India, on its quest to become a global superpower, has made significant strides towards developing its engineering sector. The Government has appointed Engineering Export Promotion Council (EEPC) as the apex body in charge of the promotion of engineering goods, products, and services from India. India exports transport equipment, capital goods, other machinery/equipment, and light engineering products such as castings, forgings, and fasteners to various countries of the world. The Indian semiconductor industry offers a high growth potential area because industries which source semiconductors as inputs are witnessing high demand.

India’s Capital Goods manufacturing industry serves as a strong base for its engagement across sectors such as Engineering, Construction, Infrastructure and Consumer goods, amongst others. It accounts for 27% of the total factories in the industrial sector and represents 63% of the overall foreign collaborations. Capital Goods sector contributes to 12% of India’s manufacturing output and 1.8% to GDP. The market valuation of the capital goods industry was US$ 43.2 billion in FY22.

Indian Electrical equipment is the largest sub-sector followed by Plant equipment & Earth moving/ mining machinery. The electrical equipment market share in India is expected to increase from US$ 52.98 billion in 2022 to US$ 125 billion by 2027, implying a robust CAGR of 11.68%.

Investment in engineering R&D sector is expected to reach US$ 63 billion by 2025.

The quick estimates of Index of Industrial Production (IIP) for December 2023 came at 151.5, improving from 144.7 in December 2022.

The Government’s ‘Vision Plan 2030’ proposed an action plan to become a manufacturing and export hub for construction equipment and propel the development of world-class infrastructure in the country.

In FY23, the exports of engineering goods from India have been estimated to stand at US$ 107.04 billion. In FY24, this figure increased to US$ 109.32 billion, marking a YoY growth of 2.1%. In June 2024 alone, exports of engineering goods amounted to US$ 27.78 billion.

Market size for the Indian Construction Equipment Market stood at US$ 7.2 billion in FY23 and is forecasted to grow at a CAGR of 15% for next 5 years, as per the estimates of CII.

The construction equipment industry is expected to sell 165,097 units by 2028.

The overall exports of electronics goods in FY23 stood at US$ 23.58 billion and grew 50.25% as compared to US$ 15.69 in FY22 with the US and the UAE being the top 2 destinations.

The Ministry of Heavy Industries (MHI) launched 2 Production Linked Incentive (PLI) Schemes, namely PLI Scheme for Automobile and Auto Component Industry, and PLI Scheme for National Programme on Advanced Chemistry Cell (ACC) Battery Storage. The PLI Scheme for the automobile and auto components industry has been launched with a total budgetary outlay of Rs. 25,938 crore (US$ 3.17 billion) for a period of 5 years (FY23 to FY27).

In February 2021, the government had introduced the PLI scheme for manufacturing of telecom and networking equipment with an outlay of Rs. 12,195 crore (US$ 1.4 billion) over a 5-year period.

The Indian machine tool market size reached US$ 1.5 billion in 2023 and is expected to reach US$ 3.2 billion by 2032, exhibiting a growth rate (CAGR) of 8.2% during 2024-32. The manufacturers of machine tools are mostly SMEs, few of them are mid-sized manufacturers which have an annual turnover varying between Rs. 300-500 crore (US$ 36-60 million). The types of machine tools currently manufactured are general/special purpose machines, standard Computer Numerical Control (CNC) machines, gear cutting, grinding, medium size machines, electrical discharge machining (EDM), presses, press brakes, pipe bending, rolling, bending machines, etc.

Major textile machineries include weaving machines, spinning machines, winding machines, processing machines, synthetic fibre machines, etc. The Indian textile machinery industry was expected to touch US$ 6 billion mark by 2022.

India’s textile machinery exports declined by 5.09% to US$ 1,003.55 million in 2023 compared to the previous year. In 2020, creation of National Technical Textiles Mission for a period of 4 years (2020-21 to 2023-24) was approved with an outlay of US$ 179 million for developing usage of technical textiles in various flagship missions, programmes of the country including strategic sectors. The Indian government announced a reduction in customs duty on textile machinery, spares, and accessories. The changes include bringing shuttleless looms under the category of zero rate of duty.

