CONTENT Introduction A real life scenario Using the promissory note in Dynamics 365 Finance and Operations |

MASTERING PROMISSORY NOTES IN D365 FINANCE: A STEP-BY-STEP GUIDE

Introduction

A promissory note is a financial instrument in which one party formally commits to paying a specific sum of money to another party. This Dynamics 365 Finance feature is versatile and can be effectively used by accounts payable (AP) teams, accounts receivable (AR) teams, treasury departments, legal teams, and vendors. By incorporating promissory notes into their processes, these teams can improve cash flow management and maintain the accuracy of financial records. Process users are as follows:

- AP teams use promissory notes to manage payments to vendors and suppliers. Promissory notes can be issued as a promise to pay at a future date, helping to manage cash flow and payment schedules.

- Finance professionals use promissory notes for cash management, planning, and ensuring that the company meets its financial obligations. They may also use them to secure short-term financing.

- Legal and compliance teams ensure that the issuance and management of promissory notes comply with legal standards and company policies. They handle the documentation and record-keeping associated with promissory notes.

In Dynamics 365 Finance, promissory notes are primarily used by companies and organizations that engage in financial transactions requiring formalized payment agreements.

Note: Dynamics 365 Finance and Operations AR teams might use promissory notes to manage incoming payments from customers. This is common in B2B transactions where credit terms are extended to clients.

Let's take a look at the overall process flow.

User creates a purchase order for the required goods, materials or services. Upon receiving physical items or services, related product receipt is posted. After receiving items, vendor invoice is posted to document the payable amount to the vendor. So far, everything is as usual.

Issuing promissory note: Instead of immediate payment, user issues a promissory note to the vendor, promising to pay the amount at a future date.

- Record liability: User creates a promissory note as a liability in the accounts payable module.

- Track promissory note: User monitors the promissory note for due dates and any interest accruals.

- Settle promissory note: On the due date, user processes the payment to settle the promissory note.

User verifies that the payment has been successfully recorded and the vendor's account is updated. When the time cones, user generates financial reports to ensure all transactions are accurately reflected in the company's financial statements.

A real life scenario

Contoso purchases $10,000 worth of inventory from Acme. Instead of making immediate payment, Contoso issues a promissory note promising to pay the amount in 60 days. While due date approaches, Contoso makes sure that funds are available. When the due date comes, Contoso settles the promissory note and issues the payment.

Using the promissory note in Dynamics 365 Finance and Operations

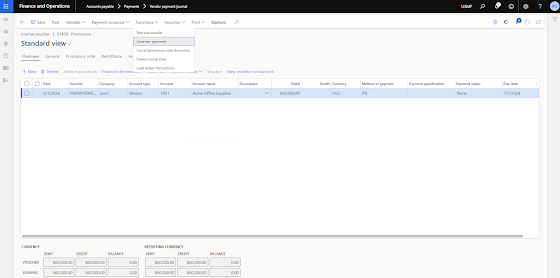

Let's take a look at the invoice that we will work on.

When you use promissory notes as payment,

- you debit the vendor account, next step is to wait for bank's payment

- when you receive notification from the bank that the promissory note has been honored (paid), you can close the promissory note.

This scenario will be covered with the below steps:

- Draw a promissory note

- Remit a promissory note

- Settle a promissory note

At the start of the process, before drawing a promissory note, the promissory note statistics inquiry shows the current status as follows:

We will get back to this screen several more times along the article. Let's create a promissory note now.

Draw promissory note: Go to AP >> Payments >> Promissory notes >> Draw promissory note journal.

Create journal header.

Click on lines.

Mark the transaction and click OK.

Click on Functions > Generate payments.

Send generated file to the vendor.

Post the journal.

Note that:

- last promised amount is now included on the Promissory note statistics form's "Drawn and invoice-confirmed document" line. Go to that form via AP >> Inquiries and reports >> payment >> Promissory note statistics.

- vendor summary account is debited and the promissory note summary account is credited.

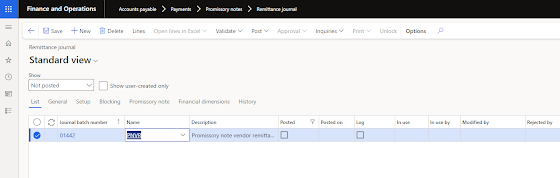

Remit payment to the bank: Remittance journal is used to generate a remittance file that you can send to your bank. The file can contain information about drawn promissory notes and invoices that have been posted.

Go to AP >> Payments >> Promissory notes >> Remittance journal.

Select the bank account on the promissory notes tab.

Click on lines.

Select the vendor >> Settle transactions

Mark the transaction and click OK.

Click on Functions > Generate remittance.

- remitted amount is now included on the Promissory note statistics form's "Remitted and remitted-confirmed documents" line. Go to that form via AP >> Inquiries and reports >> payment >> Promissory note statistics.

- vendor summary account is debited, and the invoice-remitted summary account is credited.

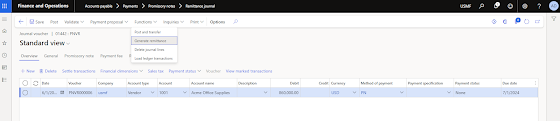

Settle promissory note: Settlement journal is used to settle promissory note when it is due.

Go to AP >> Payments >> Promissory notes >> Settle promissory journal.

Create promissory settlement journal header

Select the bank account on the promissory notes tab.

Click on lines

Mark the transaction and click OK.

Post the journal.

Note that:

- honored amount is now included on the Promissory note statistics form's "Honored documents" line. Go to that form via AP >> Inquiries and reports >> payment >> Promissory note statistics.

- when you settle an invoice-remitted invoice, the invoice-remitted summary account is debited and the vendor summary account is credited.

Lifecycle of the promissory note can be followed via promissory note journal inquiry form.

Note that the last status of promissory note #000011 is honored.

Note that the last status of promissory note #000011 is honored.

In conclusion, while the promissory note functionality in Dynamics 365 Finance offers significant benefits for managing payments and cash flow, it is important to note that this feature is not typically utilized within the United States. However, for businesses operating in regions where it is applicable, using this tool can lead to improved cash flow management.

.jpeg)