulnerable, with 744 data compromise incidents recorded between 2020 and 2023. This surge in cyber incidents has prompted organizations to strengthen their endpoint security infrastructure, driving substantial investments in advanced EDR solutions that combine artificial intelligence, machine learning, and real-time threat detection capabilities.

The manufacturing sector has become increasingly susceptible to cyber threats as Industry 4.0 initiatives accelerate digital transformation. According to the IBM Threat Intelligence Index 2023, manufacturing tops the list of attacked industries in the Asia-Pacific region, accounting for 48% of incidents. Recent events highlight this vulnerability, as demonstrated by the February 2024 ransomware attack on Thyssenkrupp's automotive unit, which forced the company to take computer systems offline after detecting malicious intrusion attempts. This growing threat landscape has catalyzed the adoption of sophisticated Endpoint Detection and Response solutions specifically designed for industrial environments.

The healthcare sector is witnessing an alarming rise in cybersecurity incidents, particularly targeting patient data and critical infrastructure. In February 2024, UnitedHealth Group confirmed a significant cyberattack by the Blackcat/AlphV ransomware group affecting its subsidiary Change Healthcare, highlighting the sector's vulnerability. According to cybersecurity firm Emisoft, 46 hospital systems in the United States suffered ransomware attacks in 2023, up from 25 in 2022, with 32 attacks resulting in sensitive data theft, including protected health information.

Mobile endpoint security has emerged as a critical concern as organizations expand their digital footprint. According to Kaspersky's annual analysis, mobile threat attacks surged to 33.7 million in 2023, representing a substantial 52% increase compared to the 22.2 million attacks recorded in 2022. In response to these evolving threats, vendors are launching innovative solutions, as exemplified by ESET's February 2024 introduction of ESET Managed Detection and Response (MDR), an advanced solution combining AI-powered automation with human expertise to address the growing cybersecurity challenges faced by businesses, particularly in mobile endpoint protection.

Endpoint Detection and Response (EDR) Market Trends

Increasing Expansion of Enterprise Mobility

Enterprise mobility has become a cornerstone of modern business operations, enabling employees to work seamlessly across various devices and applications while maintaining integration with enterprise security infrastructure. The rapid adoption of automation, driven by Industry 4.0 initiatives, machine-to-machine communication, and smart city developments, has led to unprecedented growth in endpoint devices. This expansion has created a critical need for comprehensive Endpoint Detection and Response solutions to protect the vulnerability of data and devices while deploying tools to recognize attacks and minimize potential damage.

The growing strategic developments and partnerships in the market underscore the importance of enterprise mobility security. For instance, in September 2023, Dragos Inc. expanded its partnership with CrowdStrike to include two new integrations enabling bilateral data sharing. Similarly, in October 2023, BlackBerry Limited announced two significant innovations in unified endpoint management, including BlackBerry UEM at the edge and BlackBerry UEM for the Internet of Things. These developments demonstrate the industry's response to the increasing need for sophisticated endpoint security solutions that can protect diverse enterprise mobility environments while ensuring operational efficiency.

Bring Your Own Device (BYOD) Adoption and Increased Remote Working

The proliferation of BYOD policies in organizations has dramatically increased the number of endpoints vulnerable to cyber attacks, as employees use various personal devices including laptops, desktops, and smartphones for work purposes. According to Cisco's findings, enterprises with BYOD policies in place save approximately USD 350 per year per employee, with reactive programs potentially boosting these savings to USD 1,300 per year per employee. This economic benefit has accelerated BYOD adoption, particularly among small and medium-sized businesses, creating an urgent need for robust Endpoint Detection and Response solutions.

The market is responding to these challenges with innovative solutions designed specifically for mobile security and BYOD environments. In April 2023, Lookout, Inc. introduced the industry's first mobile detection and response solution for managed security service providers called Lookout Mobile Security. This solution enables MSSPs to provide their customers with a comprehensive program for risk identification, protection of confidential data, and mobile device security. The solution leverages Lookout's extensive mobile dataset of security telemetry, built on graph-based machine intelligence that analyzes data from more than 210 million devices, 175 million apps, and processes four million web URLs daily, demonstrating the sophisticated response required to address BYOD security challenges.