Cement manufacturing machines include raw mill, cement crusher, cement mill, cement kiln, cement cooler, cement dryer, cement silo, cement packer, etc. Currently, 100% FDI is allowed under the automatic route.

India material handling equipment market share is anticipated to grow significantly from 2017-2024 due to an attractive economic landscape, and significant demand for goods movement. Material handling equipment have 4 categories: storage and handling equipment, engineered systems, industrial trucks, and bulk material handling. The Indian material handling equipment sector has grown at a CAGR of 10% between 2016-2020.

The Indian construction equipment industry recorded an excellent 26% growth YoY with sales crossing 1 lakh unit mark in FY23.

The market size of plastic machinery sector stood at US$ 500 million. Demand for plastic processing machinery is expected to increase from 12,760 units in FY20E to 13,740 units in FY21P and 14,770 units in FY22P. Out of the total machinery demand in 2020-21P, injection moulding machinery is expected to comprise 10,000 units, extrusion machines 2,770 units, and blow moulding machines 970 units.

The India Foundry Market size is estimated at US$ 19.46 billion in 2024, and is expected to reach US$ 31.77 billion by 2029, growing at a CAGR of 10.30% during the forecast period (2024-2029). There are in excess of 5,000 foundries in India of which about 85% are small units, 10% are medium sized and 5% are large, organized foundries. Foundry industry has a turnover of approx. US$ 20 billion with exports of approx. US$ 3.54 billion. India is the second largest producer of castings globally.

There are 750–800 domestic Medical Devices manufacturers in India, with an average investment of US$ 2.3–2.7 million and an average turnover of US$ 6.2-6.9 million. India is the 4th largest market for medical devices in Asia, among the top 20 markets for medical devices worldwide. India’s expected export of medical devices will reach ~ US$ 10 billion by 2025.

The Indian industrial fasteners market was valued at US$ 9,064 million in 2022 and is projected to reach US$ 17,868 million by 2030, registering a CAGR of 7.9% during the forecast period (2023-2030). The Indian automotive sector is the largest consumer of industrial fasteners, accounting for a major share of the market by 2023.

India steam boiler systems market size is expected to reach nearly US$ 22.56 billion by 2027 with the CAGR of 4.63% during the forecast period. Indian boiler manufacturer industry is worth for a sum of US$ 146 million contributing 40% to the Indian economy. The Indian boiler industry is expected to grow at a rate of 6% to surpass US$ 194 million

The India generator sets market is expected to grow at a CAGR of more than 5% over the period of 2020-25. The current annual production capacity of domestic wind turbines is about 15,000 MW. In 2022, GE Steam Power signed a US$ 165 million contract with Bharat Heavy Electricals Ltd to supply 3 nuclear steam turbines for India’s domestic nuclear power programme. The India diesel gensets (generator sets) market is expected to reach US$ 2.78 billion by 2030 compared to US$ 1.48 billion by 2022 at a CAGR of 8.20%.

The India power transformer market Is expected to rise at a CAGR of more than 3% during the forecast period of 2020-25. Factors such as increasing power generation capacity to meet energy demand and expansion of transmission and distribution systems are likely to drive the India power transformer market. A whole range of power and distribution transformers, including a special type of transformer required for furnaces, electric tracts, and rectifiers, are manufactured in India.

India switchgear market size was estimated at US$ 9.75 million in 2022 and is expected to grow at CAGR of 7.12% reaching a value of US$ 18.23 million by 2029.

India’s automotive industry is worth more than US$ 222 billion and contributes 8% of the country’s total export and accounts for 7.1% of India's GDP and is set to become the 3rd largest in the world by 2030. Export of the total number of automobiles stood at 4.7 million in FY23. India’s annual production of automobiles in FY23 was 25.93 million vehicles, as against 23.04 million vehicles in FY22.

