The broader indices gained over a percent each and started the new calendar year by outperforming the main indices, which continued the winning run in second week led by buying in auto and oil & gas stocks and DII support. Some gains were erased during the second week amid FII selling, strong dollar and rupee depreciation.

This week, BSE Sensex rose 524.04 points or 0.66 percent to close at 79,223.11, while the Nifty50 index added 191.35 points or 0.80 percent to finish at 24,004.75.

However, BSE large-cap, mid-cap and small-cap indices rose 1 percent, 1.3 percent and 2 percent.

Among sectors, Nifty Auto index surged 4 percent, Nifty Oil & Gas index rose 3.4 percent, while Nifty Energy and FMCG index added 2.4 percent each, while Nifty Realty index shed 2.5 percent.

Foreign Institutional Investors (FIIs) sold equities worth Rs 11,041.59 crore, while Domestic Institutional Investors (DII) bought equities worth Rs 9253.7 crore.

"The market concluded the week with a pessimistic note as a sell-on-rally sentiment prevails in the market due to a strong US dollar, high valuation, and investors shift towards a multi-asset strategy. The auto sector outperformed other indices, driven by robust December sales that defied the usual subdued demand. Mid and small caps exhibited a tepid recovery, while large caps lagged the former. Persistent concerns over FII outflows, a depreciating INR, along with signs of improving core sector print and reduced expectations for rate cuts in 2025, contributed to the mixed investor sentiments. Conversely, DIIs maintained their optimistic stance," said Vinod Nair, Head of Research, Geojit Financial Services.

"Uncertainty surrounding Trump's economic policies and high valuations may impact the stock market in the short term, particularly in emerging markets. Looking ahead, significant market attention is expected for the upcoming Q3 results, with an anticipated improvement on a QoQ basis. Further, the investors are likely to align their portfolios based on pre-budget expectations. The key data points such as the FOMC minutes, US non-farm payroll and unemployment rate will influence market sentiment," he added.

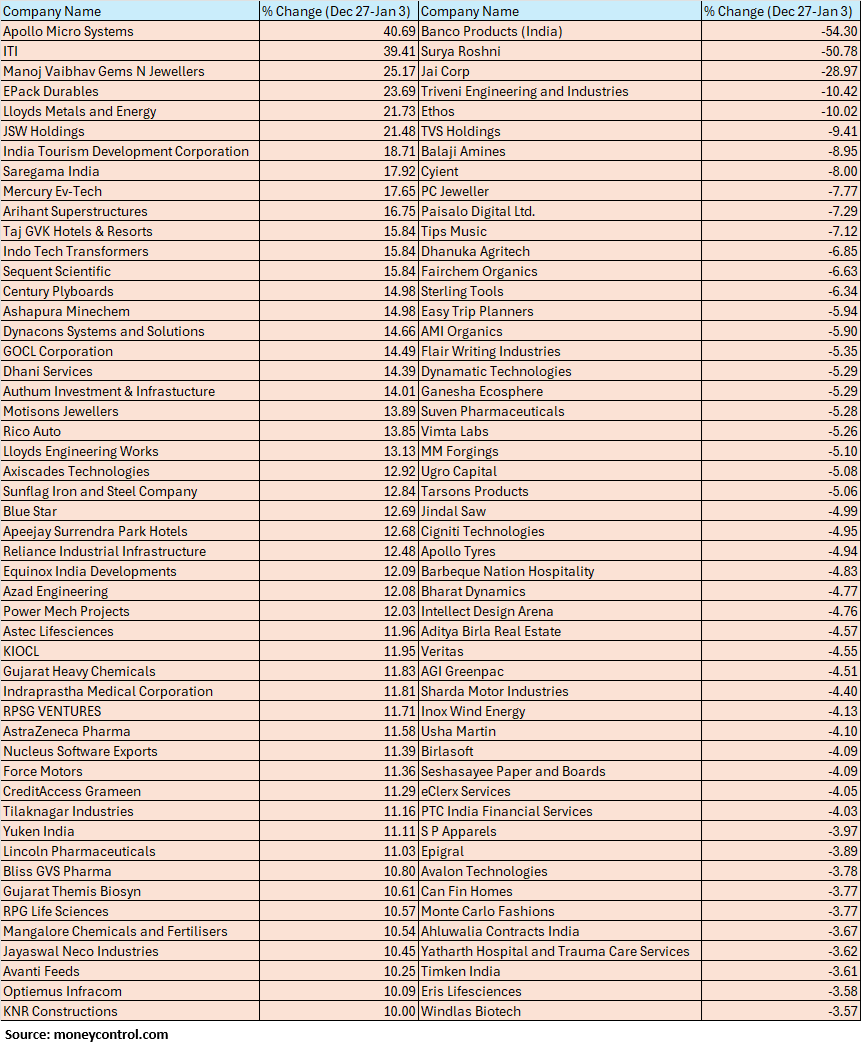

The BSE Small-cap index added 2 percent with Apollo Micro Systems, ITI, Manoj Vaibhav Gems N Jewellers, EPack Durables, Lloyds Metals and Energy, JSW Holdings, India Tourism Development Corporation, Saregama India, Mercury Ev-Tech, Arihant Superstructures, Taj GVK Hotels & Resorts, Indo Tech Transformers, Sequent Scientific gaining 15-40.

On the other hand, Banco Products (India), Surya Roshni, Jai Corp, Triveni Engineering and Industries, Ethos, TVS Holdings, Balaji Amines, Cyient, PC Jeweller, Paisalo Digital, Tips Music shed between 7-54 percent.

Where is Nifty50 headed?

Aditya Gaggar, Director of Progressive Shares

Nifty50 is currently moving within a Symmetrical Triangle Formation, with key support at 23,900 (200DMA) and resistance at 24,130 (50DMA).

Breakout above 24,130 could lead to a rise towards 24,650, while a drop below 23,900 could push it down to 23,650.

Devarsh Vakil - Deputy Head Retail Research, HDFC Securities

Immediate support levels for the Nifty are at 23,933 and 23,843, representing 38.2% and 50% retracement levels of the recent 766-point rally from the swing low of 23,460.

On the upside, the recent swing high of 24,226 will serve as immediate resistance. A breakthrough above this level could propel the index toward the 24,400-24,500 range in the near term.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

The near-term uptrend remains intact for Nifty. A decisive move above the Thursday's high (24226) could open renewed buying participation towards 24400-24500 levels. Immediate support is around 23930-23840 levels.

Rupak De, Senior Technical Analyst at LKP Securities

The Nifty was unable to break above the 50 EMA on the daily timeframe, resulting in a market correction. However, sentiment remains positive as the index closed above 24,000. The RSI shows a bullish crossover. On the upside, the index may rise towards 24,200–24,220, with a break above 24,220 potentially pushing it to 24,500. Conversely, a decisive move below 24,000 could lead the index towards 23,700.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!