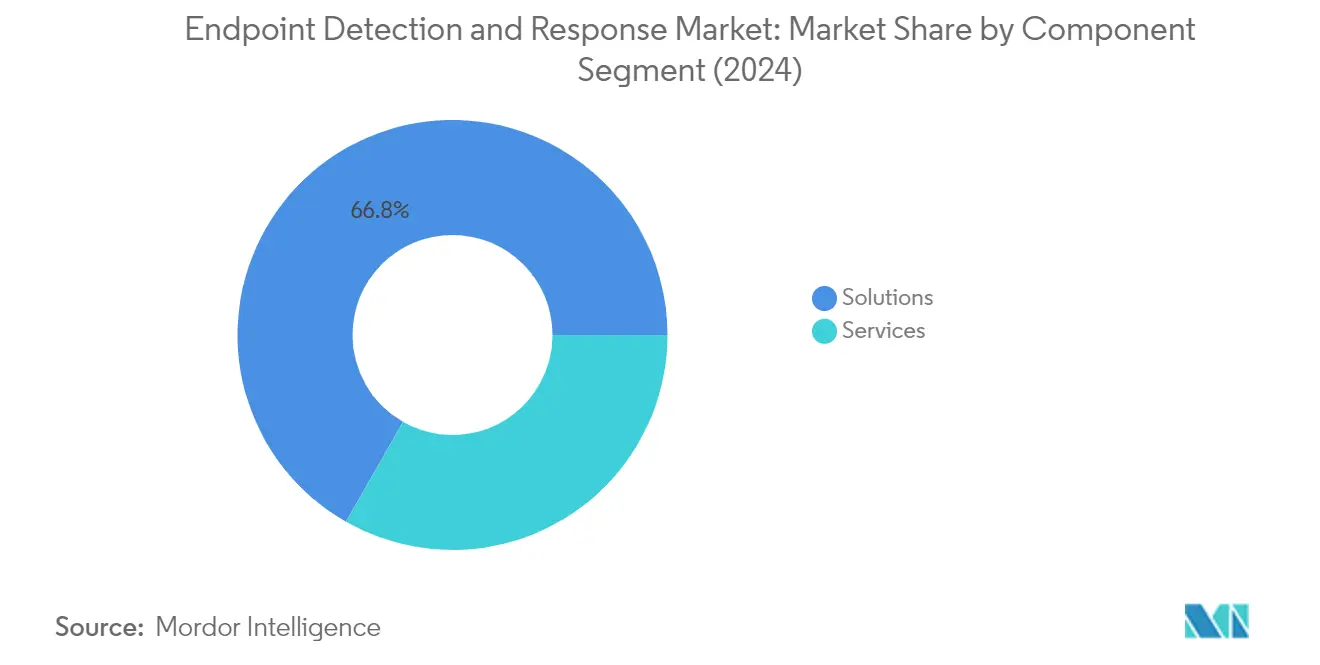

Segment Analysis: By Component

Solutions Segment in Endpoint Detection and Response Market

The Solutions segment continues to dominate the global Endpoint Detection and Response (EDR) market, commanding approximately 67% market share in 2024. This substantial market presence is primarily driven by the expanded attack surface due to growth in digitization and endpoints, coupled with the rising need to prevent malware and ransomware attacks. Organizations are increasingly adopting endpoint protection platform solutions to gain comprehensive visibility across all endpoints and effectively detect advanced cyber threats such as file-less malware by monitoring in-memory activities and detecting anomalous behavior. Market vendors are integrating advanced technologies such as artificial intelligence (AI) to reduce an organization's attack surface while guiding and accelerating response capabilities. The solutions segment's strong position is further reinforced by the growing demand from various end-user industries, particularly the healthcare sector, where EDR solutions assist organizations in meeting regulatory compliance requirements such as the Health Insurance Portability and Accountability Act (HIPAA).

Services Segment in Endpoint Detection and Response Market

The Services segment in the EDR market is experiencing remarkable growth, projected to expand at approximately 28% CAGR from 2024 to 2029. This accelerated growth is primarily driven by the increasing mandates to follow data protection and regulatory laws, a substantial rise in sophisticated attacks, and digitization initiatives across organizations worldwide. The high cost of maintaining security systems is leading many organizations to outsource their endpoint detection and response services. Managed EDR services, offering capabilities such as instant response, advanced threat hunting, 24x7 monitoring, and continuous maintenance, are gaining significant traction among organizations seeking to effectively secure endpoints across their environment. Market vendors are actively launching innovative EDR services to cater to the growing demand for comprehensive endpoint security, with solutions featuring advanced capabilities like automation and machine learning models for enhanced threat detection and response.