In June 2024, PV sales decline by 2.88% MoM to 3.37 lakh units, as against 3.47 lakh units. Export of the total number of automobiles stood at 4.5 million in FY24. The exports of passenger vehicles increased from 6.6 million units in FY23 to 6.7 million units in FY24.

The total EV sales reached 1.67 million in 2024, up from 1.18 million in 2023.

Indian auto components industry, which accounts for 2.3% of India’s GDP currently, is set to become the third largest globally by 2025. The industry clocked highest-ever turnover of US$ 69.7 billion for the period of April 2022 to March 2023, registering a YoY growth of 32.8 Exports has experienced a positive trajectory, increasing by 5.2% to reach US$ 20.1 billion in FY23. According to the Automotive Component Manufacturers Association of India, the auto-components industry of India is expected to grow by 10-15% in FY24, which would be driven by both domestic and export market demand.

The Indian agricultural equipment market has reached a value US$ 10.25 billion in 2023 and is anticipated to grow at a CAGR of 5.24% through 2029.The Indian agricultural machinery market is segmented by type of tractors, equipment, irrigation machinery, harvesting machinery, and haying and forage machinery. India's tractor exports increased by 16% YoY, reaching 8487 units in February 2024. India's farm equipment market is likely to grow to US$ 18 billion by 2025.

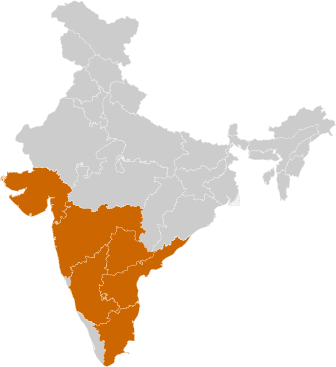

Engineering accounts for about 25% of India’s total global exports in the goods sector and is 1 of the largest foreign exchange earners. In FY24, the exports of engineering goods from India stood at US$ 109.32 billion. During June 2024, exports of engineering goods stood at US$ 27.68 billion. In December 2023, exports of engineering goods from India stood at US$ 9.71 billion, a 10.62% YoY growth. India’s engineering goods are exported to key markets such as the US, Europe, and UAE. The value of shipments to the US, the top market for India's engineering goods, stood at US$ 17.63 billion in FY24. Export of engineering goods is expected to reach US$ 200 billion by 2030. The engineering industry in Maharashtra reported exports worth US$ 22.99 billion in FY24 contributing around 21.0% of India’s engineering exports.

Creation of a significant number of special economic zones (SEZs) across the country has been approved. The development of Delhi Mumbai Industrial Corridor (DMIC) across 7 states will further bolster the engineering sector. Reliance Defence and Engineering Ltd has signed an agreement with the US Navy for undertaking service, maintenance, and repair of Seventh Fleet of US Navy at the Reliance Shipyard at Pipavav in Gujarat.

With 100% FDI allowed through the automatic route, major international players such as Cummins, GE, ABB, and Alfa Laval have entered the Indian engineering sector due to growth opportunities. American plane maker Boeing Corporation has launched the Boeing India Engineering & Technology Centre in Bengaluru.

In October 2023, the Automotive Research Association of India (ARAI) signed an agreement with IIT Guwahati to set up a common engineering facility centre titled ‘Digital Twin Centre for Emerging Automotive Systems’ in a hub and spoke model.

In July 2023, Bharat Heavy Electricals Limited (BHEL) signed a Technical Assistance and License Agreement with General Electric Technology GmbH Switzerland for Gas Turbines.

In February 2023, Reliance Industries Limited (RIL) and its vehicle partner Ashok Leyland unveiled India’s first Hydrogen Internal Combustion Engine (H2-ICE) technology solution for heavy duty trucks at the India Energy Week in Bengaluru.

State-run PSUs Nuclear Power Corporation of India Ltd (NPCIL) and Bharat Heavy Electricals Ltd (BHEL) have signed a memorandum of understanding (MoU) in April 2023 to jointly pursue business opportunities in the area of Nuclear Power Plants based on Pressurized Heavy Water Reactor (PHWR) technology.

The Ministry of Heavy Industries, in March 2023, sanctioned Rs. 800 crore (US$ 97.3 million) under FAME India Scheme Phase-II to 3 PSU oil marketing companies (OMC) for setting up 7,432 public fast charging EV stations across the country.

Companies across this sector are partnering with technology providers to enhance their capabilities and sustain the market uncertainties. In November 2022, L&T Infotech and Mindtree merged to make India’s fifth-largest IT company, LTI Mindtree, that will help businesses proactively take on and shape the future by harnessing the full power of digital technologies.

In January 2023, Bharat Heavy Electricals Ltd (BHEL) bagged the order for renovation and modernization of 200 MW Unit-3 and 210 MW Unit-5 steam turbines at Ukai thermal power station in Gujarat. ABB India ABB can utilize around Rs. 1,800 crore (US$ 217.2 million) of its cash balance for inorganic growth or acquisitions apart from organic expansion plan.

Making process changes — including the adjustment of a company’s physical footprint, outsourcing, or offshoring of particular processes, changes to organizational structure — can help increase efficiency. Strong analytical capacity will allow companies to slice and dice their operational data, identifying opportunities to make operations more efficient — such as workforce planning.

In January 2023, L&T Technology Services Limited announced to acquire the Smart World & Communication (SWC) Business of L&T, to combine synergies and take offerings in Next-Gen Communications, Sustainable Spaces and Cybersecurity to the global market.

In 2021, the government is pursuing strategic sale in 22 PSU firms of which 17 are ongoing transactions including BPCL, Shipping Corporation of India, Concor and BEML.

To increase the employability of engineering graduates in the country, AICTE (All India council of technical education) leadership is taking a lot of efforts and recommends model curriculum for engineering programs like AI, IoT, Robotics, Block chain, Machine learning, Data Science and Cyber security. In October 2022, NSIC Signs MoU with Phillips Machine Tools India Pvt. Ltd. for Skill Development Training in Additive Technologies which is the future of manufacturing. In June 2022: Ministry of Heavy Industries (MHI) and Ministry of Skill Development and Entrepreneurship (MSDE) sign MoU to facilitate training in engineering trades to boost capital goods sector. In May 2022, MHI signs an MoU with National Research Development Corporation to facilitate various activities for smooth implementation of the Scheme for Enhancement of Competitiveness in the Indian Capital Goods Sector.

India's power generation target is estimated to be 1,750 BUs in FY24, up from 1,624.15 BUs of actual generation in FY23. The total power consumption in India is 139.23 billion units as of June 2023. The growing energy requirement will require enhancement of installed power capacity. The installed power capacity in India is around 446.19 GW as of June 2024. Industrial sector is the largest consumer of energy consuming about 50% of the total commercial energy produced in the country followed by the transport sector.

In the interim budget 2023-24, Ministry of Railways received its highest-ever allocation of Rs. 2.55 lakh crore (US$ 30.6 billion), approximately ten times the allocation in 2013-14. Ministry of Road Transport and Highways received an allocation of about Rs. 2.78 lakh crore (US$ 33.4 billion).