Segment Analysis: By Deployment Type

On-premise Segment in Endpoint Detection and Response Market

The on-premise segment continues to dominate the global Endpoint Detection and Response (EDR) market, commanding approximately 55% market share in 2024. This significant market position is primarily driven by data-sensitive organizations requiring complete control and privacy of their EDR solutions. Organizations with adequate IT staff and security experts are particularly drawn to on-premise deployment due to the expanding IT ecosystem and attack surface, coupled with the ever-increasing need to proactively detect and respond to evolving threats. Features such as well-organized performance and better control to effectively mitigate evolving threats in on-premise deployment are further driving adoption among enterprises. Large-scale organizations, notably from the BFSI sector, which produce most of their data in-house or have extensive private-cloud infrastructure already in place, generally opt for on-premise deployment of endpoint detection and response solutions.

Cloud-based Segment in Endpoint Detection and Response Market

The cloud-based segment is experiencing the fastest growth trajectory in the EDR market, projected to grow at approximately 27% CAGR during 2024-2029. This remarkable growth is attributed to the rise in cloud-based operations, accelerated adoption of cloud infrastructure and services, and the remote working culture. Various factors, including scalability, flexibility, platform centralization, ease of accessibility, and cost-effectiveness, are driving the growing adoption of cloud-based cybersecurity solutions. The global workforce's increasing reliance on remote and mobile capabilities is contributing significantly to the demand for cloud-based cybersecurity. Cloud solutions facilitate secure access and monitoring of systems from any location, supporting the needs of modern, flexible work environments. Small and medium-sized enterprises are particularly driving this growth due to the quick detection and response capabilities of cloud-based EDR solutions to effectively mitigate the ever-increasing ransomware attacks.

Segment Analysis: By Solution

Workstations Segment in Endpoint Detection and Response Market

The Workstations segment continues to dominate the global Endpoint Detection and Response (EDR) market, commanding approximately 37% of the market share in 2024. This significant market position is primarily driven by workstations being common entry points for attackers as they contain sensitive organizational data, making them critical targets for cybersecurity protection. The segment's dominance is further strengthened by the growing digital transformation across industries, cloud adoption, and the expanding attack surface of workstations across organizations. With the increasing adoption of remote working and bring your own device (BYOD) policies, organizations are prioritizing workstation protection as increased business traffic over unsecured networks with various workstation devices expands the attack surface at a rapid pace. Market vendors are actively capitalizing on this demand by launching innovative EDR solutions specifically designed to address the need to manage and secure enterprise devices such as desktops and laptops.

Mobile Devices Segment in Endpoint Detection and Response Market

The Mobile Devices segment is projected to witness the highest growth rate of approximately 26% during the forecast period 2024-2029. This accelerated growth is primarily attributed to the increasing use of mobile devices for storing and remotely accessing business data, which is expanding the attack surface, coupled with the growth in mobile attack vectors and the rising need among organizations for enhanced visibility in mobile endpoint activity. The segment's growth is further fueled by businesses adapting to the new normal of remote working and continuing to invest in mobile devices, making mobile endpoint security increasingly critical. Organizations are recognizing the need for comprehensive endpoint detection and response solutions to enable proactive identification and action against malicious behavior to improve their mobile device security. Market vendors are responding to this trend by launching innovative EDR solutions specifically designed for mobile devices, incorporating advanced capabilities to help organizations protect supported endpoints against modern attacks and exploitation.

Remaining Segments in Solution Type Segmentation

The Servers and Point of Sale Terminals segments complete the solution type segmentation of the EDR market, each playing crucial roles in different aspects of endpoint security. The Servers segment is particularly vital for organizations as these endpoints often serve as data-rich targets for cybercriminals, making their protection crucial for maintaining data integrity and compliance requirements. The Point of Sale Terminals segment addresses the unique security challenges in retail and financial sectors, where these endpoints process sensitive financial transactions and customer data. Both segments are experiencing significant technological advancements with vendors introducing AI-powered capabilities, automated threat detection, and enhanced response mechanisms to address the evolving threat landscape targeting these specific endpoints.

Segment Analysis: By Organization Size

Large Enterprises Segment in Endpoint Detection and Response Market

Large enterprises continue to dominate the global endpoint detection and response market, commanding approximately 65% of the market share in 2024. This significant market presence is primarily attributed to these organizations' complex IT infrastructure resulting from various factors including organic growth, mergers and acquisitions, incremental deployment of privacy regulations, and the generation of both unstructured and structured data across multiple formats including videos, audio, emails, and financial transactions. Large enterprises, particularly in the BFSI sector, which produce most of their data in-house or have extensive private-cloud infrastructure, generally opt for comprehensive endpoint protection solutions to protect their expansive digital assets. The segment's dominance is further strengthened by these organizations' substantial IT budgets, robust security teams, and the critical need to protect sensitive data across their vast network of endpoints.

SME Segment in Endpoint Detection and Response Market

Small and Medium Enterprises (SMEs) are emerging as the fastest-growing segment in the endpoint detection and response market, projected to grow at approximately 27% CAGR from 2024 to 2029. This remarkable growth is driven by increasing awareness among SMEs about cyber threats, the growing digitalization of their operations, and the adoption of cloud-based technologies. The segment's growth is further accelerated by the introduction of cost-effective cloud-based EDR solutions specifically designed for small and medium-scale enterprises, making advanced security capabilities more accessible to organizations with limited IT resources. Market vendors are actively launching innovative solutions targeting SMEs, offering simplified deployment options, managed services, and integrated threat intelligence capabilities to address the unique challenges faced by smaller organizations in maintaining robust cybersecurity postures.

Segment Analysis: By End-User Industry

IT and Telecom Segment in Endpoint Detection and Response Market

The IT and Telecom sector emerged as the dominant segment in the endpoint detection and response market, commanding approximately 25% market share in 2024. This significant market position is attributed to the sector's increasing reliance on interconnected networks, cloud computing, and digital communication infrastructure, which necessitates robust cybersecurity measures. The sector's substantial contribution is driven by the growing recognition of comprehensive cloud security solutions, as findings indicate that nearly 80% of security exposures occur in cloud environments. The segment's leadership is further strengthened by continuous technological advancements and strategic partnerships, such as the 2024 collaboration between NinjaOne and SentinelOne, which combines endpoint management capabilities with advanced threat detection and response functionalities.

Healthcare Segment in Endpoint Detection and Response Market

The healthcare sector is projected to exhibit the highest growth rate of approximately 29% during the forecast period 2024-2029. This accelerated growth is primarily driven by the substantial increase in ransomware and malware attacks targeting healthcare institutions, coupled with the stringent regulatory compliance requirements such as the Health Insurance Portability and Accountability Act (HIPAA). The sector's rapid adoption of connected medical devices and the growing popularity of bring-your-own-device (BYOD) policies in healthcare settings have expanded the attack surface for cybercriminals, necessitating more robust endpoint detection and response solutions. The segment's growth is further catalyzed by the launch of innovative solutions specifically designed for healthcare organizations, such as At-Bay's Stance Managed Detection and Response solution introduced in late 2023.

Remaining Segments in End-User Industry

The other significant segments in the endpoint detection and response market include BFSI, Manufacturing, Retail, and various other industries. The BFSI sector maintains a strong presence due to its high data sensitivity and stringent compliance requirements. The manufacturing sector's adoption is driven by the increasing integration of Industry 4.0 technologies and industrial IoT devices, while the retail sector's demand is fueled by the growing number of point-of-sale terminals and digital transformation initiatives. These segments collectively contribute to the market's diverse landscape, each bringing unique security challenges and requirements that shape the evolution of endpoint security solutions.