The government launched the National Infrastructure Pipeline (NIP) with a forward-looking approach and with a projected infrastructure investment of around Rs. 111 lakh crore (US$ 1.3 trillion), during FY20-25 to provide high quality infrastructure across the country. The NIP currently has 9637 projects with a total cost of more than US$ 2 trillion under different stages of implementation. Increase in the construction of National Highways (NHs)/roads over time, with 10,331 km of roads constructed in FY23 as compared to 6,061 km in FY16. India’s national highway network grew by nearly 49% from 97,830 km in 2014-15 to 146,145 km at the end of January 2024. The pace increased from 12.1 km a day in 2014-15 to 28.3 km per day in FY23. Total budgetary support for investment in the sector has been increasing rapidly in the last 4 years and stood at around Rs. 1.4 lakh crore (US$ 16.8 billion) during FY23 (as of 31 October 2022). In line with the vision of monetization of public sector assets, National Highways Authority of India (NHAI) launched its InvIT in FY22. NHAI InvIT has raised more than Rs. 26,125 crore (US$ 3.1 billion) from high quality foreign and Indian institutional investors (up to January 2024). India’s Finance Minister Nirmala Sitharaman unveiled plans to spend nearly US$ 134 billion on infrastructure and focus on long-term reforms to drive growth and contain the fiscal gap. India’s national highway network grew by nearly 49% from 97,830 km in 2014-15 to 146,145 km at the end of January 2024. The pace increased from 12.1 km a day in 2014-15 to 28.3 km per day in FY23. The Ministry of Road Transport and Highways plans to construct around 13,814 km of national highway construction in FY 2024 and a network to 2 lakh km by 2025. Increasing construction of roads and highways all over the country as a source of development in the state is further responsible for the future growth of the India construction market in the upcoming 5 years. The Infrastructure Supporting Industries Index (part of the wider Index of Industrial Production) comprises 8 core industries, such as coal, crude oil, natural gas, petroleum refinery products, fertilisers, steel, cement, and electricity. This index stood at 146.7 in FY23 and 156 during April-January 2024.

Shri Dharmendra Pradhan, Minister of Skill Development and Entrepreneurship and Education, said growth of capital goods sector is correlated to the success of Make in India program.

The government approved 15 SEZs for the engineering sector, & electrical machinery is a part of the sector. The Delhi Mumbai Industrial Corridor (DMIC) is being developed across 7 states and is expected to bolster the sector.

Top infra projects that are underway includes Chenab Bridge, Delhi Mumbai Expressway, Central Vista, Eastern Dedicated Freight Corridor, Mumbai Nagpur Expressway, Kochi Water Metro.

In Budget 2023, customs duty exemption is being provided to import of specified capital goods and machinery required for manufacture of lithium-ion cells for batteries used in electric vehicles and mobile handsets.

The electrical machinery industry has been de-licensed, along with 100% FDI allowed in this sector. This has facilitated the entry of major global players into the electrical machinery industry in India.

In Union Budget 2024-25, Government has committed an outlay of Rs. 11.11 lakh crore (US$ 133.5 billion) during this year towards infrastructure capital expenditure.

Under Union budget 2023-24, the defence sector was allocated a budget of Rs. 6.21 lakh crore (US$ 74.62 billion).

In February 2022, the Prime Minister inaugurated Asia’s largest bio-CNG plant set up under the Indore Smart City Project.

Voluntary Vehicle-Fleet Modernisation Programme (VVMP)- The objectives of the policy are to reduce population of old and defective vehicles, achieve reduction in vehicular air pollutants to fulfil India’s climate commitments, improve road and vehicular safety, achieve better fuel efficiency, formalize the currently informal vehicle scrapping industry and boost availability of low-cost raw materials for automotive, steel and electronics industry. The policy will bring in investments of Rs. 10,000 crore (US$ 1.35 billion) to set up 450-500 Automated Testing Stations (ATS) and 60-70 Registered Vehicle Scrapping Facilities (RVSF) across the country. The policy has proposed to push 28 million decade old vehicles off the roads.

New export policy in Uttar Pradesh–- Export policy is being established for the State of Uttar Pradesh to tap onto opportunities in international market, optimum utilization of the resources of the state, employment generation and to synergize with the Foreign Trade Policy 2020-25. The objective of this policy is to promote development and competition in the field of exports, to provide necessary export-related assistance and services to export ancillary institutions, to establish and develop technical and physical infrastructure to increase exports from the state.