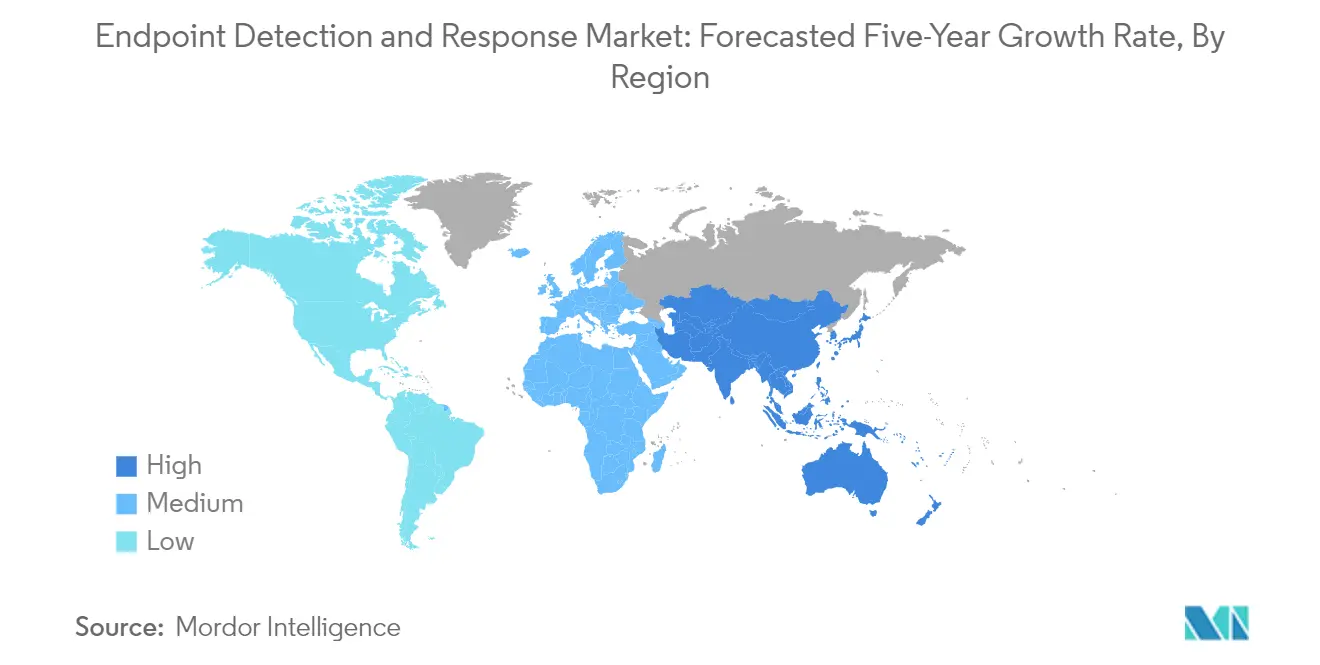

Endpoint Detection And Response Market Geography Segment Analysis

Endpoint Detection and Response Market in North America

North America represents a mature endpoint detection and response market, driven by the presence of major technology vendors and the early adoption of advanced cybersecurity measures. The region's market is characterized by sophisticated cyber threats targeting various sectors, particularly financial services and healthcare. The United States and Canada demonstrate strong demand for endpoint security solutions, supported by stringent regulatory requirements and the increasing need to protect critical infrastructure from evolving cyber threats.

Endpoint Detection and Response Market in United States

The United States dominates the North American EDR market, accounting for approximately 87% of the regional EDR market share in 2024. The country's market is driven by the significant presence of major technology hubs and financial centers, alongside ongoing cross-industry collaborations. Organizations in the US are increasingly adopting cloud-based infrastructures, necessitating robust endpoint protection solutions to protect these environments. The market is further strengthened by the presence of leading vendors offering comprehensive endpoint detection and response solutions and services, coupled with growing awareness among organizations about the importance of endpoint security in their cybersecurity strategy.

Endpoint Detection and Response Market in Canada

Canada emerges as the fastest-growing market in North America, with a projected CAGR of approximately 29% during 2024-2029. The country's growth is driven by increasing awareness among enterprises about cyber threats, growing digitalization, and the adoption of cloud-based technologies. Canadian organizations are increasingly implementing EDR market solutions to strengthen their cybersecurity posture, particularly in sectors like telecommunications and financial services. The market is further supported by government initiatives to enhance cybersecurity capabilities and protect critical infrastructure from evolving threats.

Endpoint Detection and Response Market in Europe

Europe represents a significant market for endpoint detection and response solutions, characterized by stringent data protection regulations and increasing cybersecurity investments across various sectors. The region's market is driven by the growing adoption of digital transformation initiatives and the rising number of sophisticated cyber attacks. Germany, the United Kingdom, and France emerge as key markets, each contributing significantly to the region's growth through various industry verticals and technological advancements.

Endpoint Detection and Response Market in Germany

Germany leads the European EDR market, commanding approximately 34% of the regional market share in 2024. The country's market is primarily driven by the emergence of Industry 4.0 and the increasing integration of IoT and computer systems in industrial premises. German automakers and manufacturing sectors are particularly focused on cybersecurity, with vehicle development increasingly becoming software-driven and shop floors being connected to the internet. The market is further strengthened by the expansion of smart factories and the country's priority on making its industrial landscape more resilient against cyber-attacks.