Total foreign direct investment (FDI) inflow to India stood at US$ 678.86 billion during April 2000-March 2024. FDI inflow for miscellaneous mechanical and engineering industries stood at US$ 4.50 billion between April 2000-March 2024.FDI inflow depends on a host of factors such as availability of natural resource, market size, infrastructure, political and general investment climate as well as macro-economic stability and investment decision of foreign investors. The Government reviews the FDI policy on an ongoing basis and makes significant changes from time to time, to ensure that India remains attractive and investor friendly destination. To further liberalize and simplify FDI policy for providing Ease of doing business and attract investments, reforms have been undertaken recently across sectors such as Coal Mining, Contract Manufacturing, Digital Media, Single Brand Retail Trading, Civil Aviation, Defence, Insurance and Telecom.

In FY24, India’s defence and aerospace sector achieved exports soaring to a record Rs. 21,083 crore (US$ 2.53 billion). This represents a significant increase of 32.5% YoY. Defence sector Interim union budget 2023-24, the defence sector was allocated a budget of Rs. 6.21 lakh crore (US$ 74.74 billion). In 2023, Defence Minister of India has called upon Indian and global industry leaders to support the government’s endeavour to design, develop and manufacture cutting-edge products, using critical technologies within India to attain complete ‘Aatmanirbharta’ in defence. The vision of the government is to achieve a turnover of US$ 25 billion including export of US$ 5 billion in Aerospace and Defence goods and services by 2025. Ministry of Defence released the fifth 'Positive Indigenisation List' comprising of 98 defence equipment to be manufactured locally in October 2023. With the notification of 164 additional items, the total number of indigenised items till December 2022 from 'Positive Indigenisation Lists' of the Department of Defence Production DDP stands at 2,736, worth an import substitution value of Rs. 2,570 crore (US$ 312.5 million). The government has also announced 2 dedicated Defence Industrial Corridors in the States of Tamil Nadu and Uttar Pradesh to act as clusters of defence manufacturing that leverage existing infrastructure, and human capital.

Auto components - The automobile component industry turnover stood at Rs. 2.9 lakh crore (US$ 36.1 billion) during H1 2023-24, registering a revenue growth of 12.6% as compared to H1 2022-23. By FY28, the Indian auto industry aims to invest Rs. 58,000 crore (US$ 7 billion) to boost localization of advanced components like electric motors and automatic transmissions, reducing imports and leveraging 'China Plus One’ trend. In February 2024, ZF inaugurated its 19th manufacturing plant in India at Oragadam in Tamil Nadu. With an Rs. 1,800 crore (US$ 216.3 million) project outlay, ZF plans to strengthen its manufacturing presence and expansion in India with investment realization by 2030. In May 2023, JBM announced to invest Rs. 350 crore (US$ 42.1 million) for setting-up auto component manufacturing plants in Haryana and Gujarat the Indian government has outlined US$ 7.8 billion for the automobile and auto components sector in production-linked incentive (PLI) schemes under the Department of Heavy Industries.

Civil nuclear sector - India’s installed nuclear power capacity of 6,780 MW will increase to 22,480 MW by 2031 on progressive completion of projects under construction and accorded sanction. India will triple its present installed nuclear power generation capacity in the next 10 years.

Machine tools - The Indian machine tool market size reached US$ 1.5 billion in 2023 and is expected to reach US$ 3.2 billion by 2032, exhibiting a growth rate (CAGR) of 8.2% during 2024-32. The growing prominence of automation across numerous manufacturing processes, to enhance their productivity and meet quality standards, is currently driving the India machine tools market.

Material handling equipment - The India Automated Material Handling market size is estimated at US$ 1.47 billion in 2024, and is expected to reach US$ 2.66 billion by 2029, growing at a CAGR of 12.70% during the forecast period (2024-2029). The Indian material handling sector has observed a momentous growth in recent years due to rising investment in infrastructure development, increased demand for higher automation, and safe working practices in the manufacturing area.