Endpoint Detection and Response Market in United Kingdom

The United Kingdom demonstrates the highest growth potential in Europe, with a projected CAGR of approximately 27% during 2024-2029. The country's market is driven by the development of 5G and fiber network infrastructure, encouraging the usage of connected technology in enterprises. The healthcare sector is particularly contributing to this growth, supported by governmental priorities in modernizing healthcare facilities and encouraging remote patient monitoring. The market is further strengthened by increasing investments in digital transformation and the adoption of cloud-based technologies across various sectors.

Endpoint Detection and Response Market in Asia-Pacific

The Asia-Pacific region represents a rapidly evolving endpoint detection and response market, characterized by increasing digital transformation initiatives and rising cybersecurity awareness. The region demonstrates strong growth potential, driven by the expanding IT infrastructure, growing adoption of cloud services, and increasing cyber threats. China, Japan, and India emerge as key markets, each contributing significantly to the region's growth through various technological advancements and industry-specific implementations.

Endpoint Detection and Response Market in China

China leads the Asia-Pacific EDR market, driven by the rising number of connected devices and the adoption of Internet of Things technologies across different industries. The country's market is particularly strong in the manufacturing sector, supported by governmental priorities in making the industrial sector more cyber resilient. The market is further strengthened by the expansion of indigenous cybersecurity solution providers and the growing adoption of cloud-based solutions in the manufacturing sector.

Endpoint Detection and Response Market in India

India emerges as the fastest-growing market in the Asia-Pacific region, driven by significant growth in the usage of Information and Communication Technology across various sectors. The country's market is particularly strong in the healthcare and BFSI sectors, supported by governmental initiatives such as the Digital India program. The market is further strengthened by increasing investments in fintech companies and the growing adoption of managed detection and response solutions among small and medium enterprises.

Endpoint Detection and Response Market in Middle East & Africa

The Middle East and Africa region demonstrates growing potential in the endpoint detection and response market, driven by increasing investments in telecom and IT infrastructure. The region's market is characterized by the emergence of highly developing economies and the growing adoption of digital technologies in business environments. The market is particularly strong in countries like South Africa, Kenya, and Nigeria, with South Africa emerging as the largest market and Kenya showing the fastest growth potential in the region. The increasing frequency of cyber attacks on IoT devices and the development of security operation centers across the BFSI sector are further driving the adoption of EDR market solutions in the region.

Endpoint Detection and Response Market in Latin America

Latin America shows promising growth in the endpoint detection and response market, driven by the expanding digital economy and increasing internet penetration across various countries. The region's market is characterized by growing IT service industries, industrial sectors, and the online payment landscape. Brazil emerges as the largest market in the region, while Mexico demonstrates the fastest growth potential, supported by increasing cloud service adoption and digital transformation initiatives. The market is further strengthened by the growth of connected devices in enterprises, supported by the adoption of cloud services, IIoT installations, and the emergence of smart healthcare facilities across the region.

Endpoint Detection and Response (EDR) Market Overview

Top Companies in Endpoint Detection and Response Market

The endpoint detection and response market features prominent players like Palo Alto Networks, Cisco Systems, CrowdStrike, Broadcom, Cybereason, Deep Instinct, Fortra, Trellix, OpenText, Sophos, and Fortinet leading the competitive landscape. These endpoint detection and response vendors are heavily investing in artificial intelligence and machine learning capabilities to enhance their EDR solutions, with a particular focus on cloud-native architectures and real-time threat detection capabilities. Strategic partnerships and technology integrations have become crucial differentiators, as vendors seek to provide comprehensive endpoint security ecosystems that extend beyond traditional endpoint protection. Companies are increasingly emphasizing managed security services and cloud-delivered solutions to address the growing demand for simplified deployment and management. The market is characterized by continuous product innovation, particularly in areas such as automated response capabilities, behavioral analytics, and integration with broader XDR market platforms.

Dynamic Market Structure Drives Competitive Evolution

The endpoint detection and response market exhibits a balanced mix of large cybersecurity conglomerates and specialized security providers, creating a diverse competitive landscape. Global technology giants leverage their extensive resources and established customer relationships to maintain market positions, while specialized security vendors compete through focused innovation and rapid response to emerging threats. The market is experiencing ongoing consolidation through strategic acquisitions, as larger players seek to expand their capabilities and market reach by incorporating innovative technologies and specialized expertise from smaller providers.

The competitive dynamics are shaped by the increasing integration of EDR solutions within broader security platforms, driving partnerships and ecosystem development. Market participants are expanding their geographical presence through channel partnerships and regional investments, particularly in emerging markets with growing cybersecurity needs. The landscape is further influenced by the rising importance of managed security service providers (MSSPs) as key distribution channels, leading to strategic alignments between vendors and service providers to enhance market penetration and service delivery capabilities.

Innovation and Adaptability Drive Market Success

Success in the endpoint detection and response market increasingly depends on vendors' ability to deliver comprehensive security platforms while maintaining operational agility. Established players are focusing on expanding their technological capabilities through internal development and strategic acquisitions, while also strengthening their partner ecosystems to enhance market reach. The ability to provide seamless integration with existing security infrastructure, coupled with advanced threat detection and automated response capabilities, has become crucial for maintaining competitive advantage. Vendors are also investing in customer success programs and professional services to ensure effective implementation and ongoing value realization.

Market contenders are finding opportunities through specialization in specific industry verticals or deployment models, particularly in addressing the unique needs of small and medium enterprises. The increasing regulatory focus on cybersecurity and data protection is driving demand for compliance-oriented features and reporting capabilities, creating opportunities for vendors to differentiate their offerings. Success in the market also requires maintaining a balance between advanced security capabilities and ease of use, as organizations seek solutions that can be effectively managed with limited security expertise. The ability to demonstrate clear return on investment and operational efficiency improvements has become increasingly important in winning and retaining customers. The EDR market share by vendor is a critical metric for assessing competitive positioning, as vendors strive to increase their EDR market share through innovation and customer-centric strategies.

Endpoint Detection and Response (EDR) Market Leaders

-

Palo Alto Networks Inc.

-

Cisco Systems Inc.

-

CrowdStrike Inc.

-

Broadcom Inc.

-

Cybereason Inc.

*Disclaimer: Major Players sorted in no particular order

_Market__competive_loog.webp)

Endpoint Detection and Response (EDR) Market News

- October 2023: HarfangLab, a French cybersecurity company offering endpoint detection and response (EDR) solutions to enhance the identification and neutralization of cyberattacks against companies, has closed a EUR 25 million Series A funding round, which would be used to accelerate HarfangLab's business expansion in Europe, and can support the market growth.

- August 2023: Fortinet received the Google Cloud Technology Partner of the Year Award for Security for Identity & Endpoint Protection, which recognizes the ability of its FortiEDR solution to identify and stop breaches in real time, enabling organizations to be resilient to threats and integrate endpoint security within their ecosystem, which can support its market growth in the future.

Endpoint Detection and Response (EDR) Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