The electrical equipment market share in India is expected to increase from US$ 52.98 billion in 2022 to US$ 125 billion by 2027, implying a robust CAGR of 11.68%. In FY23, India’s heavy electrical equipment production stood at Rs. 2,44,300 crore (US$ 29.38 billion). The electrical machinery segment grew nearly 13% with shipments jumping to US$ 10.19 billion in the April-December 2023 from US$ 9.06 billion in the year-ago period. The Indian textile machinery industry was expected to touch the US$ 6 billion mark by 2022.

The Indian construction equipment (CE) industry, which aspires to become the world's second largest by 2030, turned in its best-ever performance with 26% year-on-year growth in FY23 as sales crossed the 1 lakh unit mark driving on road construction and railway demand. The growth was led by 29% increase in the domestic sales along with a 3% rise in the exports. Market size for the Indian Construction Equipment Market stood at US$ 7.2 billion in FY23 and is forecasted to grow at a CAGR of 15% for next 5 years, as per the estimates of CII. Construction Equipment sales grew by 26% YoY to 135,650 units in FY24. The earthmoving equipment and road construction equipment account for close to 70% of India’s construction equipment market. The demand outlook for the construction equipment sector remains robust with Ministry of Road Transport & Highways targeting 13,814 km of national highway construction in FY 2024 and a network to 2 lakh km by 2025.

100% FDI is allowed through the automatic route, with major international players looking for growth opportunities to enter the Indian engineering sector. The engineering sector in India attracts immense interest from foreign players as it enjoys a comparative advantage in terms of manufacturing cost, technology, and innovation. The above, coupled with favourable regulatory policies and growth in the manufacturing sector, has allowed several foreign players to invest in India.

Microsoft India and Larsen & Toubro (L&T) have signed a Memorandum of Understanding (MoU) to build a regulated sector cloud product. The 2 businesses will collaborate with a select group of significant customers in regulated industries to design architectures and roadmaps to help them achieve their digital transformation goals and transition traditional datacentres to hybrid cloud architecture.

Tesla, the electric car maker, has set up a R&D centre in Bengaluru and registered its subsidiary as Tesla India Motors and Energy Private Limited.

With the aim to boost the manufacturing sector, the government has relaxed the excise duties on factory gate tax, capital goods, consumer durables and vehicles.

To increase the employability of engineering graduates in the country, the Ministry of Human Resource Development is working along with Sector Skill Councils (SSCs) under National Skill Development Corporation (NSDC) to undertake apprenticeship/internship embedded degree programmes with a core focus on the development of knowledge, skills, aptitude, and on-job training.

The AICTE has entered into collaborations with the MSME ministry, NHAI and DM offices in 150 districts to facilitate engineering internships for students.

In the Union Budget 2023-24, the government has given a massive push to the infrastructure sector by allocating Rs. 2,78,000 crore (US$ 33.43 billion) to enhance the transport infrastructure.

Prime Minister Mr. Narendra Modi, on the country's 75th Independence Day, announced plans to invest Rs. 100 trillion (US$ 1.35 trillion) in infrastructure to stimulate economic development and generate employment.

The government has announced its PLI scheme of Rs. 10,683 crore (US$ 1.4 billion) for textiles, specifically aimed at boosting production of man-made fibre (MMF) fabric, MMF apparel and technical textiles. The government has also announced a PLI scheme for automobiles and auto components worth Rs. 25,938 crore (US$ 3.49 billion). This scheme is expected to bring investments of Rs. 42,500 (US$ 5.74 billion) by 2026.

According to the National Association of Software and Service Companies (NASSCOM), India’s share in the global engineering and research and development (ER&D) market is likely to expand at a CAGR of 12-13% to reach US$ 63 billion by 2025.

By 2030, India has plans to invest US$ 34.2 billion to set up an interstate transmission network (ISTS) in order to evacuate renewable energy.