4.1 Market Overview

4.2 Industry Attractiveness - Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Threat of Substitues

4.2.5 Degree of Competition

4.3 Industry Value Chain Analysis

4.4 Impact of COVID-19 on the Market

5. MARKET DYNAMICS

5.1 Market Drivers

5.1.1 Increasing Expansion of Enterprise Mobility

5.1.2 Bring your Own Device (BYOD) Adoption and Increased Remote Working

5.2 Market Challenges

5.2.1 Higher Innovation Costs

5.2.2 Endpoint Detection and Response Falling Short of Protecting Mobile Devices

6. MARKET SEGMENTATION

6.1 By Component

6.1.1 Solutions

6.1.2 Services

6.2 By Deployment Type

6.2.1 Cloud-based

6.2.2 On-premise

6.3 By Solution Type

6.3.1 Workstations

6.3.2 Mobile Devices

6.3.3 Servers

6.3.4 Point of Sale Terminals

6.4 By Organization Size

6.4.1 Small And Medium Enterprises (SMES)

6.4.2 Large Enterprises

6.5 By End-user Industry

6.5.1 BFSI

6.5.2 IT and Telecom

6.5.3 Manufacturing

6.5.4 Healthcare

6.5.5 Retail

6.5.6 Other End-user Industries

6.6 By Geography***

6.6.1 North America

6.6.1.1 United States

6.6.1.2 Canada

6.6.2 Europe

6.6.2.1 Germany

6.6.2.2 United Kingdom

6.6.2.3 France

6.6.3 Asia

6.6.3.1 China

6.6.3.2 Japan

6.6.3.3 India

6.6.4 Australia and New Zealand

6.6.5 Middle East and Africa

6.6.6 Latin America

7. COMPETITIVE LANDSCAPE

7.1 Company Profiles*

7.1.1 Palo Alto Networks Inc.

7.1.2 Cisco Systems Inc.

7.1.3 CrowdStrike Inc.

7.1.4 Broadcom Inc.

7.1.5 Cybereason Inc.

7.1.6 Deep Instinct Ltd

7.1.7 Fortra LLC

7.1.8 Musarubra US LLC (Trellix)

7.1.9 Open Text Corporation

7.1.10 Sophos Ltd

7.1.11 Fortinet Inc.

8. INVESTMENT ANALYSIS

9. FUTURE OUTLOOK OF THE MARKET

Endpoint Detection and Response (EDR) Market Industry Segmentation

The global endpoint detection and response market is defined based on the revenues generated from the solutions and services used in various end-user industries across the globe. The analysis is based on the market insights captured through secondary research and the primaries. The market also covers the major factors impacting the growth of the market in terms of drivers and restraints.

The endpoint detection and response market is segmented by component (solutions, services), deployment type (cloud-based and on-premise), solution type (workstations, mobile devices, servers, and point of sale terminals), organization size (small and medium enterprises((SMES)) and large enterprises), end-user industry (BFSI, IT and telecom, manufacturing, healthcare, and retail), and geography (North America (United States, Canada), Europe (Germany, United Kingdom, France, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), Middle East and Africa, and Latin America). The market size and forecasts are provided in terms of value (USD) for all the above segments.

| By Component | |

| Solutions | |

| Services |

| By Deployment Type | |

| Cloud-based | |

| On-premise |

| By Solution Type | |

| Workstations | |

| Mobile Devices | |

| Servers | |

| Point of Sale Terminals |

| By Organization Size | |

| Small And Medium Enterprises (SMES) | |

| Large Enterprises |

| By End-user Industry | |

| BFSI | |

| IT and Telecom | |

| Manufacturing | |

| Healthcare | |

| Retail | |

| Other End-user Industries |

| By Geography*** | |||||

| |||||

| |||||

| |||||

| Australia and New Zealand | |||||

| Middle East and Africa | |||||

| Latin America |

Endpoint Detection and Response (EDR) Market Research FAQs

How big is the Endpoint Detection And Response Market?

The Endpoint Detection And Response Market size is expected to reach USD 5.10 billion in 2025 and grow at a CAGR of 24.80% to reach USD 15.45 billion by 2030.

What is the current Endpoint Detection And Response Market size?

In 2025, the Endpoint Detection And Response Market size is expected to reach USD 5.10 billion.

Who are the key players in Endpoint Detection And Response Market?

Palo Alto Networks Inc., Cisco Systems Inc., CrowdStrike Inc., Broadcom Inc. and Cybereason Inc. are the major companies operating in the Endpoint Detection And Response Market.

Which is the fastest growing region in Endpoint Detection And Response Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Endpoint Detection And Response Market?

In 2025, the North America accounts for the largest market share in Endpoint Detection And Response Market.

What years does this Endpoint Detection And Response Market cover, and what was the market size in 2024?

In 2024, the Endpoint Detection And Response Market size was estimated at USD 3.84 billion. The report covers the Endpoint Detection And Response Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Endpoint Detection And Response Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Endpoint Detection and Response (EDR) Market Research

Mordor Intelligence provides comprehensive industry analysis and market insights for the endpoint detection and response market, covering crucial aspects like market size, growth trends, and competitive landscape. Our research thoroughly examines the evolution of endpoint security solutions and advanced threat protection market, with detailed analysis of emerging technologies like extended detection and response (XDR) and managed detection and response (MDR). The report pdf includes in-depth coverage of EDR vendors, their market positioning, and strategic initiatives, helping stakeholders make informed decisions in this rapidly evolving cybersecurity landscape.

Our consulting expertise extends beyond traditional market research to provide strategic insights for cybersecurity stakeholders. We conduct thorough technology scouting to identify emerging trends in endpoint security and threat detection systems, while our competition assessment helps clients understand their positioning against leading EDR market players. Through extensive B2B surveys and data analytics, we help organizations understand customer needs and behavior patterns in endpoint protection implementation. Our consulting services include comprehensive analysis of product pricing and positioning strategies, new product launch assessment, and strategic partner identification, enabling clients to optimize their go-to-market strategies in the endpoint detection and response ecosystem.